- United States

- /

- Software

- /

- NasdaqGM:VERI

Can Veritone's (VERI) Expanding Government AI Focus Reshape Its Long-Term Business Model?

Reviewed by Simply Wall St

- In the past week, Veritone completed a US$25 million follow-on equity offering and presented at the H.C. Wainwright Global Investment Conference, showcasing its AI-driven solutions for government and law enforcement sectors as well as a promising Veritone Data Refinery pipeline.

- An interesting insight is Veritone's focus on securing direct government contracts and progressing toward a pure AI-centric model, supported by validation from early proof-of-concept contracts with agencies such as the U.S. Navy.

- We'll examine how Veritone's accelerated push into government AI and recent contract validation influences the company's investment outlook.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

Veritone Investment Narrative Recap

Investors in Veritone need conviction in the company's ability to grow its AI and Data Refinery offerings, particularly through pipeline momentum and government contracts, while the threat of continued net losses and cash needs looms large. The recent US$25 million equity raise bolsters short-term liquidity and reduces near-term capital constraints, but it is not a fundamental game changer, persistent operating losses and the need for future fundraising remain the most pressing risk for shareholders.

Among the recent developments, completion of the US$25 million follow-on equity offering stands out as the most directly relevant. This fundraising, together with revised credit covenants, helps support operational runway as Veritone works to convert government and enterprise pipeline into revenue. However, the increased share count introduces further dilution, reinforcing the importance of achieving sustainable, profitable growth as a key catalyst.

By contrast, sustained access to capital is not guaranteed for any loss-making company for long, making it critical that investors pay close attention to...

Read the full narrative on Veritone (it's free!)

Veritone's narrative projects $158.0 million revenue and $20.7 million earnings by 2028. This requires 20.2% yearly revenue growth and a $114.1 million increase in earnings from -$93.4 million today.

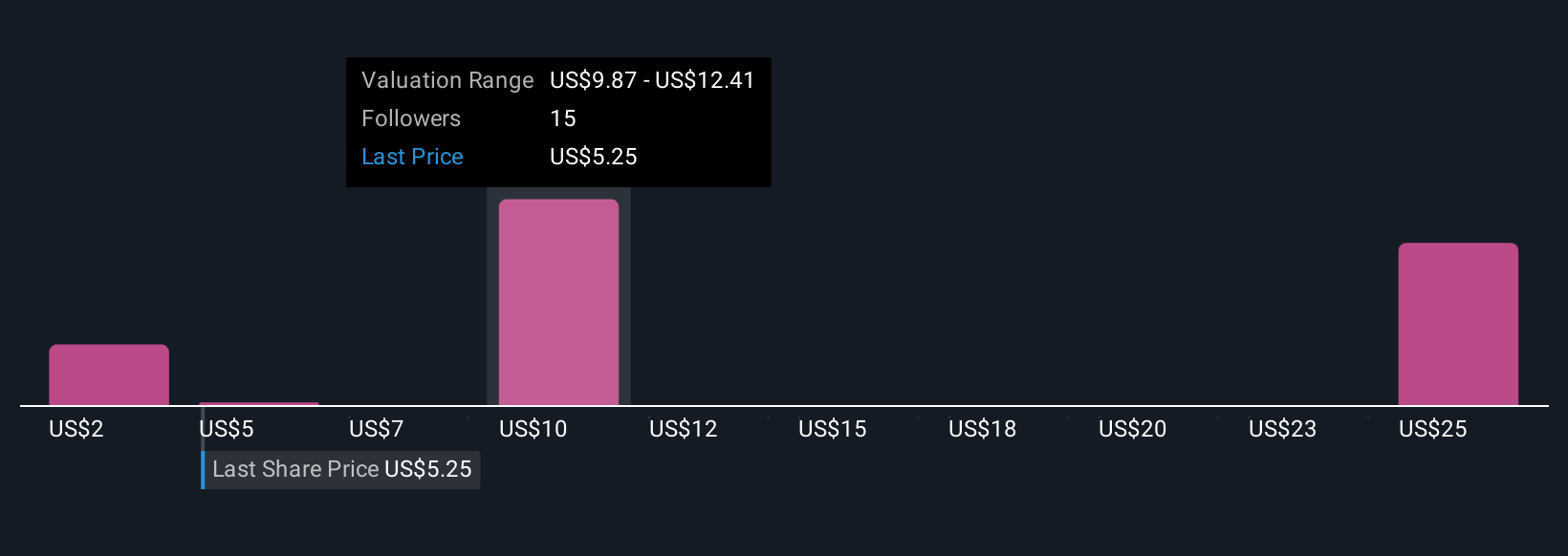

Uncover how Veritone's forecasts yield a $5.25 fair value, a 41% upside to its current price.

Exploring Other Perspectives

Six fair value estimates in the Simply Wall St Community span from US$3.74 to US$27.68, revealing sharply conflicting outlooks. With persistent net losses still a critical challenge, you can see why opinions differ so widely on Veritone's future, explore how these diverse perspectives could shape your own view.

Explore 6 other fair value estimates on Veritone - why the stock might be worth just $3.74!

Build Your Own Veritone Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Veritone research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Veritone research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Veritone's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VERI

Veritone

Engages in the provision of artificial intelligence (AI) computing solutions and services in the United States, the United Kingdom, France, Australia, Israel, and India.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives