- United States

- /

- IT

- /

- NasdaqGS:SHOP

High Growth Tech Stocks in US for November 2025

Reviewed by Simply Wall St

As the tech-heavy Nasdaq faces its worst week since the 'Liberation Day' tariffs, with cooling AI sentiment and valuation concerns weighing heavily on the sector, investors are closely monitoring economic indicators and Federal Reserve actions amid a precarious labor market. In this environment of heightened volatility, identifying high-growth tech stocks requires careful consideration of companies that demonstrate resilience through innovation and adaptability in response to shifting market dynamics.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Exelixis | 11.26% | 21.94% | ★★★★★☆ |

| Palantir Technologies | 26.74% | 29.17% | ★★★★★★ |

| Workday | 11.19% | 32.07% | ★★★★★☆ |

| Praxis Precision Medicines | 74.33% | 58.23% | ★★★★★★ |

| RenovoRx | 65.52% | 68.63% | ★★★★★☆ |

| Circle Internet Group | 27.53% | 82.41% | ★★★★★☆ |

| OS Therapies | 56.64% | 68.61% | ★★★★★☆ |

| Gorilla Technology Group | 32.75% | 122.61% | ★★★★★☆ |

| Procore Technologies | 12.13% | 86.69% | ★★★★★☆ |

| Zscaler | 15.72% | 40.94% | ★★★★★☆ |

Click here to see the full list of 74 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Shopify (SHOP)

Simply Wall St Growth Rating: ★★★★☆☆

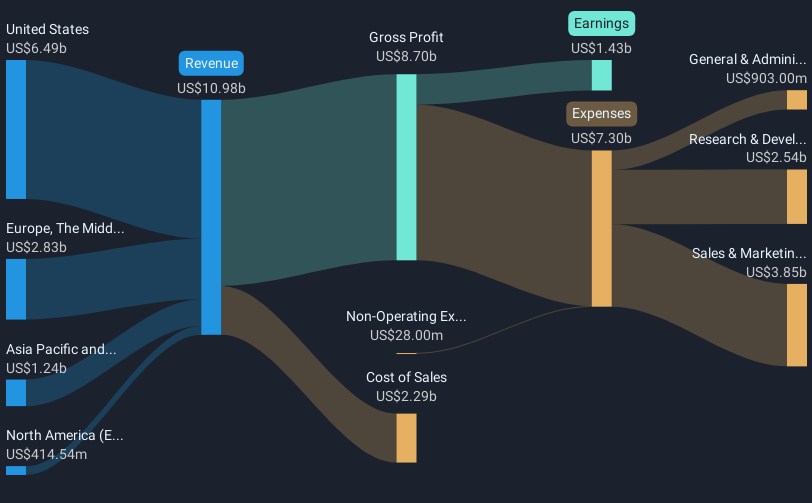

Overview: Shopify Inc. is a commerce technology company that offers tools to start, scale, market, and run businesses of various sizes across multiple regions globally, with a market cap of $212.10 billion.

Operations: Shopify generates revenue primarily from its Internet Software & Services segment, amounting to $10.70 billion. The company operates across multiple regions, including North America, Europe, and Asia Pacific.

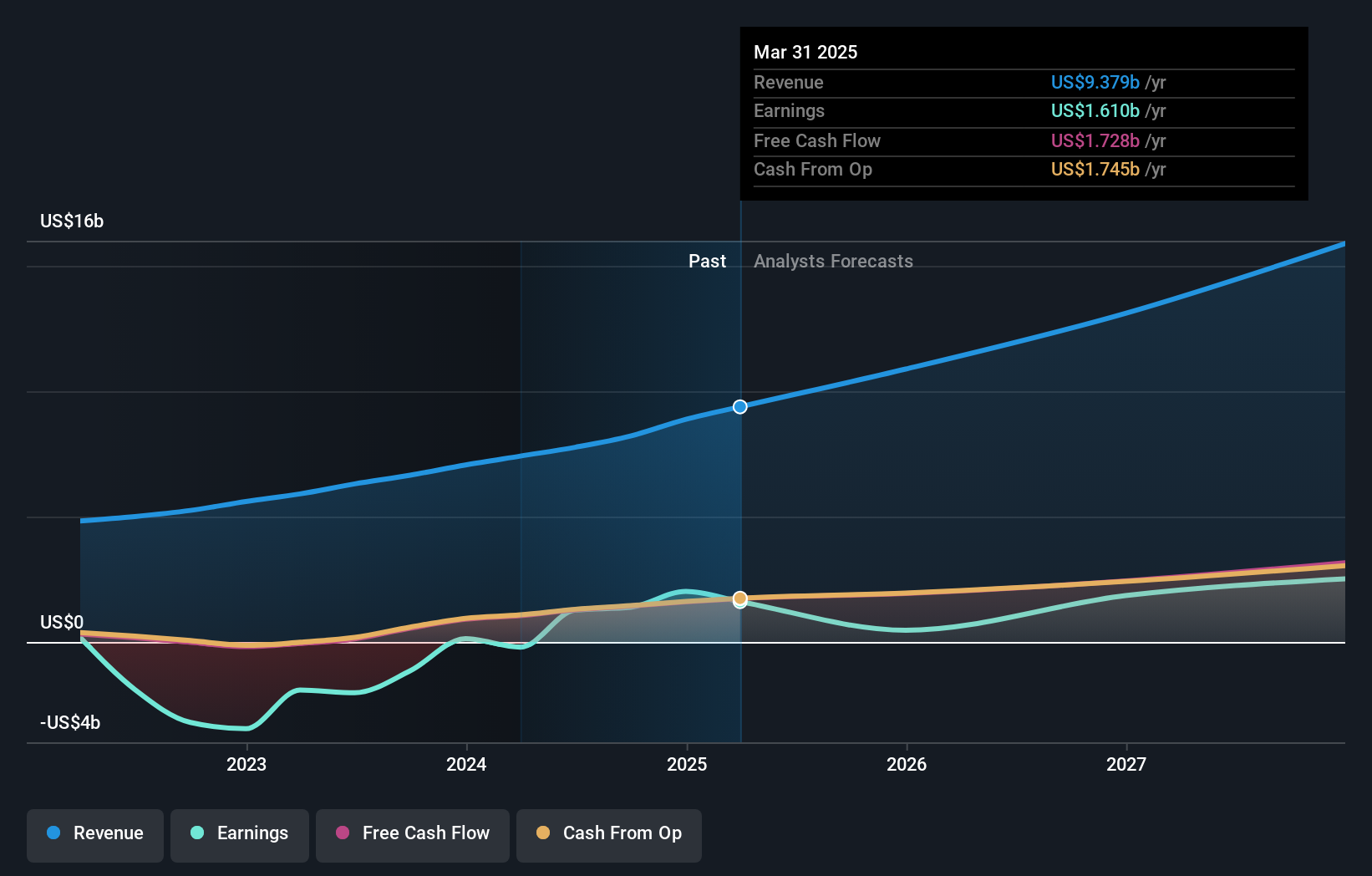

Shopify's recent growth trajectory is underscored by a robust 18.5% annual revenue increase and an even more impressive 20.8% rise in earnings, signaling strong market demand and operational efficiency. In the latest quarter, Shopify reported a significant revenue jump to $2,844 million from $2,162 million year-over-year, although net income dipped to $264 million from $828 million in the same period last year due to large one-off gains previously inflating results. The company's commitment to innovation is evident in its R&D spending trends which have consistently aligned with or outpaced revenue growth, ensuring continuous improvement and expansion of its e-commerce platform capabilities. This strategic focus on R&D not only enhances Shopify’s service offerings but also solidifies its competitive position in the fast-evolving tech landscape.

- Click here to discover the nuances of Shopify with our detailed analytical health report.

Evaluate Shopify's historical performance by accessing our past performance report.

Atlassian (TEAM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atlassian Corporation offers collaboration software designed to enhance productivity across global organizations, with a market capitalization of approximately $41.08 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to $5.46 billion. The focus on collaboration software aims to boost productivity for organizations globally.

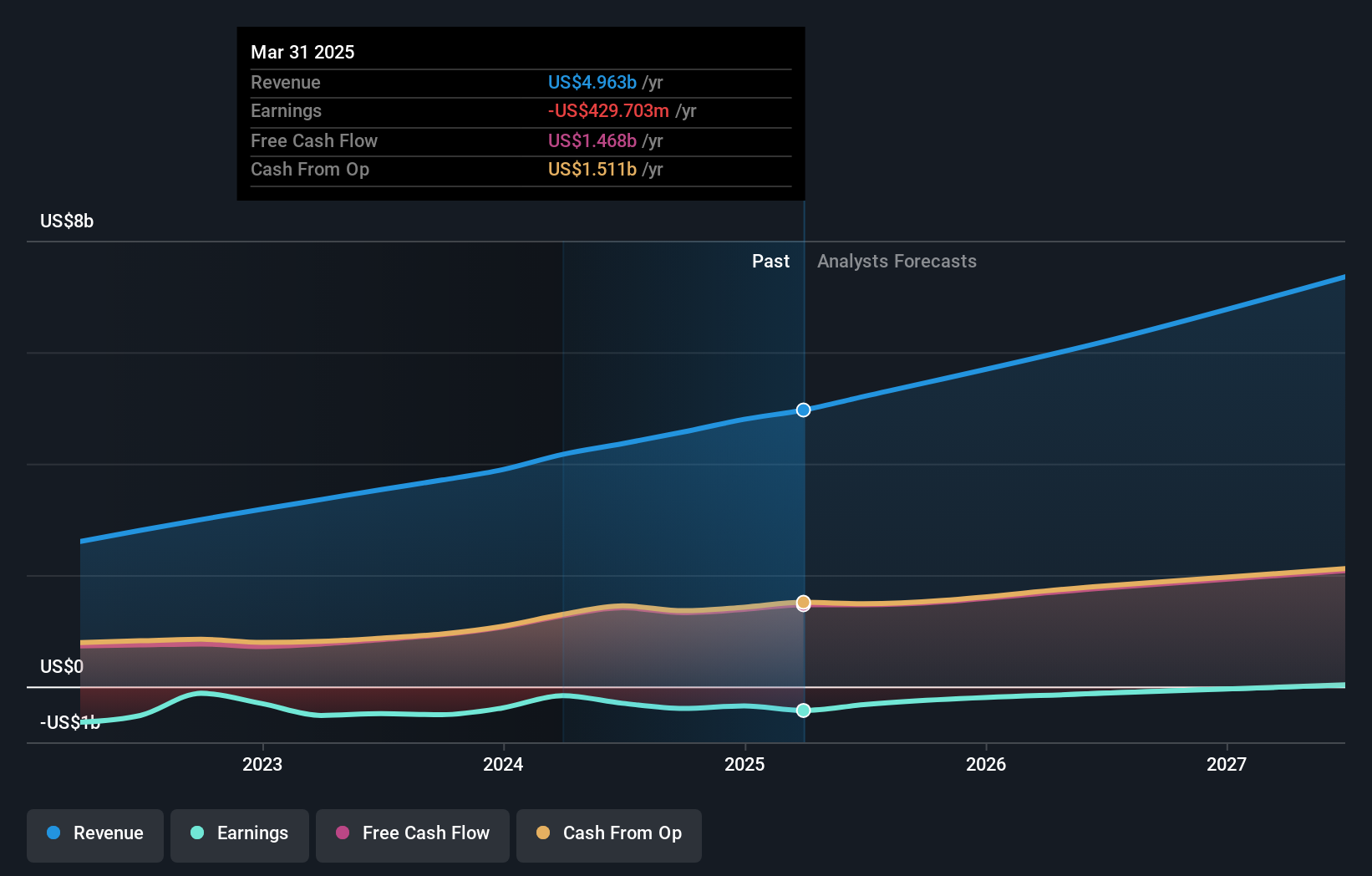

Atlassian's financial dynamics reveal a promising trajectory, with revenue climbing to $1,432.55 million in Q1 2026 from $1,187.78 million the previous year, reflecting a robust annual growth rate of 14.9%. Despite reporting a net loss reduction to $51.87 million from $123.77 million year-over-year, the company's aggressive R&D spending underscores its commitment to innovation and market competitiveness—essential in the rapidly evolving tech landscape. This strategic focus is further exemplified by its recent share repurchase of 1,383,000 shares for approximately $249.96 million and an ongoing buyback program valued at up to $2,500 million, signaling confidence in its future prospects and dedication to shareholder value.

- Delve into the full analysis health report here for a deeper understanding of Atlassian.

Understand Atlassian's track record by examining our Past report.

ServiceNow (NOW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ServiceNow, Inc. offers cloud-based solutions for digital workflows across various regions worldwide and has a market capitalization of $182.58 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $12.67 billion.

ServiceNow's recent strategic collaborations and robust financial performance underscore its role in driving high-tech growth. The company's revenue surged to $3.41 billion in Q3 2025, up from $2.8 billion the previous year, reflecting a strong demand for its AI-enabled solutions. Notably, ServiceNow's partnership with Figma has revolutionized enterprise application development by integrating design and AI automation, reducing UI implementation time by over 80%. This innovation aligns with their aggressive R&D spending, ensuring ServiceNow remains at the forefront of transforming enterprise operations through technology.

- Dive into the specifics of ServiceNow here with our thorough health report.

Review our historical performance report to gain insights into ServiceNow's's past performance.

Taking Advantage

- Click here to access our complete index of 74 US High Growth Tech and AI Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives