Stock Analysis

- United States

- /

- IT

- /

- NYSE:SHOP

Exploring High Growth Tech Stocks In October 2024

Reviewed by Simply Wall St

The United States market has remained flat over the last week but has experienced a significant 37% increase over the past year, with earnings expected to grow by 15% annually in the coming years. In light of these conditions, identifying high growth tech stocks involves evaluating companies that demonstrate robust innovation and scalability potential to capitalize on this upward trajectory.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.92% | 27.84% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| Amicus Therapeutics | 20.26% | 62.89% | ★★★★★★ |

| Invivyd | 45.42% | 61.68% | ★★★★★★ |

| Blueprint Medicines | 26.31% | 69.27% | ★★★★★★ |

| Travere Therapeutics | 29.19% | 70.82% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 244 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

ExlService Holdings (NasdaqGS:EXLS)

Simply Wall St Growth Rating: ★★★★☆☆

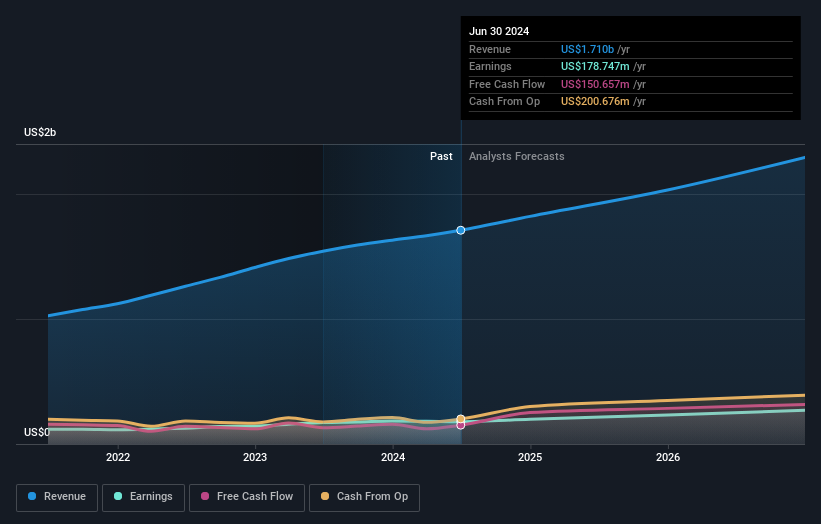

Overview: ExlService Holdings, Inc. is a company that provides data analytics and digital operations solutions both in the United States and internationally, with a market cap of $6.28 billion.

Operations: ExlService Holdings generates revenue through its data analytics and digital operations services, catering to a diverse range of industries across global markets. The company focuses on leveraging advanced analytics to enhance business processes and decision-making for its clients.

ExlService Holdings, Inc. (EXLS) demonstrates robust growth in the tech sector with a strategic focus on mergers and acquisitions and share repurchases, signaling strong capital allocation. In its recent earnings call, EXLS highlighted an aggressive approach towards acquiring assets that enhance data management capabilities and expand its client base, spending approximately $185 million on share repurchases this year at favorable prices. Additionally, the launch of the EXL Enterprise AI Platform showcases their commitment to integrating cutting-edge GenAI solutions into enterprise workflows, leveraging partnerships with industry leaders like NVIDIA to foster innovation across various sectors. This blend of financial strategy and technological advancement positions EXLS uniquely within its industry landscape as it continues to outperform with a revenue forecast growth rate of 11.5% per year and an earnings growth projection of 15.2%, both surpassing market averages.

- Dive into the specifics of ExlService Holdings here with our thorough health report.

Assess ExlService Holdings' past performance with our detailed historical performance reports.

Atlassian (NasdaqGS:TEAM)

Simply Wall St Growth Rating: ★★★★★☆

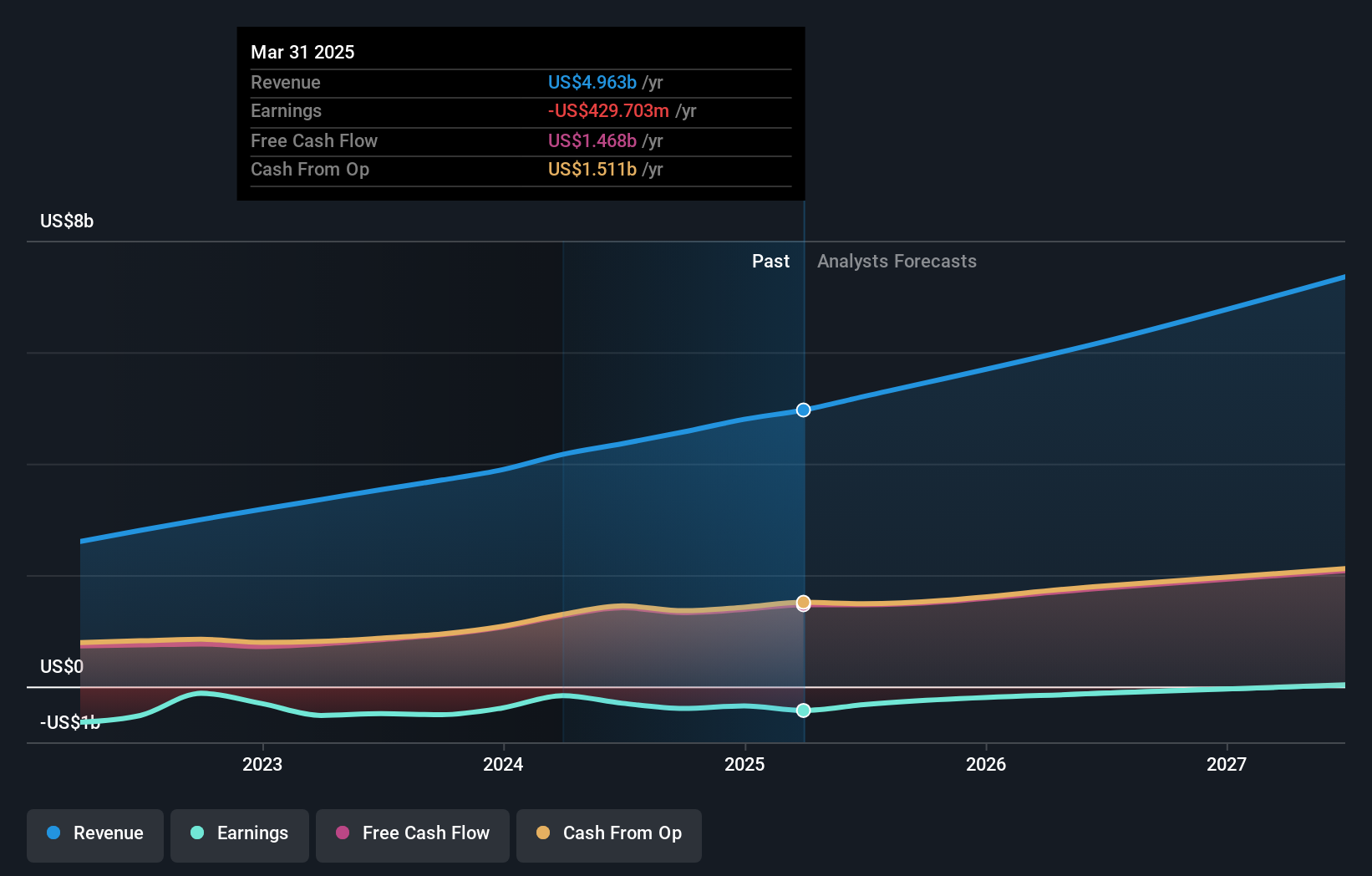

Overview: Atlassian Corporation, with a market cap of $49.99 billion, designs, develops, licenses, and maintains various software products globally through its subsidiaries.

Operations: Atlassian generates revenue primarily from its software and programming segment, which brought in $4.36 billion. The company's business model focuses on designing and licensing software products worldwide.

Atlassian's recent activities underscore its strategic direction and market challenges. Despite a net loss reported in Q4 2024, the company has a robust R&D focus, with expenses constituting a significant 15.2% of revenue, reflecting its commitment to innovation in software solutions. This investment supports an anticipated revenue growth of 16% for FY2025, outpacing the broader US market average of 8.9%. Moreover, Atlassian's earnings are expected to surge by 57.9% annually, showcasing potential recovery and profitability ahead despite current unprofitability issues. The firm also actively manages its capital through share repurchases totaling $548.5 million over the past year, enhancing shareholder value amidst financial volatility.

- Get an in-depth perspective on Atlassian's performance by reading our health report here.

Examine Atlassian's past performance report to understand how it has performed in the past.

Shopify (NYSE:SHOP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shopify Inc. is a commerce company that offers a comprehensive platform and services across multiple regions including Canada, the United States, Europe, and others, with a market cap of $103.84 billion.

Operations: Shopify generates revenue primarily from its Internet Software & Services segment, amounting to $7.76 billion. The company operates across various regions, offering a platform and services that cater to diverse market needs.

Shopify, amid a landscape where digital transformation is crucial, has notably increased its R&D spending to 21.0% of revenue, underscoring its commitment to innovation and staying ahead in the competitive tech space. This investment strategy aligns with its recent partnerships, like those with Zaelab and Pivotree, aimed at enhancing B2B commerce solutions through advanced digital platforms. These collaborations are not only expanding Shopify's market reach but also boosting its technological capabilities, as evidenced by a significant revenue surge to $2.04 billion in Q2 2024 from $1.69 billion the previous year—a growth rate of 17.2%. With such strategic moves and robust financial performance, Shopify is well-positioned to maintain its momentum in the evolving e-commerce sector.

Seize The Opportunity

- Take a closer look at our US High Growth Tech and AI Stocks list of 244 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHOP

Shopify

A commerce company, provides a commerce platform and services in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, Australia, China, and Latin America.