- United States

- /

- Diversified Financial

- /

- NasdaqGS:STNE

Low Profitability and Concerning External Environment are Chipping at StoneCo (NASDAQ:STNE)

When it comes to volatility, young companies in turbulent sectors are unmatched in making or breaking a bank. After a yearly high at US$95, StoneCo (NASDAQ: STNE) is now trading close to an all-time low at US$17.

Despite increasing growth and profitability, negative external developments and policy shifts are spooking the investors.

See our latest analysis for StoneCo.

Third-quarter 2021 results

- R$4.05 loss per share (down from R$0.87 profit in 3Q 2020)

- Revenue: R$1.42b (up 56% from 3Q 2020)

- Net loss: R$1.25b (down R$1.51b from profit in 3Q 2020)

Revenue exceeded analyst estimates by 2.5%, but earnings per share (EPS) missed analyst estimates. Over the next year, revenue is forecast to grow 83%, compared to a 21% growth forecast for the industry in the US. Over the last 3 years, on average, earnings per share have increased by 11% per year, but its share price has fallen by 8% per year, which means it is significantly lagging earnings.

As per usual, emerging markets like Brazil are a polarizing story. On one side, we have a promise of growth; on the other – a history of macroeconomic turmoil and political risks.

Currently, 2 notable issues impact the fundamentals

- Faulty registry system: Stone relied on a faulty registry of receivables that led to the discovery of uncollateralized loans – leading to increased provisions. And R$397.2m adjustment. Furthermore, now the company has to reduce the number of loans, leading to opportunity costs.

- Transaction fee cap: Brazil's central bank is proposing to revise a resolution regarding the interchange fees for debit cards, as the current one imposed the 0.5% cap only to those offering a deposit account – which is banks. Although Stone's exposure shouldn't be substantial, policy shifts in emerging markets are enough to raise some eyebrows.

Understanding Return On Capital Employed (ROCE)

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Ideally, a business will show two trends: a growing return on capital employed (ROCE) and an increasing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities.

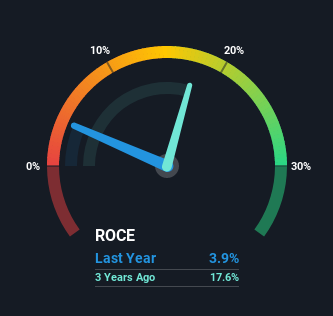

To clarify, if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for StoneCo:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.039 = R$778m ÷ (R$40b - R$20b) (Based on the trailing twelve months to September 2021).

Thus, StoneCo has a ROCE of 3.9%. In absolute terms, that's a low return, and it also under-performs the IT industry average of 14%.

Above you can see how the current ROCE for StoneCo compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts' predictions in our free report on analyst forecasts for the company.

What The Trend Of ROCE Can Tell Us

In terms of StoneCo's historical ROCE trend, it doesn't precisely demand attention. The company has consistently earned 3.9% for the last four years, and the capital employed within the business has risen 770% in that time. This poor ROCE doesn't inspire confidence right now, and with the increase in capital employed, it's evident that the business isn't deploying the funds into high return investments.

One more thing to note, even though ROCE has remained relatively flat over the last four years, the reduction in current liabilities to 50% of total assets is good to see from a business owner's perspective. This can eliminate some of the risks inherent in the operations because the business has fewer outstanding obligations to their suppliers and or short-term creditors than they did previously. Although because current liabilities are still 50%, some of that risk is still prevalent.

Our Take On StoneCo

In conclusion, StoneCo has been investing more capital into the business, but returns on that capital haven't increased. Since the stock has declined 22% over the last three years, investors may not be too optimistic about this trend improving either.

Yet, it is not all doom and gloom, as the Linx merger earlier this year contributed to recurring revenue and 15% organic growth. It is also worth mentioning that Berkshire Hathaway has a 3.46% stake in the company worth R$182m, albeit not by Warren Buffett but through his potential successor, Todd Combs.

On a final note, we've found 1 warning sign for StoneCo that we think you should be aware of.

While StoneCo may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:STNE

StoneCo

Provides financial technology and software solutions to merchants and integrated partners to conduct electronic commerce across in-store, online, and mobile channels in Brazil.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026