- United States

- /

- Software

- /

- NasdaqGS:SPSC

Has the 25% Drop Made SPS Commerce a Bargain or a Risk for 2025?

Reviewed by Bailey Pemberton

- Wondering if SPS Commerce is a hidden bargain or a value trap? Here is a breakdown of what’s going on with this software stock before you decide whether it deserves a spot on your radar.

- The stock has caught plenty of attention after plunging by 25.6% this week and over 54% year-to-date. You may be wondering if this volatility hints at risk, opportunity, or both.

- Recent news around sector-wide shifts in software demand and emerging competitive pressures have added fuel to the fire. Investors want to know if software valuations have reset for good or if there is potential for a rebound as the market digests these changes.

- According to the Simply Wall St Value Score, SPS Commerce scores a 3 out of 6 for undervaluation checks, meaning it clears half of the benchmarks for discounted value. Next, we will look at classic approaches to valuation, but keep reading to discover a more insightful way to judge value by the end of the article.

Find out why SPS Commerce's -50.6% return over the last year is lagging behind its peers.

Approach 1: SPS Commerce Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting future cash flows and discounting them back to today's value. This approach relies on forecasting how much money the company will generate over time and takes into account the time value of money to determine its present worth.

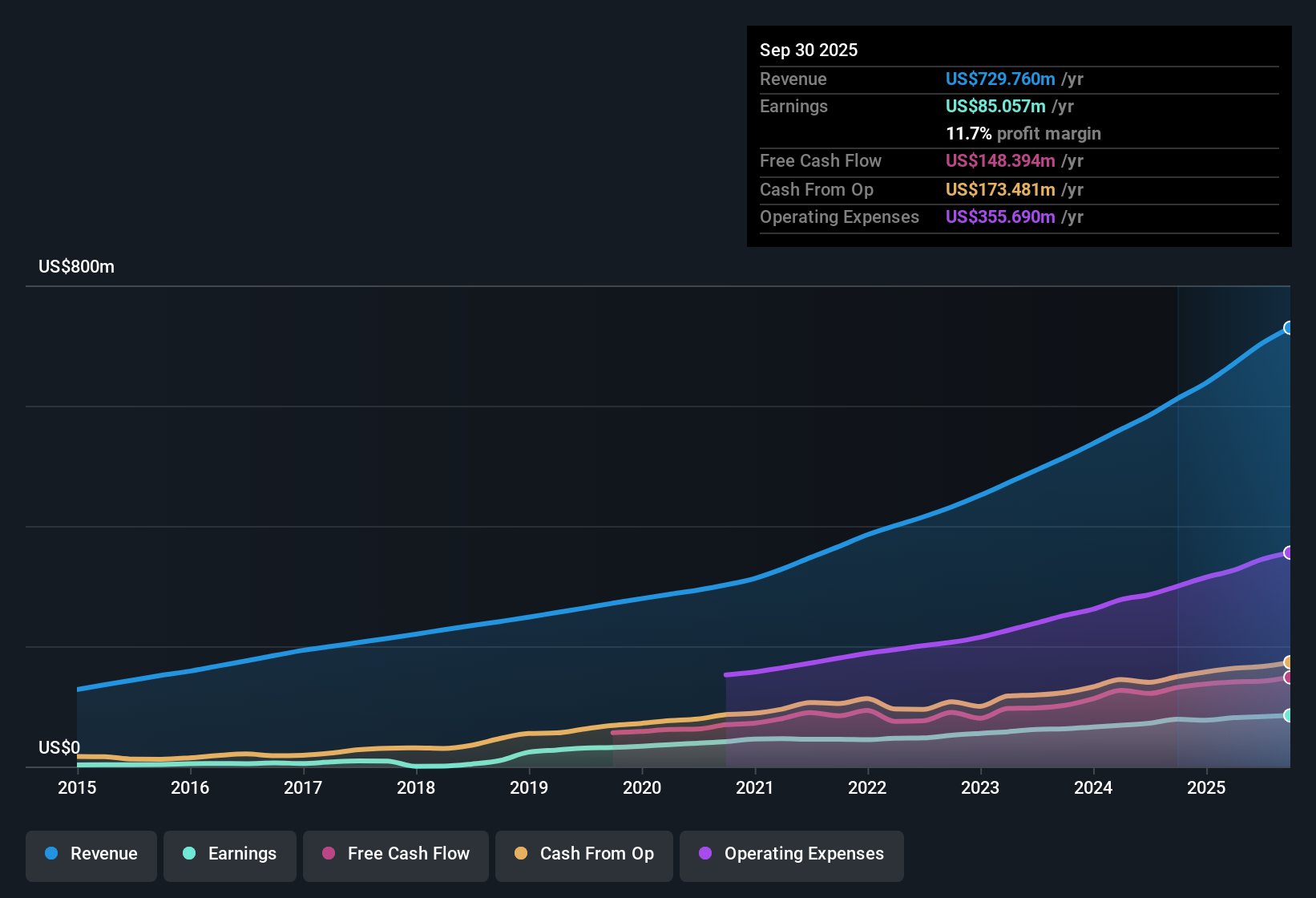

For SPS Commerce, the latest reported Free Cash Flow (FCF) is $148.05 million. Analyst estimates project steady growth, with FCF expected to reach $223.03 million by the end of 2027. According to Simply Wall St, projections continue out ten years, with extrapolated FCF expected to reach over $342.27 million by 2035. This highlights confidence in the company's capacity to grow cash generation beyond analyst coverage.

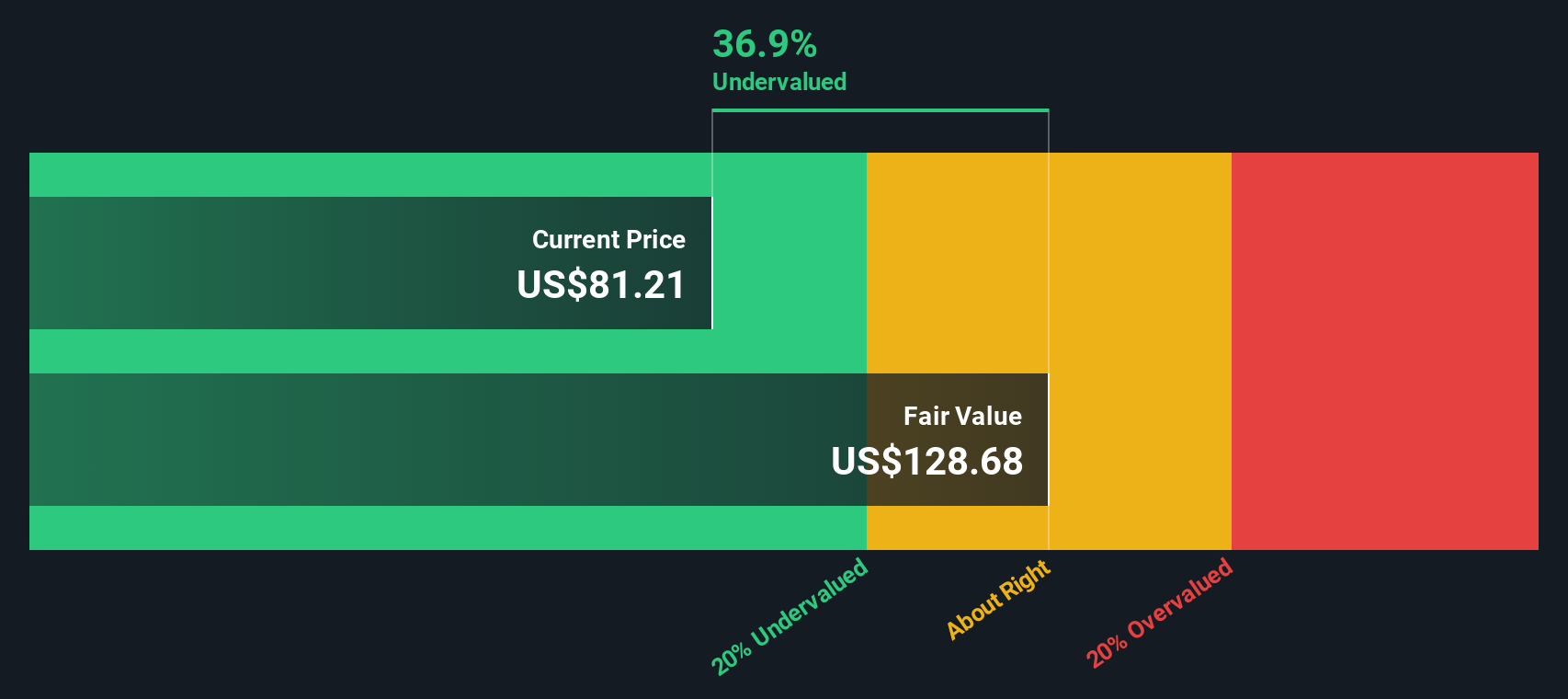

Based on these cash flows and the 2 Stage Free Cash Flow to Equity model, the intrinsic value for SPS Commerce is calculated at $125.02 per share. This valuation suggests the stock is trading at a 34.0% discount compared to its estimated fair value.

For investors, this points to a potentially attractive entry point, as the DCF analysis indicates SPS Commerce may be meaningfully undervalued relative to its cash flow prospects.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SPS Commerce is undervalued by 34.0%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: SPS Commerce Price vs Earnings

The Price-to-Earnings (PE) ratio is widely considered the preferred metric for valuing profitable software companies like SPS Commerce. It offers a quick snapshot of how much investors are willing to pay for each dollar of earnings, which makes it especially relevant when a company delivers consistent profits.

However, what constitutes a “normal” or “fair” PE ratio depends on several factors. Higher growth expectations generally warrant higher PE ratios, as investors are willing to pay a premium for above-average expansion. Conversely, riskier or slower-growing businesses tend to trade at lower ratios. Other influences include the company’s size, profitability, and the general sentiment toward its industry.

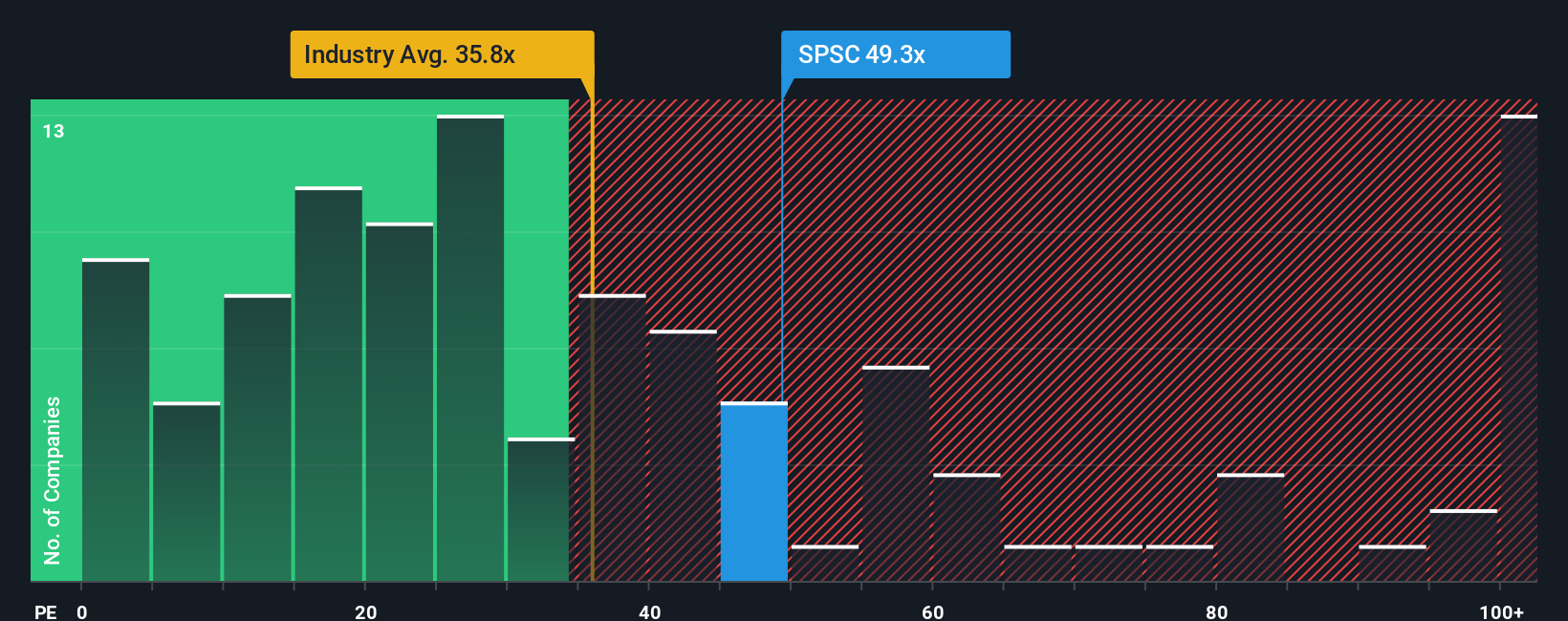

SPS Commerce currently trades at 36.6x earnings. That is slightly above the broader software industry’s average PE of 35.9x and below the peer group average of 55.4x. While traditional analysis would compare these figures side by side, Simply Wall St’s proprietary “Fair Ratio” goes further. This metric sets an optimal multiple in this case, 31.5x by factoring in specific company traits like forecasted growth, profit margins, industry dynamics, and company size alongside external risks.

Relying on the Fair Ratio is more robust than just comparing with peers or the industry, as it tailors the benchmark to SPS Commerce’s actual profile. In comparison, the current PE is modestly higher than its Fair Ratio, suggesting the stock’s valuation is slightly rich versus what would be justified by fundamentals alone.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SPS Commerce Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple but powerful concept. It’s your story of what you believe about SPS Commerce’s future, combined with the numbers you think are realistic for revenue, earnings, and margins. Narratives help you connect a company’s story to your financial forecast and then automatically link that to an actionable fair value, so you can see whether the stock is under- or overvalued based on your own perspective.

Narratives are built to be accessible. You can create or explore them on Simply Wall St’s Community page, used by millions of investors. This approach lets you compare your Fair Value calculation with the current share price to decide if it’s the right time to buy or sell. Plus, Narratives update dynamically each time new info, like company news or fresh earnings, is released, helping you keep your view up to date.

For example, some SPS Commerce investors believe recurring revenue and strong execution will drive the stock towards a bullish fair value of $170, while others see macro and competitive risks putting fair value as low as $120.

Do you think there's more to the story for SPS Commerce? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SPSC

SPS Commerce

Provides cloud-based supply chain management solutions in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives