- United States

- /

- Software

- /

- NasdaqCM:SMSI

What You Need To Know About The Smith Micro Software, Inc. (NASDAQ:SMSI) Analyst Downgrade Today

Today is shaping up negative for Smith Micro Software, Inc. (NASDAQ:SMSI) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

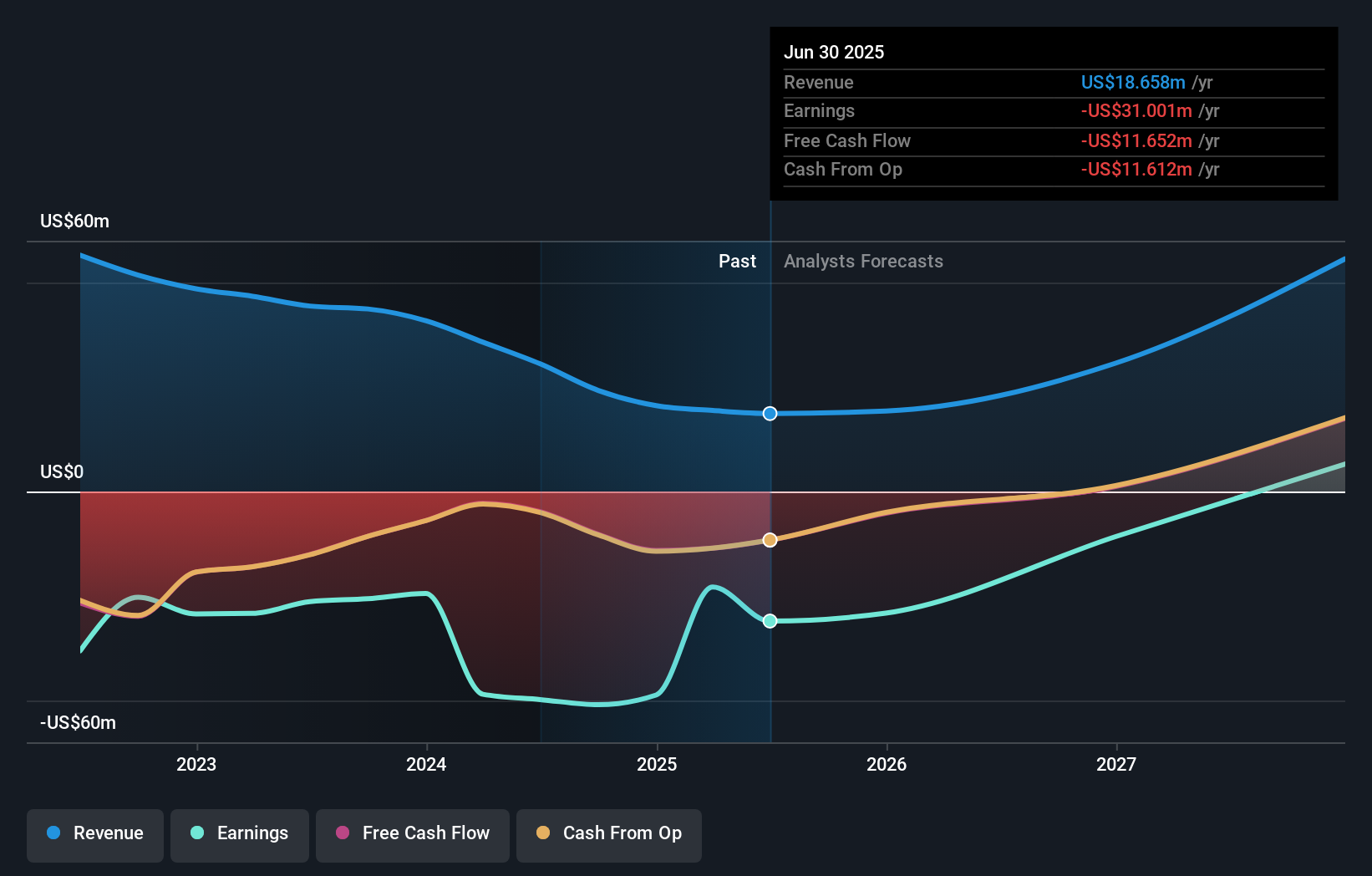

Following the downgrade, the latest consensus from Smith Micro Software's dual analysts is for revenues of US$19m in 2025, which would reflect a satisfactory 3.2% improvement in sales compared to the last 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 65% to US$0.52. However, before this estimates update, the consensus had been expecting revenues of US$22m and US$0.27 per share in losses. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a serious cut to their revenue forecasts while also expecting losses per share to increase.

See our latest analysis for Smith Micro Software

The consensus price target lifted 13% to US$4.50, clearly signalling that the weaker revenue and EPS outlook are not expected to weigh on the stock over the longer term.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. One thing stands out from these estimates, which is that Smith Micro Software is forecast to grow faster in the future than it has in the past, with revenues expected to display 6.4% annualised growth until the end of 2025. If achieved, this would be a much better result than the 17% annual decline over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue grow 13% per year. Although Smith Micro Software's revenues are expected to improve, it seems that the analysts are still bearish on the business, forecasting it to grow slower than the broader industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at Smith Micro Software. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Smith Micro Software's revenues are expected to grow slower than the wider market. There was also a nice increase in the price target, with analysts apparently feeling that the intrinsic value of the business is improving. Given the stark change in sentiment, we'd understand if investors became more cautious on Smith Micro Software after today.

After a downgrade like this, it's pretty clear that previous forecasts were too optimistic. What's more, we've spotted several possible issues with Smith Micro Software's business, like major dilution from new stock issuance in the past year. For more information, you can click here to discover this and the 3 other risks we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SMSI

Smith Micro Software

Develops and sells software solutions to simplify and enhance the mobile experience to wireless and cable service providers in the Americas, Europe, the Middle East, and Africa.

Undervalued with mediocre balance sheet.

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Okamoto Machine Tool Works focus on profitability

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Inotiv NAMs Test Center

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.