Stock Analysis

- United States

- /

- Software

- /

- NasdaqCM:SMSI

The Smith Micro Software, Inc. (NASDAQ:SMSI) First-Quarter Results Are Out And Analysts Have Published New Forecasts

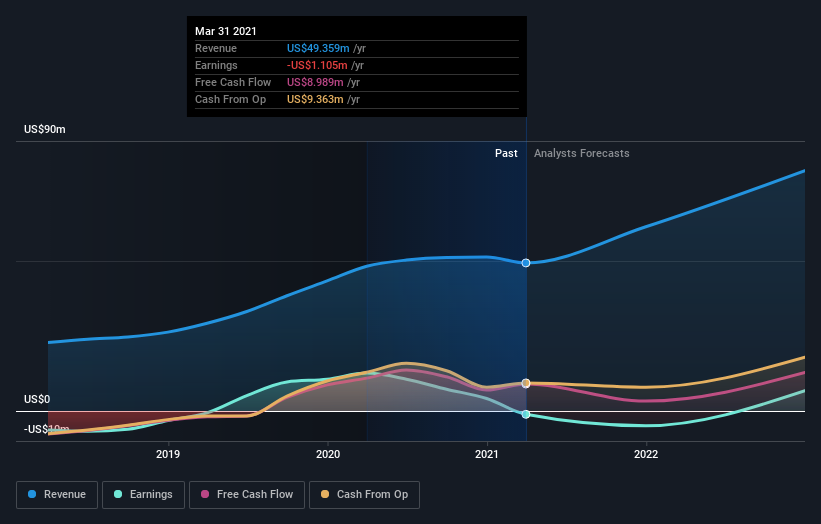

It's been a mediocre week for Smith Micro Software, Inc. (NASDAQ:SMSI) shareholders, with the stock dropping 16% to US$4.81 in the week since its latest quarterly results. Revenues of US$11m beat expectations by a respectable 3.1%, although statutory losses per share increased. Smith Micro Software lost US$0.07, which was 289% more than what the analysts had included in their models. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

See our latest analysis for Smith Micro Software

Taking into account the latest results, the consensus forecast from Smith Micro Software's five analysts is for revenues of US$61.4m in 2021, which would reflect a major 24% improvement in sales compared to the last 12 months. Losses are forecast to balloon 180% to US$0.074 per share. Yet prior to the latest earnings, the analysts had been forecasting revenues of US$61.4m and losses of US$0.074 per share in 2021.

As a result there was no major change to the consensus price target of US$9.55, implying that the business is trading roughly in line with expectations despite ongoing losses. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values Smith Micro Software at US$11.25 per share, while the most bearish prices it at US$8.00. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Smith Micro Software's past performance and to peers in the same industry. The analysts are definitely expecting Smith Micro Software's growth to accelerate, with the forecast 34% annualised growth to the end of 2021 ranking favourably alongside historical growth of 14% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 13% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Smith Micro Software to grow faster than the wider industry.

The Bottom Line

The most obvious conclusion is that the analysts made no changes to their forecasts for a loss next year. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. The consensus price target held steady at US$9.55, with the latest estimates not enough to have an impact on their price targets.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Smith Micro Software going out to 2022, and you can see them free on our platform here..

However, before you get too enthused, we've discovered 3 warning signs for Smith Micro Software that you should be aware of.

If you’re looking to trade Smith Micro Software, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Smith Micro Software is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:SMSI

Smith Micro Software

Engages in the development and sale of software to enhance the mobile experience to wireless and cable service providers in the Americas, Europe, the Middle East, and Africa.

Flawless balance sheet and undervalued.