- United States

- /

- Software

- /

- NasdaqCM:SMSI

Smith Micro Software, Inc. (NASDAQ:SMSI) Stock Rockets 29% But Many Are Still Ignoring The Company

Smith Micro Software, Inc. (NASDAQ:SMSI) shares have continued their recent momentum with a 29% gain in the last month alone. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 77% share price drop in the last twelve months.

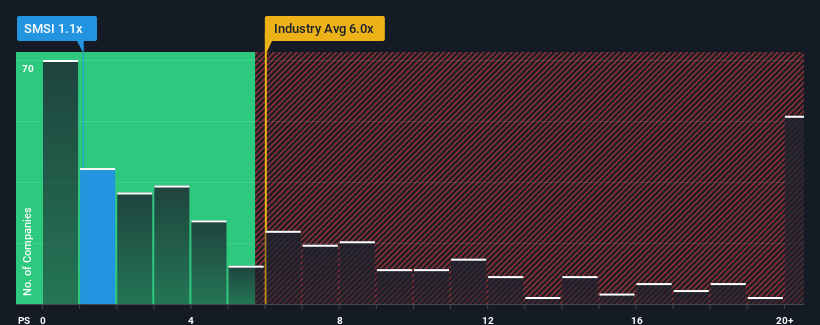

In spite of the firm bounce in price, Smith Micro Software's price-to-sales (or "P/S") ratio of 1.1x might still make it look like a strong buy right now compared to the wider Software industry in the United States, where around half of the companies have P/S ratios above 6.1x and even P/S above 13x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Smith Micro Software

What Does Smith Micro Software's Recent Performance Look Like?

Smith Micro Software could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Smith Micro Software.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Smith Micro Software's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 45%. As a result, revenue from three years ago have also fallen 57% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 34% each year as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 20% each year growth forecast for the broader industry.

In light of this, it's peculiar that Smith Micro Software's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Smith Micro Software's recent share price jump still sees fails to bring its P/S alongside the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Smith Micro Software's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Smith Micro Software (at least 2 which make us uncomfortable), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SMSI

Smith Micro Software

Develops and sells software solutions to simplify and enhance the mobile experience to wireless and cable service providers in the Americas, Europe, the Middle East, and Africa.

Undervalued with mediocre balance sheet.

Market Insights

Community Narratives