- United States

- /

- Software

- /

- NasdaqCM:SMSI

Smith Micro Software, Inc. (NASDAQ:SMSI) Just Reported, And Analysts Assigned A US$3.50 Price Target

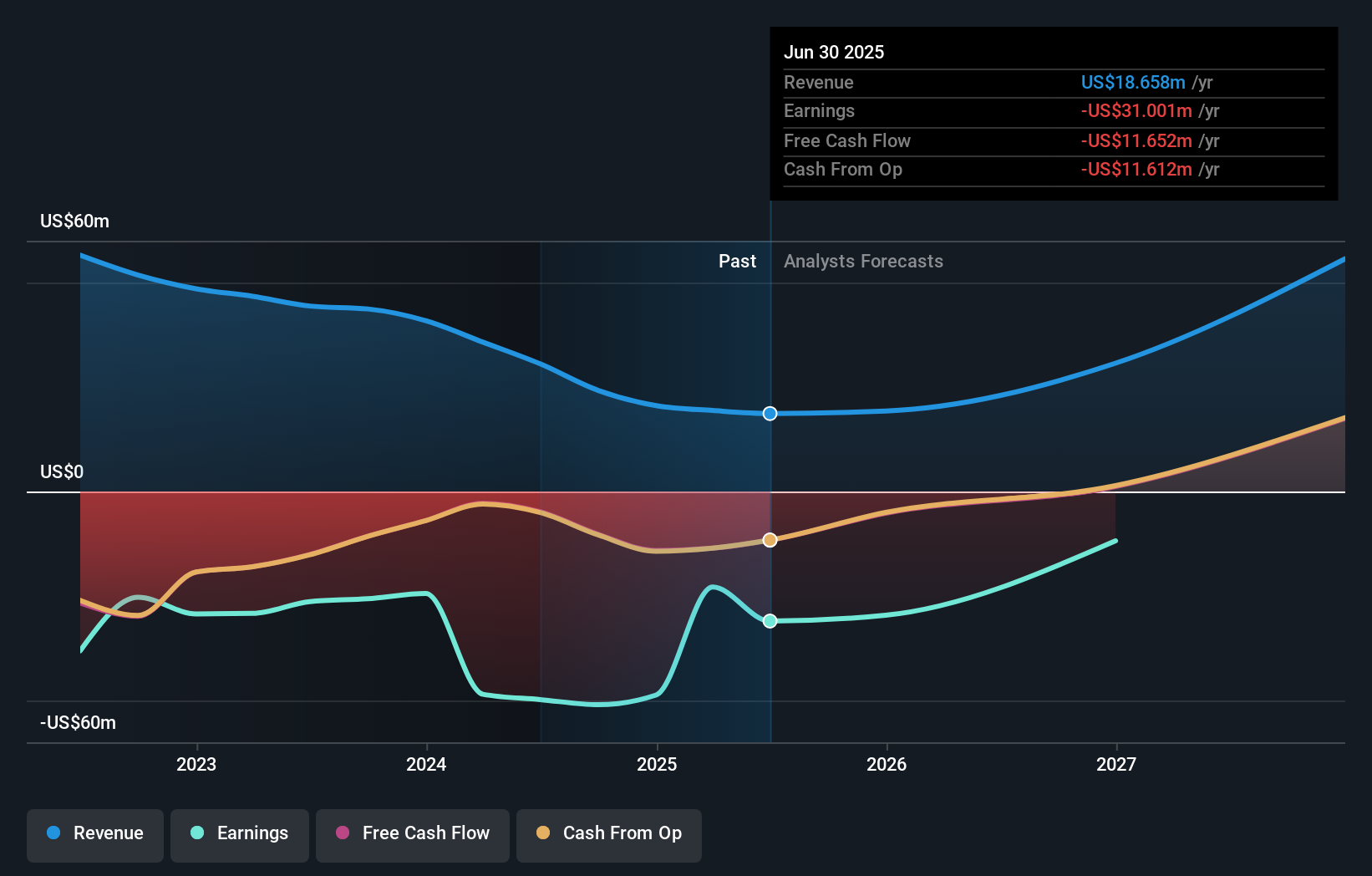

Smith Micro Software, Inc. (NASDAQ:SMSI) just released its latest second-quarter report and things are not looking great. Revenues missed expectations somewhat, coming in at US$4.4m, but statutory earnings fell catastrophically short, with a loss of US$0.78 some 208% larger than what the analysts had predicted. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

Taking into account the latest results, the current consensus from Smith Micro Software's twin analysts is for revenues of US$19.3m in 2025. This would reflect a credible 3.2% increase on its revenue over the past 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 45% to US$0.81. Yet prior to the latest earnings, the analysts had been forecasting revenues of US$22.2m and losses of US$0.85 per share in 2025. We can see there's definitely been a change in sentiment in this update, with the analysts administering a meaningful downgrade to next year's revenue estimates, while at the same time reducing their loss estimates.

See our latest analysis for Smith Micro Software

The analysts have cut their price target 13% to US$3.50per share, suggesting that the declining revenue was a more crucial indicator than the forecast reduction in losses.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. One thing stands out from these estimates, which is that Smith Micro Software is forecast to grow faster in the future than it has in the past, with revenues expected to display 6.4% annualised growth until the end of 2025. If achieved, this would be a much better result than the 17% annual decline over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue grow 13% per year. So although Smith Micro Software's revenue growth is expected to improve, it is still expected to grow slower than the industry.

The Bottom Line

The most important thing to take away is that the analysts reconfirmed their loss per share estimates for next year. Unfortunately, they also downgraded their revenue estimates, and our data indicates underperformance compared to the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. Even so, long term profitability is more important for the value creation process. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for Smith Micro Software going out as far as 2027, and you can see them free on our platform here.

It is also worth noting that we have found 4 warning signs for Smith Micro Software (1 is a bit unpleasant!) that you need to take into consideration.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SMSI

Smith Micro Software

Develops and sells software solutions to simplify and enhance the mobile experience to wireless and cable service providers in the Americas, Europe, the Middle East, and Africa.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Proximus The Amplify Reset, State-Backed, Debt-Disciplined, and Building Toward €400M FCF by 2030

Delta Air Lines Inc. (DAL): The Premium Powerhouse – Scaling Loyalty and International Dominance in 2026

The Walt Disney Company (DIS): The Turnaround Flywheel – Scaling Streaming and Experiences in 2026

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks