- United States

- /

- Software

- /

- NasdaqCM:SMSI

Smith Micro Software, Inc. (NASDAQ:SMSI) Just Reported, And Analysts Assigned A US$14.67 Price Target

It's been a pretty great week for Smith Micro Software, Inc. (NASDAQ:SMSI) shareholders, with its shares surging 11% to US$2.60 in the week since its latest first-quarter results. Revenues were in line with expectations, at US$5.8m, while statutory losses ballooned to US$3.28 per share. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for Smith Micro Software

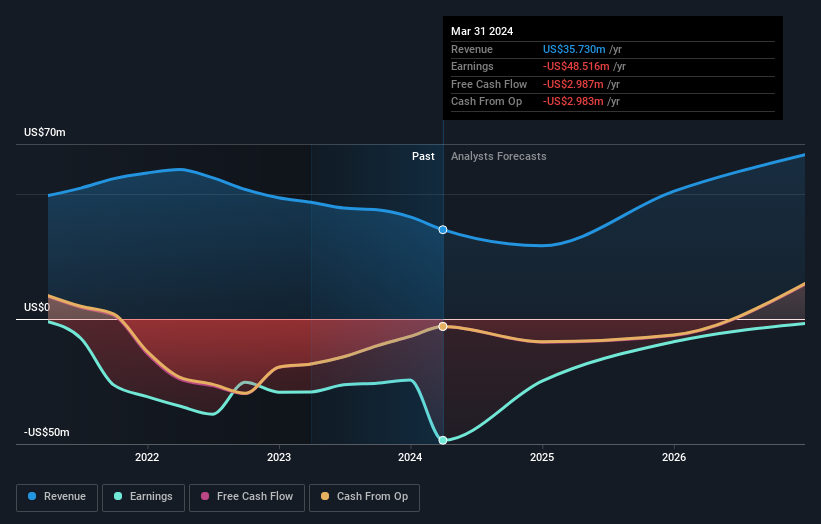

After the latest results, the consensus from Smith Micro Software's three analysts is for revenues of US$29.3m in 2024, which would reflect a definite 18% decline in revenue compared to the last year of performance. Losses are predicted to fall substantially, shrinking 47% to US$2.67. Before this earnings announcement, the analysts had been modelling revenues of US$30.3m and losses of US$2.70 per share in 2024.

The analysts have cut their price target 11% to US$14.67per share, signalling that the declining revenue and ongoing losses are contributing to the lower valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Smith Micro Software, with the most bullish analyst valuing it at US$24.00 and the most bearish at US$8.00 per share. As you can see the range of estimates is wide, with the lowest valuation coming in at less than half the most bullish estimate, suggesting there are some strongly diverging views on how analysts think this business will perform. With this in mind, we wouldn't rely too heavily the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We would highlight that revenue is expected to reverse, with a forecast 23% annualised decline to the end of 2024. That is a notable change from historical growth of 2.3% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 13% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Smith Micro Software is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that the analysts reconfirmed their loss per share estimates for next year. On the negative side, they also downgraded their revenue estimates, and forecasts imply they will perform worse than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of Smith Micro Software's future valuation.

With that in mind, we wouldn't be too quick to come to a conclusion on Smith Micro Software. Long-term earnings power is much more important than next year's profits. We have forecasts for Smith Micro Software going out to 2026, and you can see them free on our platform here.

It is also worth noting that we have found 4 warning signs for Smith Micro Software (1 is a bit unpleasant!) that you need to take into consideration.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SMSI

Smith Micro Software

Develops and sells software solutions to simplify and enhance the mobile experience to wireless and cable service providers in the Americas, Europe, the Middle East, and Africa.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

The NVIDIA Phenomenon

Take Two Interactive Software TTWO Valuation Analysis

Recursion Pharmaceuticals! WTH is going on?

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Nu holdings will continue to disrupt the South American banking market

Trending Discussion