- United States

- /

- Software

- /

- NasdaqCM:SMSI

Is Smith Micro Software (NASDAQ:SMSI) Using Debt Sensibly?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Smith Micro Software, Inc. (NASDAQ:SMSI) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Smith Micro Software

What Is Smith Micro Software's Net Debt?

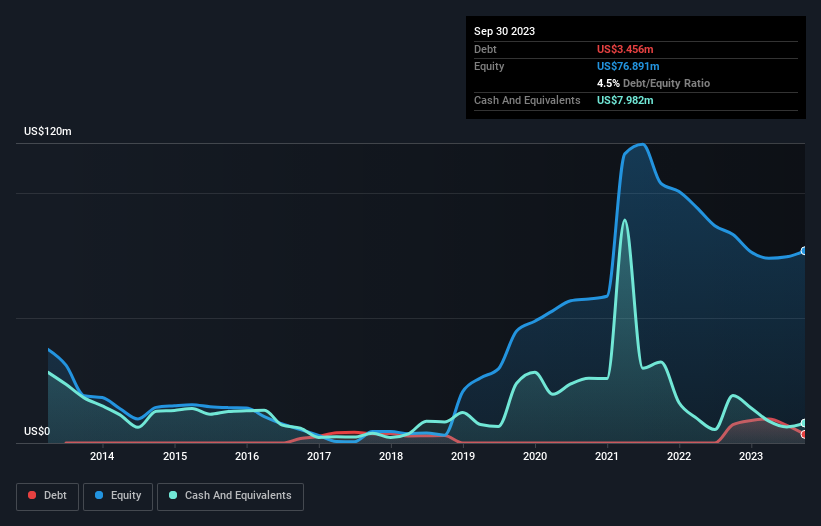

You can click the graphic below for the historical numbers, but it shows that Smith Micro Software had US$3.46m of debt in September 2023, down from US$7.31m, one year before. But on the other hand it also has US$7.98m in cash, leading to a US$4.53m net cash position.

A Look At Smith Micro Software's Liabilities

According to the last reported balance sheet, Smith Micro Software had liabilities of US$12.2m due within 12 months, and liabilities of US$3.24m due beyond 12 months. Offsetting these obligations, it had cash of US$7.98m as well as receivables valued at US$10.3m due within 12 months. So it actually has US$2.85m more liquid assets than total liabilities.

This surplus suggests that Smith Micro Software has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Smith Micro Software boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Smith Micro Software can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Smith Micro Software had a loss before interest and tax, and actually shrunk its revenue by 16%, to US$44m. We would much prefer see growth.

So How Risky Is Smith Micro Software?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Smith Micro Software lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of US$11m and booked a US$26m accounting loss. Given it only has net cash of US$4.53m, the company may need to raise more capital if it doesn't reach break-even soon. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 4 warning signs for Smith Micro Software you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SMSI

Smith Micro Software

Develops and sells software solutions to simplify and enhance the mobile experience to wireless and cable service providers in the Americas, Europe, the Middle East, and Africa.

Undervalued with mediocre balance sheet.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

The Green Consolidator

EDP as a safe capital allocation with a potential upside of 28% with steady dividends

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion