- United States

- /

- IT

- /

- NasdaqGS:SHOP

Shopify’s Recent 12% Drop Raises New Questions After Expansion News

Reviewed by Bailey Pemberton

- Wondering if Shopify stock is a bargain or overpriced? You're not alone—it’s a question that deserves a closer look as markets shift.

- Despite rallying an impressive 30.1% year-to-date and gaining 32.2% over the past year, Shopify has dipped by nearly 12% in both the last week and month. This puts recent momentum and investor confidence up for debate.

- Recent headlines spotlight Shopify's continued push into new markets and its strategic partnerships with key e-commerce players, both of which have influenced investor sentiment. These moves have generated excitement but also raised questions about future profitability and competitive threats facing the business.

- When it comes to valuation, Shopify currently scores just 1 out of 6 on our undervalued checks, suggesting plenty of room for debate. Let's explore what goes into that score and why there may be an even better way to judge whether Shopify offers real value for investors.

Shopify scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Shopify Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a fundamental valuation approach that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their present value. For Shopify, this method uses both analyst forecasts and long-term estimates to map out where the business could be headed financially.

Looking at Shopify's latest financials, the company produced Free Cash Flow (FCF) of $1.89 Billion over the last twelve months. Analysts predict this will grow significantly, with FCF estimated to reach $5.45 Billion by the end of 2029. These projections are the product of five years of analyst estimates, with longer-term numbers extrapolated using growth forecasts beyond 2029.

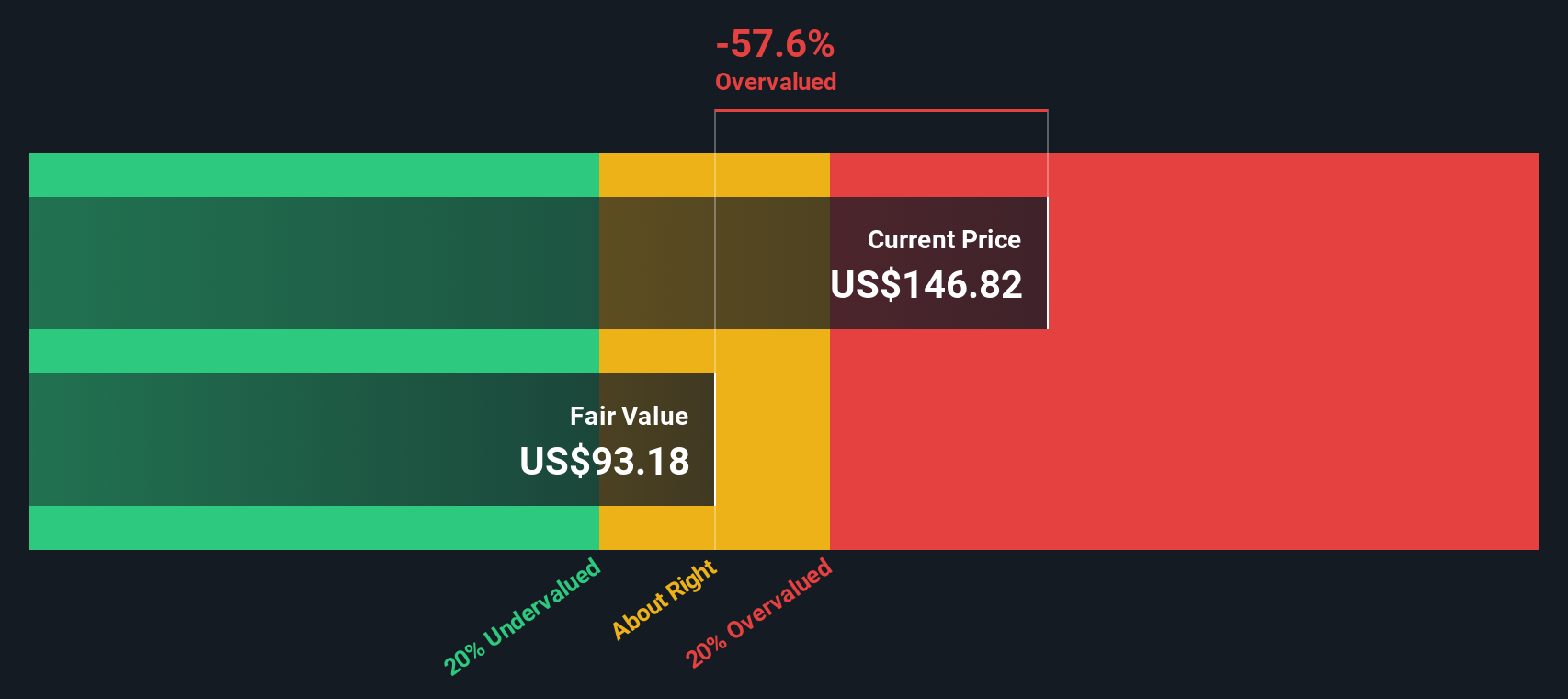

Based on these cash flows and the DCF model, Shopify's estimated intrinsic value stands at $98.15 per share. However, when compared to the current trading price, this suggests that the stock is about 42.6 percent overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Shopify may be overvalued by 42.6%. Discover 894 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Shopify Price vs Earnings (PE) Multiple

The Price-to-Earnings (PE) ratio is widely used to assess profitable companies like Shopify because it relates a company’s stock price directly to its actual earnings, offering a quick reading on how much investors are willing to pay for each dollar of profit. For firms with consistent profitability, the PE multiple can help highlight whether a stock is priced in line with realistic earning capacity.

What makes a “fair” PE ratio can vary. High-growth companies and those with lower risk profiles tend to command higher PE multiples, while slower-growing or riskier firms see lower numbers. Investors use these benchmarks to judge if a company’s future prospects already appear to be reflected in its current price.

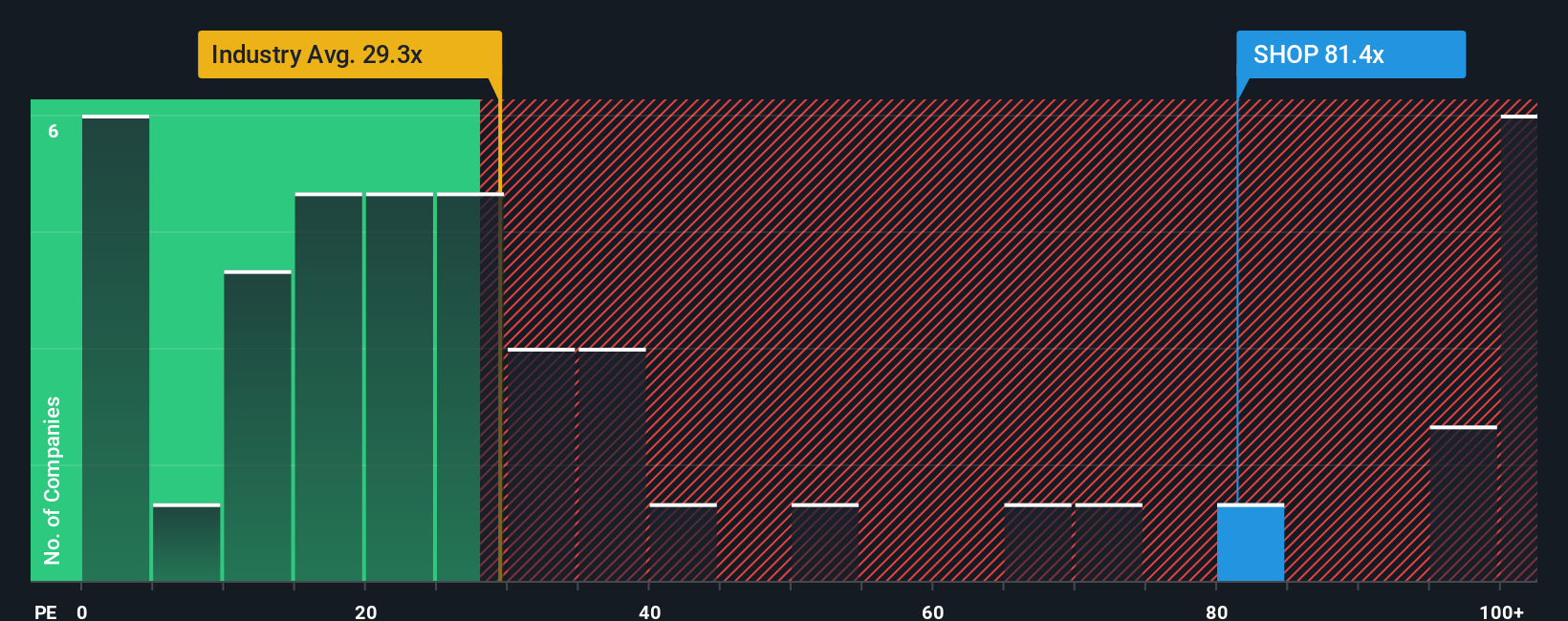

At present, Shopify trades at a PE ratio of 102.3x, which is much higher than both the IT industry average of 26.9x and its peer group average of 39.7x. Simply Wall St’s proprietary metric, known as the Fair Ratio, predicts what Shopify’s PE should be by taking into account not only expected earnings growth but also profit margins, industry dynamics, company size, and unique risks. For Shopify, the Fair Ratio is 51.4x. This holistic approach gives a more tailored view than simple peer or industry comparisons.

Comparing Shopify’s current PE of 102.3x to its Fair Ratio of 51.4x suggests that the stock is trading at a significant premium above what would generally be considered fair based on its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Shopify Narrative

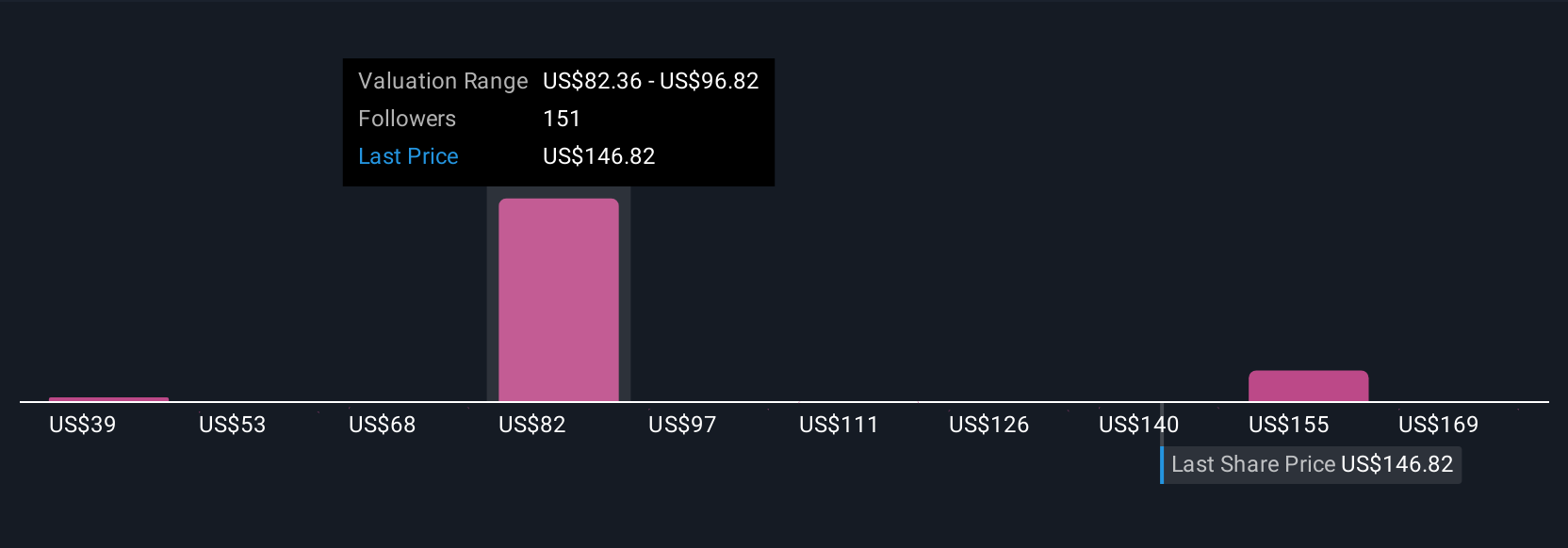

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, structured way for investors to tell their own story about a company. It connects your expectations for Shopify’s future revenue, earnings and margins with your assumed fair value, all supported by a brief explanation of what you believe is driving the business.

Unlike static models, Narratives link the company’s story directly to a financial forecast and an estimated fair value, helping you move beyond just looking at ratios or analyst targets. With Simply Wall St, millions of investors use Narratives on the Community page to record their viewpoints and instantly compare them against the views of others.

Narratives make it easy to decide when to buy or sell by letting you transparently compare your Fair Value to Shopify’s current share price, and they update automatically whenever new news or earnings reports change the outlook.

For example, some investors see Shopify’s aggressive international expansion and AI-driven ecosystem as justifying the highest price targets, while others focus on increasing competition and regulatory hurdles, supporting a much lower fair value. Your Narrative helps you map your own view to real numbers and better investing decisions.

Do you think there's more to the story for Shopify? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives