- United States

- /

- IT

- /

- NasdaqGS:SHOP

Shopify (SHOP): Taking Stock of Valuation Following Recent Platform Updates and Merchant Tool Expansion

Reviewed by Simply Wall St

Shopify (SHOP) shares have seen a mix of movement this month, catching investors’ interest as the company continues to roll out platform updates and expand merchant tools. Recent trading has reflected changing sentiment around its growth outlook.

See our latest analysis for Shopify.

Shopify’s share price has ridden a wave of momentum this year, with a stellar year-to-date gain of 47.53% and a 1-year total shareholder return of 40.41%. While the last month brought a modest pullback, the stock’s strong 90-day share price return and remarkable 288.92% total shareholder return over three years reflect sustained optimism about Shopify’s long-term growth story.

If you’re interested in fast-moving tech names with growth stories like Shopify, you can discover See the full list for free.

As Shopify continues to deliver impressive growth numbers and remains a leader in commerce technology, investors are left to wonder if its current share price leaves any upside on the table, or if the market has already factored in all the good news.

Most Popular Narrative: 9.4% Undervalued

Shopify’s most widely followed valuation narrative sees fair value at $175.11 compared to the last close of $158.64. This suggests room for further price appreciation if growth assumptions play out. The methodology incorporates global expansion, product innovation, and shifting profit dynamics into its assessment.

Shopify is expanding rapidly in international markets, with 42% year-over-year GMV growth internationally (especially in Europe, but also in Asia Pacific). As digital commerce adoption increases globally, this drives a larger addressable market and will support outperformance in revenue growth and GMV. The company is aggressively integrating AI-driven capabilities (for example, Sidekick, AI store builder, conversational commerce integrations with large language models). These enable merchants to launch, manage, and scale stores with less friction and more efficiency, which is likely to accelerate merchant acquisition, improve retention, and drive higher margins through automation and new high-value features.

Want to know why the narrative points to record growth but sees thinner profit margins ahead? The mix driving this target puts international and digital commerce acceleration at center stage. What future assumptions let this projection soar? Click to see how bold expansion, fresh tech bets, and surprisingly rich multiples shape this valuation outlook.

Result: Fair Value of $175.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from e-commerce giants and regulatory changes could quickly disrupt Shopify’s growth trajectory and put downward pressure on margins.

Find out about the key risks to this Shopify narrative.

Another View: What Do Earnings Multiples Say?

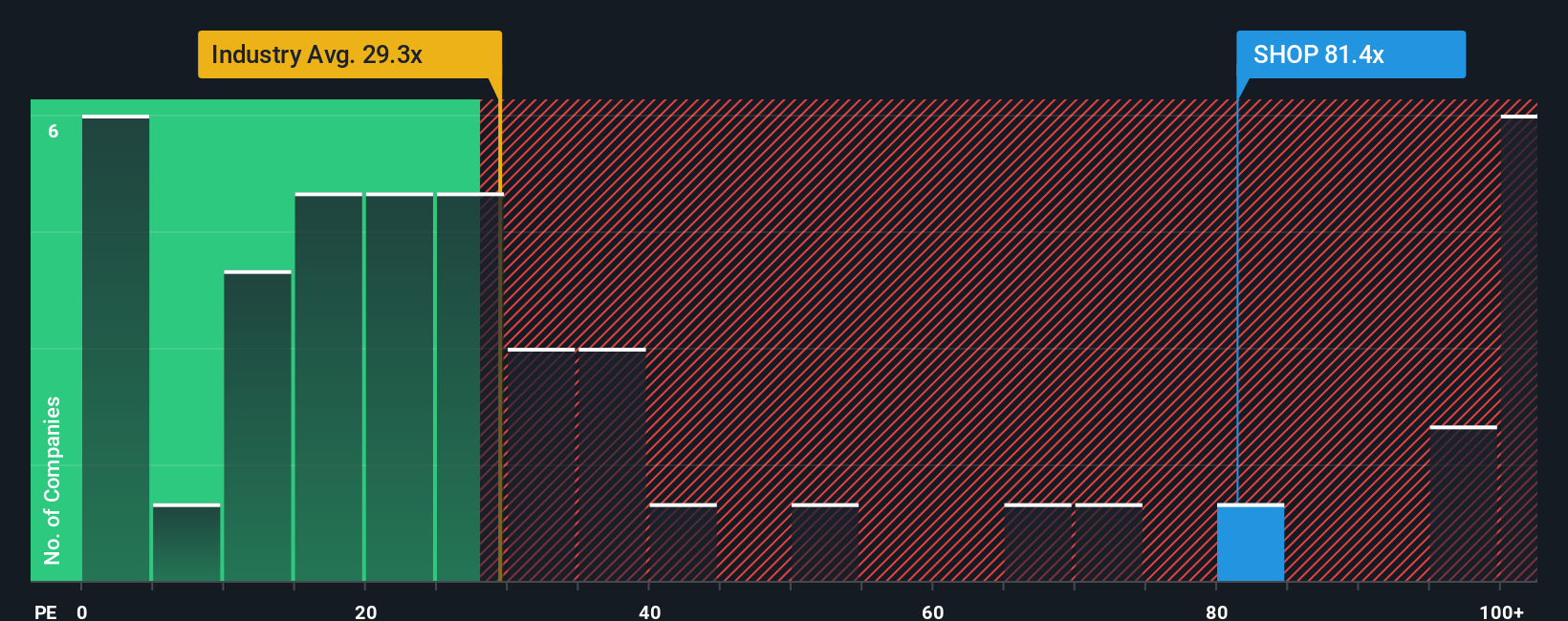

Looking through the lens of the price-to-earnings ratio shows a starkly different picture. Shopify’s P/E stands at 116x, which is far richer than both its peer average of 39.8x and the IT industry’s 28.1x. Even compared to a fair ratio of 49.1x, Shopify trades at a significant premium. Does this hefty multiple reflect optimism, or could it signal a valuation risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Shopify Narrative

If you see things differently or want a deeper dive into the numbers, you can create your own narrative in just a few minutes. Do it your way.

A great starting point for your Shopify research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your investing strategy to just one stock. Expand your horizons with targeted ideas from Simply Wall Street’s personalized screeners and move closer to your goals.

- Capture potential with high-yield companies by checking out these 15 dividend stocks with yields > 3%, which offer robust income and attractive financial fundamentals.

- Tap into innovations shaping tomorrow by reviewing these 28 quantum computing stocks, powering advancements in quantum algorithms, security, and computing performance.

- Uncover overlooked opportunities by seeing these 3556 penny stocks with strong financials, which combine strong financials with growth potential in emerging industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026