- United States

- /

- IT

- /

- NasdaqGS:SHOP

Can Shopify (SHOP)’s New AI Partnership Redefine Its Role in Omnichannel Retail Expansion?

Reviewed by Sasha Jovanovic

- Shopify recently showcased its innovations at the EU-Canada Business Summit and saw new retail integrations through Leap's announcement of Bombas’ third physical store leveraging Shopify’s technology.

- A key insight is that Shopify’s ongoing partnerships and technology integrations are enabling brands to expand from online to premium brick-and-mortar retail with streamlined operations and unified digital management.

- We'll now explore how Shopify's latest AI partnership with Liquid AI could strengthen its core platform and enhance the investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Shopify Investment Narrative Recap

To be a Shopify shareholder, you need to believe in its ability to capture long-term growth as a global commerce enabler, leveraging technology and partnerships to drive new channels and services for merchants. While recent innovations and AI integrations highlight product momentum, neither these developments nor the Bombas retail expansion are likely to materially shift the most important near-term catalyst, sustained large brand adoption, or address ongoing risks such as regulatory scrutiny and rising compliance demands.

The Shopify–Liquid AI partnership stands out, as faster, higher-quality AI-powered search and recommendations could better position Shopify's core platform for large enterprise and omnichannel retail customers, correlating directly with key growth catalysts like upmarket migration and improved merchant retention.

By contrast, investors should keep in mind that increased regulatory pressures in digital commerce may introduce unexpected challenges and costs for Shopify in coming quarters...

Read the full narrative on Shopify (it's free!)

Shopify's outlook anticipates $18.5 billion in revenue and $2.7 billion in earnings by 2028. This is based on a projected 22.6% annual revenue growth rate and a $0.4 billion increase in earnings from the current level of $2.3 billion.

Uncover how Shopify's forecasts yield a $175.11 fair value, a 10% upside to its current price.

Exploring Other Perspectives

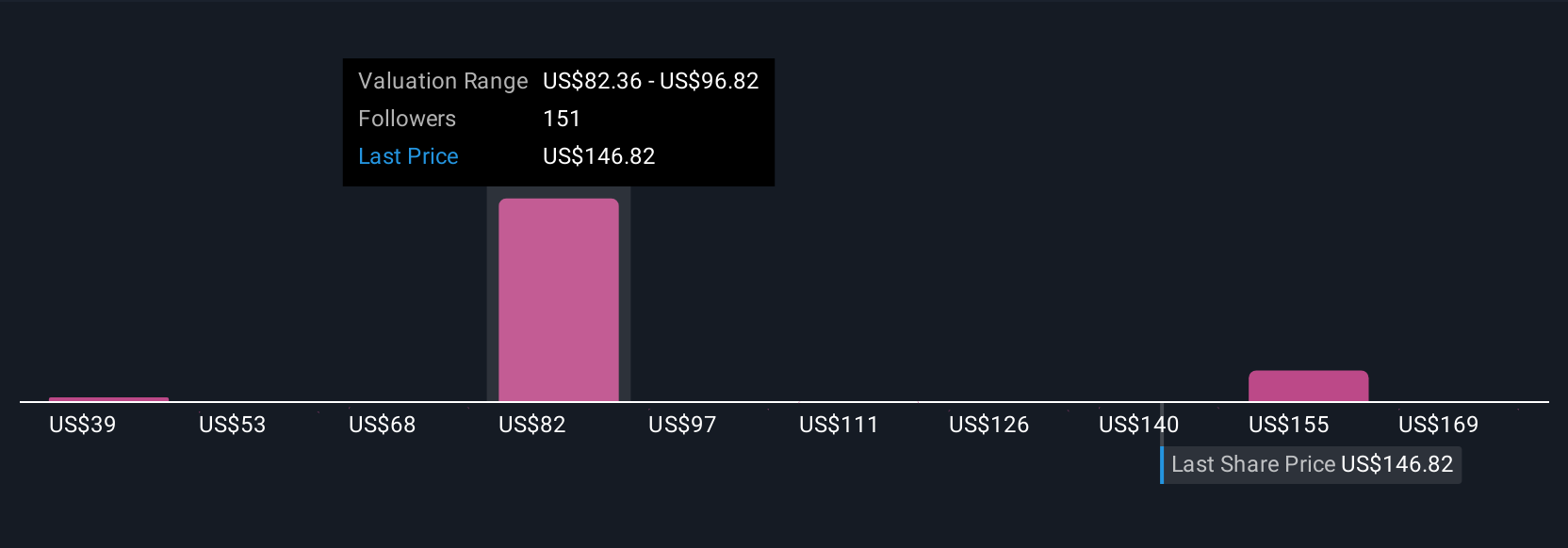

Fair value estimates from the Simply Wall St Community span from US$82 to US$200 per share across 22 viewpoints, underscoring significant differences in growth assumptions. With AI-driven capabilities accelerating, the ability to win and retain premium merchants could have meaningful effects on future revenue and platform resilience, see how your outlook aligns with the range of market opinions.

Explore 22 other fair value estimates on Shopify - why the stock might be worth 49% less than the current price!

Build Your Own Shopify Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shopify research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Shopify research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shopify's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success