- United States

- /

- Software

- /

- NasdaqGM:RPD

A Closer Look at Rapid7 (RPD) Valuation Following Recent Business Update and Share Price Performance

Reviewed by Simply Wall St

See our latest analysis for Rapid7.

Rapid7’s share price has struggled for momentum despite recent operational progress, with a sharp 21.05% seven-day decline and a year-to-date share price return of -63.43%. Looking at the bigger picture, the company’s one-year total shareholder return of -65.12% puts all eyes on whether current valuations now reflect its risks and potential.

If you’re weighing sector opportunities after Rapid7’s wild ride, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading well below analyst price targets, investors face a key question: does Rapid7 represent an undervalued opportunity, or is the market already factoring in the company’s future growth prospects?

Most Popular Narrative: 34.0% Undervalued

Rapid7's most widely followed narrative suggests its fair value is materially higher than its last close of $14.40, hinting at structural upside if expectations play out. This sets the stage for a growth-driven outlook built around next-generation cybersecurity solutions and expanding end markets.

Rapid7's unified Command platform and MDR-led solutions are increasingly winning larger, strategic consolidation deals as enterprises seek to reduce fragmentation and simplify compliance in complex, highly regulated environments. This points to an expanding addressable market, higher average revenue per customer, and sustained revenue growth opportunity.

Curious what’s fueling the optimism? The full narrative reveals Rapid7’s future hinges on an ambitious set of financial targets, powerful margin expansion assumptions, and a profit multiple that many software leaders dream of achieving. Dive in to uncover which bold forecasts could upend the company’s valuation story.

Result: Fair Value of $21.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing execution challenges and slower revenue growth from legacy products may weaken the company’s ability to achieve the projected upside.

Find out about the key risks to this Rapid7 narrative.

Another View: Multiples Tell a Different Story

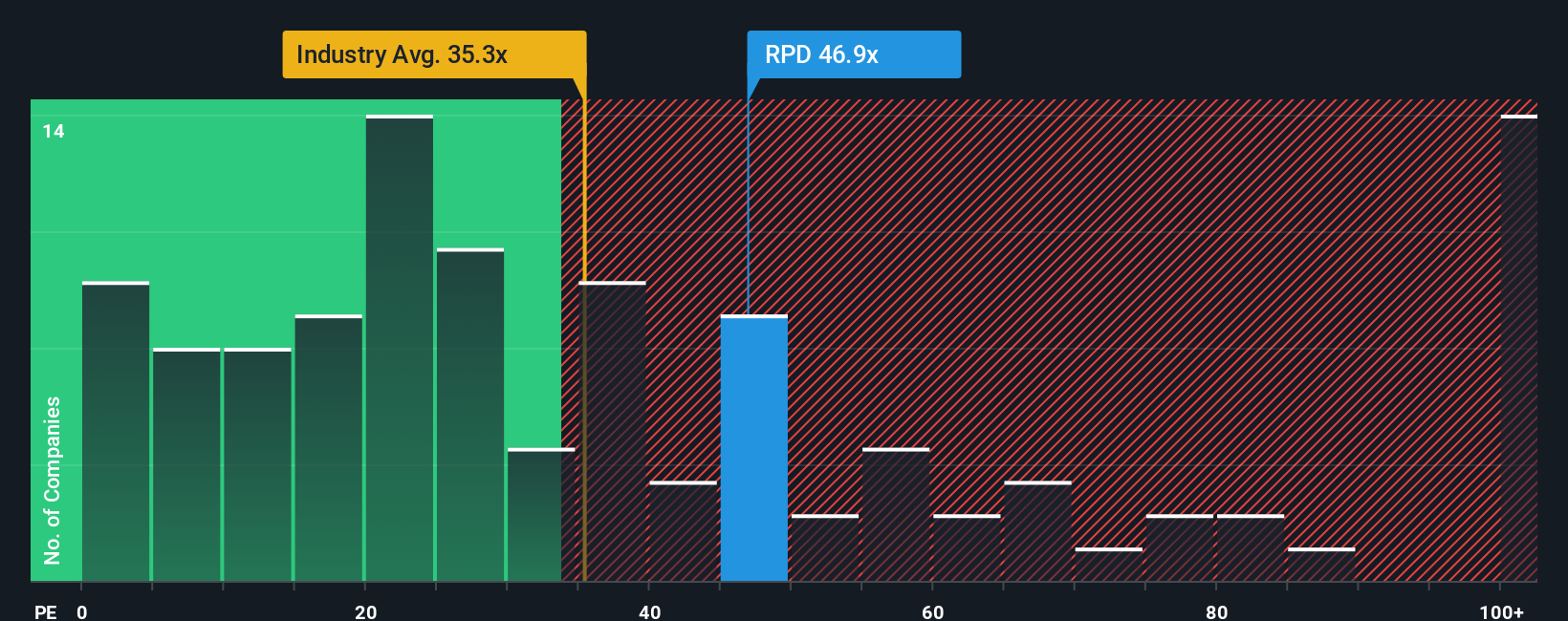

Looking at Rapid7 through the lens of price-to-earnings, things appear less optimistic. The company trades at a multiple of 42x, which is well above both the industry average of 35.2x and its fair ratio of 37.8x. This premium suggests investors are paying up for potential growth, adding valuation risk if expectations are not met. Could the market shift closer to the fair ratio, or is optimism here justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rapid7 Narrative

If you see things differently or want to dig deeper on your own terms, you can build your own story and perspective in just a few minutes with Do it your way.

A great starting point for your Rapid7 research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing comes from taking action on new trends and sectors, not just following the crowd. Supercharge your portfolio by tapping into unique opportunities others might overlook.

- Grab the chance for high income by checking out these 17 dividend stocks with yields > 3%, which boasts attractive yields above 3% and solid track records.

- Spot tomorrow’s leaders by evaluating these 25 AI penny stocks, which show explosive growth in artificial intelligence and automation.

- Catch the momentum shaping secure payments and blockchain innovation with these 82 cryptocurrency and blockchain stocks before the next wave hits the mainstream.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RPD

Rapid7

Provides cybersecurity software and services under the Rapid7, Nexpose, and Metasploit brand names.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives