- United States

- /

- Software

- /

- NasdaqCM:RIOT

Riot Platforms (RIOT): Assessing Valuation After Bitcoin Mining Drop and AI Project Silence

Reviewed by Simply Wall St

Riot Platforms (RIOT) has seen its stock drop sharply in recent days, as October's lower Bitcoin production numbers and silence on AI or high-performance computing initiatives have put investors on edge.

See our latest analysis for Riot Platforms.

Riot’s recent slide follows a pattern of volatility seen throughout the year, with the 7-day share price return down 16.4% and October’s operational update adding fuel to near-term uncertainty. Still, the stock is up 51.4% over the last 90 days and boasts a 65.6% share price return year-to-date, while its one-year total shareholder return of 15.7% remains positive. Momentum may be choppy, but long-run returns are still impressive by industry standards.

Curious to see what other fast-moving, growth-focused stocks might be worth your attention? Now’s the ideal moment to explore fast growing stocks with high insider ownership.

With Riot’s shares trading well below analyst price targets, but investors skittish over recent slowdowns, the real question is whether the current dip represents an undervalued opportunity or if future growth is already priced in.

Most Popular Narrative: 37% Undervalued

According to the most widely followed narrative, Riot Platforms’ fair value estimate is $27.53 compared to the last close at $17.32. The narrative’s valuation is driven by expectations for surging AI and data center demand, along with confidence in the company’s strategic pivots and sector position.

Riot's aggressive build-out of a scalable data center business leverages its extensive, readily available power capacity in high-demand regions. This well-positions the company to benefit from increasing demand for AI and cloud computing infrastructure, which could lead to higher revenue growth and improved valuation multiples over time.

Want to know what’s fueling that bold price target? One forecasted trend underpins everything: future revenue expansion paired with a major improvement in profitability. But how realistic are these assumptions? Discover what analysts are projecting as the secret ingredients behind Riot’s much higher valuation estimate.

Result: Fair Value of $27.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy dependence on volatile Bitcoin prices and uncertain execution of new data center operations could quickly shift Riot's bullish narrative.

Find out about the key risks to this Riot Platforms narrative.

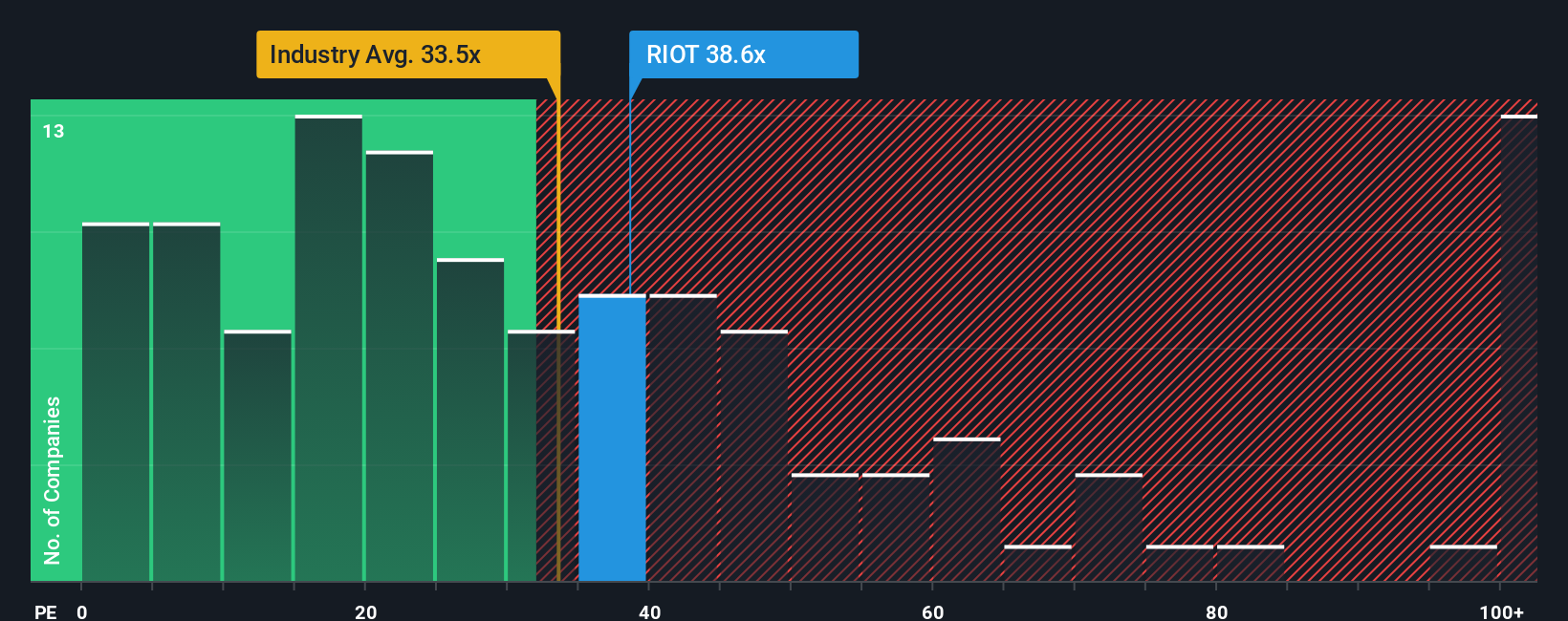

Another View: Multiples Tell a Different Story

While the fair value estimate points to Riot being undervalued, looking at its price-to-earnings ratio reveals something else. Riot trades at 39.3x earnings, which is higher than both the US Software industry at 32.5x and its peer average of 19.5x. Its fair ratio is just 3.9x, suggesting the current multiple is well above a level the market could eventually move toward. The question remains whether this premium reflects genuine long-term growth potential or simply adds valuation risk if sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Riot Platforms Narrative

If you want to dig deeper or come to your own conclusion, you can craft a personal narrative in just a few minutes. Do it your way.

A great starting point for your Riot Platforms research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for More Smart Investment Ideas?

If you want to stay ahead of the curve, don't sit on the sidelines. These high-potential screeners on Simply Wall St spotlight unique sectors and opportunities you won't want to miss.

- Unlock possible market-beaters by checking out these 865 undervalued stocks based on cash flows, where you can find companies selling for less than what they're really worth.

- Tap into innovation by browsing these 25 AI penny stocks, which features emerging businesses set to benefit from the surging demand for artificial intelligence.

- Boost your portfolio with steady income through these 16 dividend stocks with yields > 3%, featuring stocks with reliable dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RIOT

Riot Platforms

Operates as a Bitcoin mining company in the United States.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives