- United States

- /

- Software

- /

- NasdaqGS:RDWR

Radware (RDWR): Evaluating Valuation After New Cloud Security Centers Expand Global Coverage

If you have been following Radware (RDWR), there is a fresh catalyst to pay attention to. The company just announced the launch of two new cloud security centers in Tel Aviv and Bogota, ramping up its global network to more than 50 locations. This expansion not only increases Radware’s attack mitigation capacity but also demonstrates their commitment to staying ahead of new threats, given the major surge in web-based and application-layer attacks highlighted in their recent 2025 Global Threat Analysis.

This latest move follows recent security center additions in India, Kenya, and Peru. Over the past year, Radware’s stock has climbed 25%, handily outpacing more modest results from previous years. With annual revenues growing 7%, the company appears to be experiencing positive momentum, supported by industry recognition from groups like Forrester and Gartner for their innovative cybersecurity solutions.

With this momentum and ongoing expansion, some investors may be considering whether Radware is at an attractive entry point or if the market has already factored in optimistic expectations for future growth.

Price-to-Earnings of 77x: Is it justified?

Radware is currently valued at a price-to-earnings (P/E) ratio of 77 times, a figure that marks it as significantly more expensive than both the US software industry average of 35.8x and its peer average of 25.1x. On a pure valuation basis, this suggests a premium is being paid for Radware shares compared to sector and peer benchmarks.

The P/E ratio reflects how much investors are willing to pay now for each dollar of future earnings. For software companies, a higher ratio sometimes signals expectations for exceptional growth, innovation, or sustainable profits. However, a high multiple also heightens pressure for Radware to maintain or accelerate profit growth to justify its valuation.

With recent profitability and positive momentum, investors might see some rationale for the premium. Still, the multiple indicates that the market could be overpricing expected earnings relative to what peers command, especially given the company's historic earnings performance.

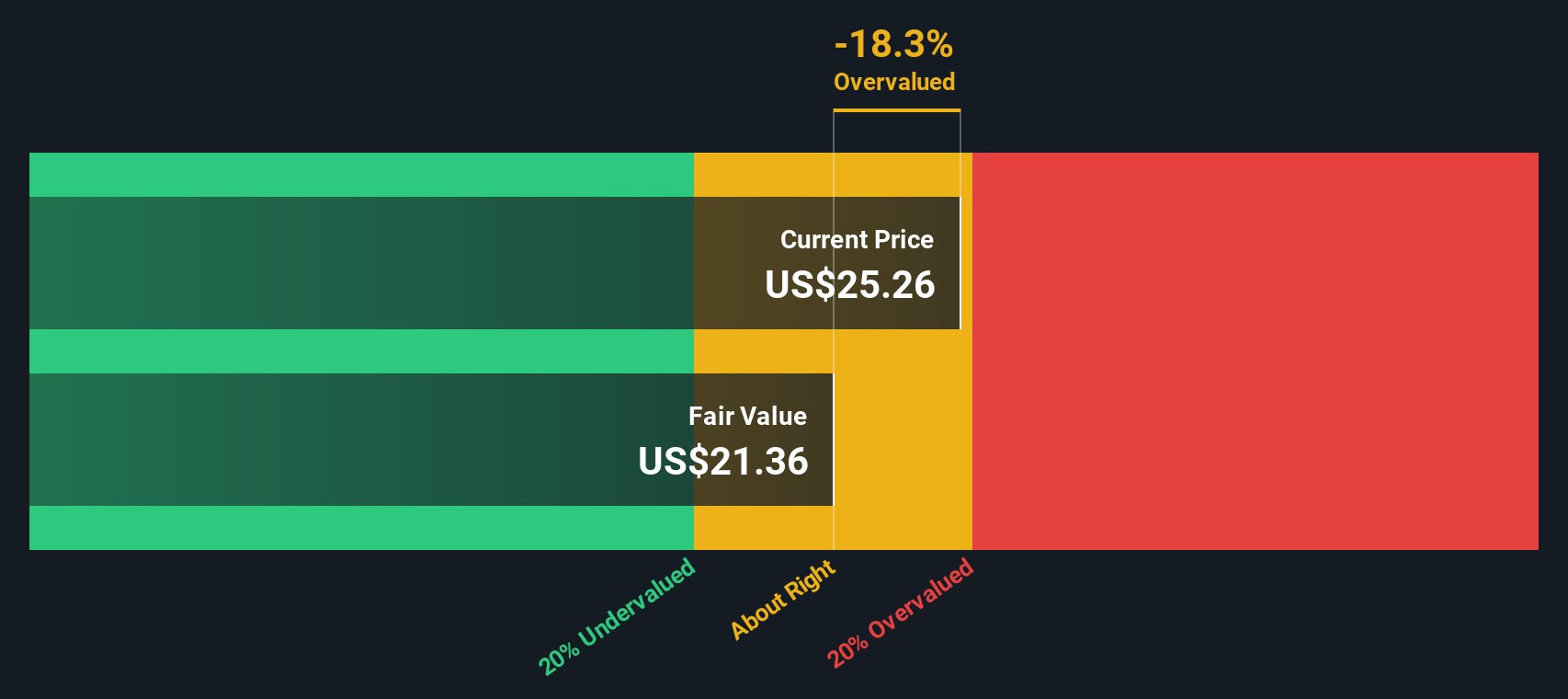

Result: Fair Value of $21.57 (OVERVALUED)

See our latest analysis for Radware.However, slowing net income growth or a failure to deliver on analyst price targets could challenge Radware’s valuation premium in the future.

Find out about the key risks to this Radware narrative.Another View: Our DCF Model's Perspective

While the market is pricing Radware high relative to other software companies, our SWS DCF model also judges the shares to be overvalued at this time. Could both methods be overlooking something? Or is this a warning signal?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Radware Narrative

If you have a different take or want to investigate the data further, you can easily build and share your unique insights in just a few minutes with our tools. Do it your way

A great starting point for your Radware research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don't hold back your portfolio potential. Open the door to a world of unique investment ideas handpicked for forward-thinkers, only on Simply Wall Street.

- Tap into market disruptors offering strong financials by checking out penny stocks with strong financials and discover what could be next in powerful small-cap growth stories.

- Uncover savings with stocks currently undervalued by cash flow metrics using undervalued stocks based on cash flows so you never miss a bargain others might overlook.

- Put yourself at the cutting edge of technology by spotting tomorrow's breakthroughs with quantum computing stocks and gain insight into companies shaping the quantum revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:RDWR

Radware

Develops, manufactures, and markets cyber security and application delivery solutions for cloud, on-premises, and software defined data canters.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

SoFi Technologies will ride a 33% revenue growth wave in the next 5 years

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.