- United States

- /

- Tech Hardware

- /

- NasdaqCM:QUBT

Does Quantum Computing (NASDAQ:QUBT) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Quantum Computing Inc. (NASDAQ:QUBT) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Quantum Computing

What Is Quantum Computing's Debt?

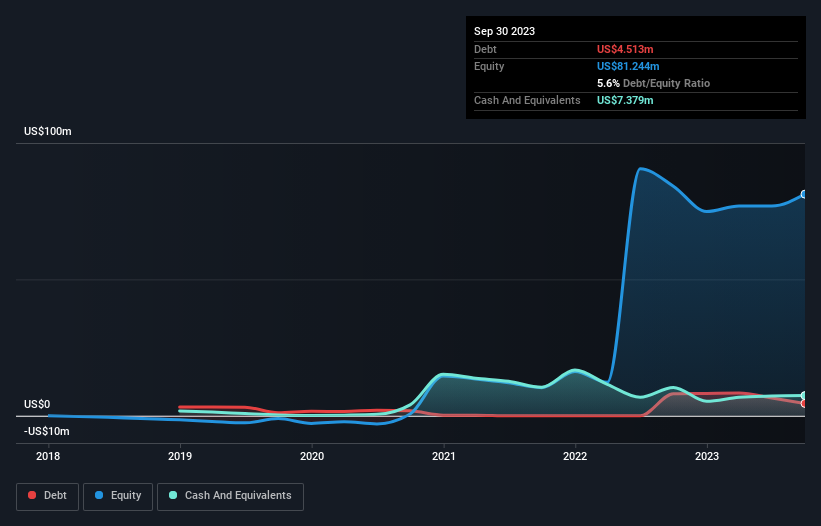

The image below, which you can click on for greater detail, shows that Quantum Computing had debt of US$4.51m at the end of September 2023, a reduction from US$8.04m over a year. But on the other hand it also has US$7.38m in cash, leading to a US$2.87m net cash position.

How Strong Is Quantum Computing's Balance Sheet?

According to the balance sheet data, Quantum Computing had liabilities of US$8.09m due within 12 months, but no longer term liabilities. On the other hand, it had cash of US$7.38m and US$545.6k worth of receivables due within a year. So its liabilities total US$164.0k more than the combination of its cash and short-term receivables.

Having regard to Quantum Computing's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the US$71.3m company is struggling for cash, we still think it's worth monitoring its balance sheet. While it does have liabilities worth noting, Quantum Computing also has more cash than debt, so we're pretty confident it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Quantum Computing's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

It seems likely shareholders hope that Quantum Computing can significantly advance the business plan before too long, because it doesn't have any significant revenue at the moment.

So How Risky Is Quantum Computing?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Quantum Computing lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through US$22m of cash and made a loss of US$40m. With only US$2.87m on the balance sheet, it would appear that its going to need to raise capital again soon. Importantly, Quantum Computing's revenue growth is hot to trot. While unprofitable companies can be risky, they can also grow hard and fast in those pre-profit years. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 5 warning signs we've spotted with Quantum Computing (including 2 which are a bit unpleasant) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Quantum Computing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:QUBT

Quantum Computing

An integrated photonics company, provides quantum machines to commercial and government markets in the United States.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Hotel101 Global: A Scalable Hospitality Platform Built to Compound

Tesla’s Nvidia Moment – The AI & Robotics Inflection Point

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion