- United States

- /

- Software

- /

- NasdaqGS:QLYS

Qualys (QLYS): Margins Hold 29% as Profit Growth Moderates, Challenging Bullish Expectations

Reviewed by Simply Wall St

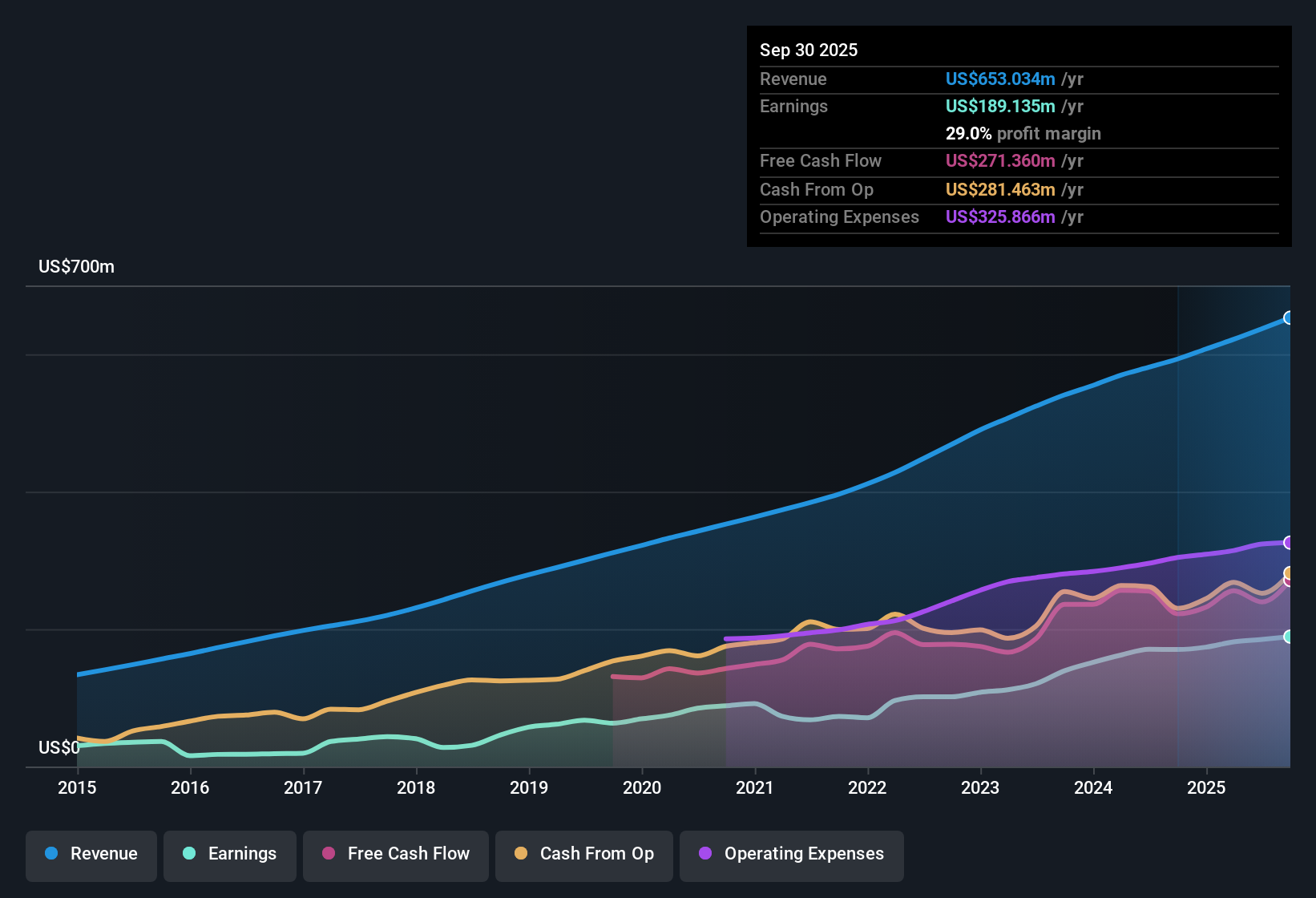

Qualys (QLYS) posted robust results, with net profit margins holding high at 29%, just below last year's 29.4%. Earnings growth averaged 21.6% annually over the past five years, though the most recent year saw a more modest 8.4% gain. Looking ahead, the company expects earnings to rise 3.6% per year and revenue to expand at 6.5% annually, both trailing the broader US market. Qualys’s price-to-earnings ratio is 28.3x, below both its US Software peers and the industry average, while shares are currently trading below an estimate of fair value. For investors, the consistency of profitability, solid margins, and relative valuation strength present a compelling backdrop ahead of this earnings season, even as growth moderates and minor insider selling emerges as the only flagged risk.

See our full analysis for Qualys.Next, we will stack these headline results against current market narratives and community perspectives, highlighting where expectations could shift and where consensus might get challenged.

See what the community is saying about Qualys

Profit Margins Stay Above 29% Despite Slight Compression

- Net profit margins were 29%, a slight dip from the previous year’s 29.4%. This remains among the highest margins in the US software sector and signals continuing operational discipline even as growth moderates.

- According to analysts' consensus view, persistent digital transformation and growing compliance needs are expected to help Qualys keep margins healthy and expand into new markets.

- Consensus narrative specifically points to unified cybersecurity, AI-driven automation, and success in winning government and international contracts as likely contributors to margin strength.

- However, rapid AI adoption and macroeconomic headwinds noted in the consensus could pressure future profitability and cause margin contraction, particularly if new investments do not deliver expected sales conversions.

Growth Projections Trail Broader Market Pace

- Looking ahead, Qualys expects 3.6% annual earnings growth and 6.5% yearly revenue expansion. Both figures are below the broader US market growth rates, suggesting more moderate acceleration despite a strong five-year earnings history averaging 21.6% per year.

- Analysts' consensus view highlights that, while new AI platforms and cloud-native risk tooling could eventually expand total addressable market and increase average revenue per user,

- Slower-than-market guidance, ongoing macro challenges, and uncertain customer adoption of new pricing may limit near-term EPS growth, challenging the idea that recent innovation alone will drive rapid growth.

- Recent investments in go-to-market and sales channels are expected to support future growth. However, forecasts may be undershot if customer adoption lags or competition intensifies.

Valuation Undercuts Industry Benchmarks and DCF Fair Value

- With a price-to-earnings ratio of 28.3x, Qualys trades at a lower valuation than the software industry average (35.2x) and its peer group (38.2x). At a $146.13 share price, it also trades below its discounted cash flow (DCF) fair value of $165.37 and under the latest analyst target price of $141.65.

- According to analysts' consensus view, the relatively small premium over today’s quoted price indicates that most expect Qualys to be fairly valued for now.

- Consensus expects that, unless there is a notable boost in revenue or margins, valuation multiples will stay below industry levels. However, faster adoption of AI or new cloud modules could shift sentiment more positively.

- Despite a narrow gap to the consensus price target, the DCF fair value suggests potential longer-term upside if current fundamentals persist or improve.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Qualys on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do the numbers tell you a different story? Bring your unique perspective and craft a personal narrative in just minutes. Do it your way

A great starting point for your Qualys research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Qualys’ projected earnings and revenue growth lag the broader US market, raising questions about whether it can deliver sustained outperformance in the years ahead.

If you are seeking steadier expansion and more reliable growth rates, check out stable growth stocks screener (2074 results) to discover companies known for consistent results even as conditions change.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qualys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QLYS

Qualys

Provides cloud-based platform delivering information technology (IT), security, and compliance solutions in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives