- United States

- /

- Diversified Financial

- /

- NasdaqGS:PYPL

PayPal Holdings' (NASDAQ:PYPL) Earnings Are Better Than They Appear

- PayPal is showing positive signs of a turnaround.

- Despite a significant decline, short interest remains low

- Management authorized buyback of up to 10% of market capitalization

After a full year of subpar performance, where the stock lost over 75% of its value, PayPal is finally turning around following 2 quarters of solid performance.

With the focus on improving the margin and almost 10% of the current market cap in authorized stock buybacks, it seems that the company finally bought some peace of mind.

Check out our latest analysis for PayPal Holdings

PayPal's Q2 2022 Earnings Results

- Non-GAAP EPS: US$0.93 (beat by US$0.06)

- Revenue: US$6.8b (beat by US$20m)

- Revenue growth: +9% Y/Y

FY guideline

- Revenue expected: US$27.85b

- Total Payment Volume: US$1.4tn

- Adjusted EPS: US$3.87-US$3.97

CEO Dan Schulman called the results solid, pointing out that currency-neutral revenue and non-GAAP earnings growth exceeded expectations. Furthermore, the board authorized US$15b in share buyback, close to 10% of the current market capitalization. While EPS declined on a Y/Y basis, much of that was already priced in due to eBay's exit.

Investigating PayPal Holdings' Earnings

As finance nerds would already know, the accrual ratio from cash flow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. The accrual ratio subtracts the FCF from the profit for a given period and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cash flow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably worse because it means paper profits are not matched by cash flow. Notably, some academic evidence suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

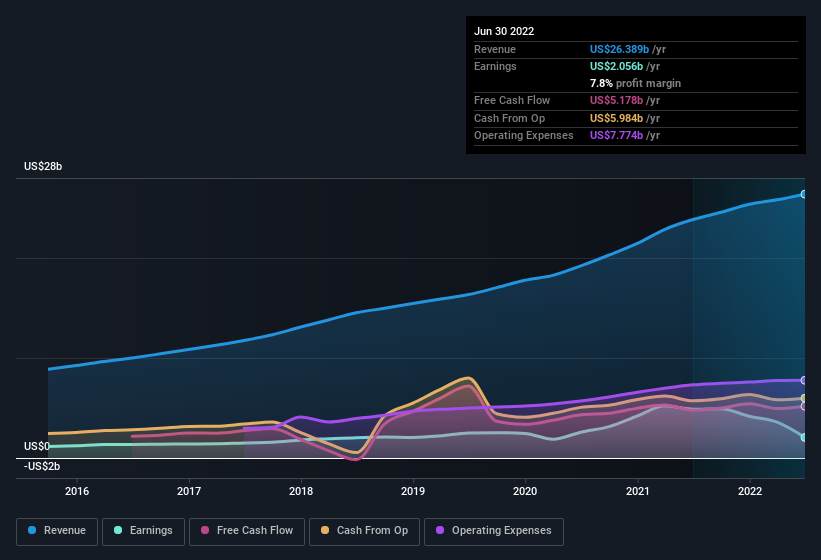

For the year to June 2022, PayPal Holdings had an accrual ratio of -0.16. That indicates that its free cash flow exceeded its statutory profit. Indeed, in the last twelve months, it reported a free cash flow of US$5.2b, well over the US$2.06b it reported in profit. PayPal Holdings' free cash flow improved over the last year, which is a positive thing. Having said that, there is more to the story. We can see that unusual items have impacted its statutory profit and, therefore, the accrual ratio.

If you're wondering about the future forecast, you can click here to see an interactive graph depicting future profitability based on the analyst's estimates.

Positive Catalysts

Considering both PayPal Holdings' accrual ratio and its unusual items, we think its statutory earnings are unlikely to exaggerate the company's underlying earnings power. Based on these factors, we believe that PayPal Holdings' underlying earnings potential is as good or probably even better than the statutory profit makes it seem!

Even after the stock rose almost 10% following the earnings news, this cannot be attributed to a short squeeze. In fact, with just 1.94% of short interest, PayPal is not a highly shorted stock despite its significant decline. Thus, we can observe this rise due to improving customer sentiment and fundamentals. Additionally, with activist investor Elliott Management disclosing a US$2b stake, their managing partner Jesse Cohn is optimistic that the partnership will go in a positive direction.

If you want to dive deeper into PayPal Holdings, you'd also look into what risks it is currently facing. Every company has risks, and we've spotted 3 warning signs for PayPal Holdings you should keep in mind.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:PYPL

PayPal Holdings

Operates a technology platform that enables digital payments for merchants and consumers worldwide.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion