- United States

- /

- Software

- /

- NasdaqGS:PRGS

Progress Software (NASDAQ:PRGS) Has Affirmed Its Dividend Of $0.175

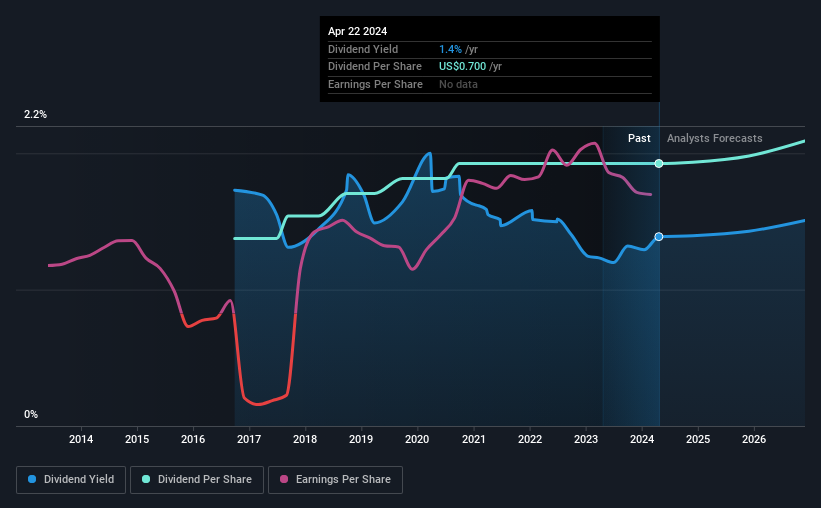

Progress Software Corporation (NASDAQ:PRGS) has announced that it will pay a dividend of $0.175 per share on the 17th of June. The dividend yield will be 1.4% based on this payment which is still above the industry average.

View our latest analysis for Progress Software

Progress Software's Earnings Easily Cover The Distributions

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Based on the last payment, Progress Software was quite comfortably earning enough to cover the dividend. This indicates that quite a large proportion of earnings is being invested back into the business.

Looking forward, earnings per share is forecast to rise by 71.4% over the next year. If the dividend continues on this path, the payout ratio could be 28% by next year, which we think can be pretty sustainable going forward.

Progress Software Doesn't Have A Long Payment History

Progress Software's dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. Since 2016, the dividend has gone from $0.50 total annually to $0.70. This means that it has been growing its distributions at 4.3% per annum over that time. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

We Could See Progress Software's Dividend Growing

Investors could be attracted to the stock based on the quality of its payment history. Progress Software has impressed us by growing EPS at 9.8% per year over the past five years. Since earnings per share is growing at an acceptable rate, and the payout policy is balanced, we think the company is positioning itself well to grow earnings and dividends in the future.

Progress Software Looks Like A Great Dividend Stock

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. The company is easily earning enough to cover its dividend payments and it is great to see that these earnings are being translated into cash flow. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 3 warning signs for Progress Software that investors should know about before committing capital to this stock. Is Progress Software not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PRGS

Progress Software

Develops, deploys, and manages artificial intelligence (AI) powered applications and digital experiences in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A Quality Compounder Marked Down on Overblown Fears

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion