- United States

- /

- Software

- /

- NasdaqGS:PRGS

Is Progress Software Corporation's (NASDAQ:PRGS) Liquidity Good Enough?

Stocks with market capitalization between $2B and $10B, such as Progress Software Corporation (NASDAQ:PRGS) with a size of US$2.0b, do not attract as much attention from the investing community as do the small-caps and large-caps. However, history shows that overlooked mid-cap companies have performed better on a risk-adjusted manner than the smaller and larger segment of the market. Let’s take a look at PRGS’s debt concentration and assess their financial liquidity to get an idea of their ability to fund strategic acquisitions and grow through cyclical pressures. Note that this commentary is very high-level and solely focused on financial health, so I suggest you dig deeper yourself into PRGS here.

See our latest analysis for Progress Software

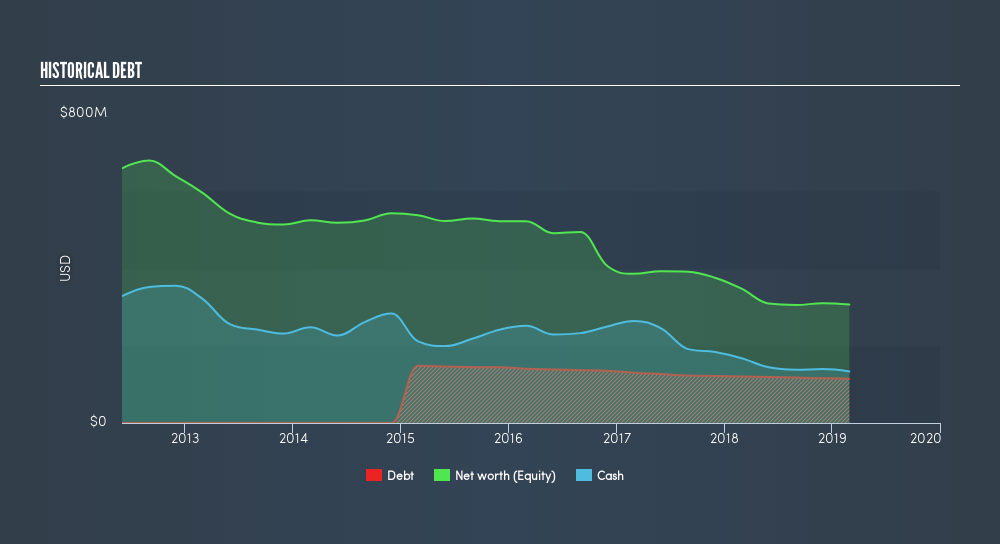

PRGS’s Debt (And Cash Flows)

Over the past year, PRGS has maintained its debt levels at around US$115m – this includes long-term debt. At this stable level of debt, PRGS currently has US$133m remaining in cash and short-term investments , ready to be used for running the business. On top of this, PRGS has produced US$114m in operating cash flow in the last twelve months, resulting in an operating cash to total debt ratio of 100%, indicating that PRGS’s operating cash is sufficient to cover its debt.

Can PRGS pay its short-term liabilities?

With current liabilities at US$182m, the company has maintained a safe level of current assets to meet its obligations, with the current ratio last standing at 1.18x. The current ratio is the number you get when you divide current assets by current liabilities. Usually, for Software companies, this is a suitable ratio since there's a sufficient cash cushion without leaving too much capital idle or in low-earning investments.

Can PRGS service its debt comfortably?

With debt at 37% of equity, PRGS may be thought of as appropriately levered. PRGS is not taking on too much debt commitment, which may be constraining for future growth. We can test if PRGS’s debt levels are sustainable by measuring interest payments against earnings of a company. Ideally, earnings before interest and tax (EBIT) should cover net interest by at least three times. For PRGS, the ratio of 20.47x suggests that interest is comfortably covered, which means that debtors may be willing to loan the company more money, giving PRGS ample headroom to grow its debt facilities.

Next Steps:

PRGS’s high cash coverage and appropriate debt levels indicate its ability to utilise its borrowings efficiently in order to generate ample cash flow. In addition to this, the company exhibits an ability to meet its near term obligations should an adverse event occur. I admit this is a fairly basic analysis for PRGS's financial health. Other important fundamentals need to be considered alongside. I suggest you continue to research Progress Software to get a more holistic view of the stock by looking at:

- Future Outlook: What are well-informed industry analysts predicting for PRGS’s future growth? Take a look at our free research report of analyst consensus for PRGS’s outlook.

- Valuation: What is PRGS worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether PRGS is currently mispriced by the market.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:PRGS

Progress Software

Provides software products that develops, deploys, and manages artificial intelligence (AI) powered applications and digital experiences in the United States and internationally.

Good value with very low risk.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Take Two Interactive Software TTWO Valuation Analysis

Recursion Pharmaceuticals! WTH is going on?

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion