- United States

- /

- Software

- /

- NasdaqCM:PRCH

Porch Group, Inc.'s (NASDAQ:PRCH) Prospects Need A Boost To Lift Shares

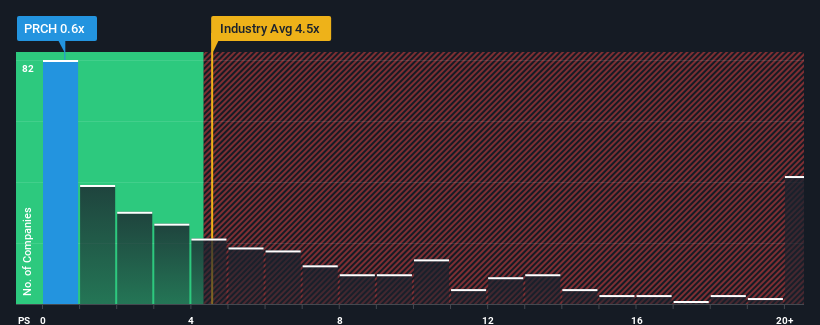

With a price-to-sales (or "P/S") ratio of 0.6x Porch Group, Inc. (NASDAQ:PRCH) may be sending very bullish signals at the moment, given that almost half of all the Software companies in the United States have P/S ratios greater than 4.5x and even P/S higher than 11x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Porch Group

How Has Porch Group Performed Recently?

With revenue growth that's superior to most other companies of late, Porch Group has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Porch Group's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Porch Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 44%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 7.1% during the coming year according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 15%, which is noticeably more attractive.

In light of this, it's understandable that Porch Group's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Porch Group's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you settle on your opinion, we've discovered 3 warning signs for Porch Group (2 are concerning!) that you should be aware of.

If you're unsure about the strength of Porch Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PRCH

Porch Group

Operates a vertical software and insurance platform in the United States.

Good value with reasonable growth potential.

Market Insights

Community Narratives