- United States

- /

- Healthcare Services

- /

- NasdaqCM:ASTH

3 Growth Companies With High Insider Ownership Expecting 46% Profit Growth

Reviewed by Simply Wall St

In a week marked by significant volatility in the U.S. stock market, with major indices like the S&P 500 and Nasdaq poised for their biggest weekly losses since April, investors are closely watching Federal Reserve signals that may indicate an upcoming rate cut. Amid these turbulent times, growth companies with high insider ownership can present intriguing opportunities as they often reflect strong internal confidence and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 14.0% | 50.7% |

| StubHub Holdings (STUB) | 23.3% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| FTC Solar (FTCI) | 23% | 78.8% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Cloudflare (NET) | 10.4% | 43.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.2% |

| Astera Labs (ALAB) | 12.5% | 29.1% |

| AppLovin (APP) | 27.5% | 26.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Astrana Health (ASTH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Astrana Health, Inc. is a healthcare management company offering medical care services in the United States with a market cap of $1.10 billion.

Operations: Astrana Health generates revenue through its Care Delivery segment at $195.02 million, Care Partners segment at $2.78 billion, and Care Enablement segment at $212.87 million.

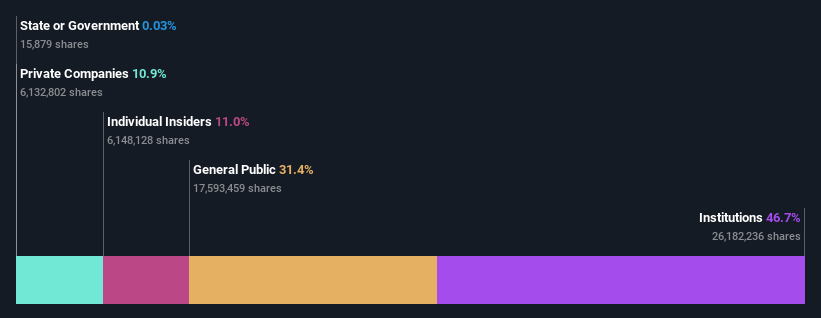

Insider Ownership: 12.5%

Earnings Growth Forecast: 38.2% p.a.

Astrana Health shows potential as a growth company with high insider ownership, despite recent challenges. The company forecasts significant earnings growth of 38.2% annually, surpassing the US market average, though profit margins have decreased from 3.6% to 0.3%. Recent revenue guidance suggests an increase to between US$3.1 billion and US$3.18 billion for 2025, indicating strong top-line expansion despite lower net income compared to last year.

- Navigate through the intricacies of Astrana Health with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Astrana Health's shares may be trading at a discount.

Porch Group (PRCH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Porch Group, Inc. operates a vertical software and insurance platform in the United States with a market cap of approximately $964.15 million.

Operations: Porch Group's revenue segments include its vertical software and insurance platform operations within the United States.

Insider Ownership: 19.4%

Earnings Growth Forecast: 32.2% p.a.

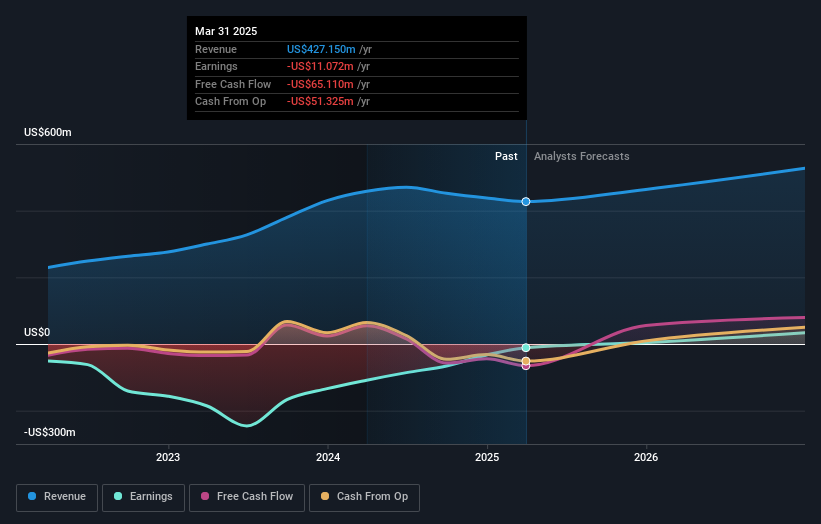

Porch Group is navigating growth with insider ownership, yet faces challenges. The company forecasts annual earnings growth of 32.2%, outpacing the US market. However, recent earnings showed a net loss of US$10.86 million for Q3 2025, contrasting with last year's profit. Revenue guidance was slightly revised to US$410-420 million for 2025, reflecting cautious optimism amid volatility and substantial insider selling over the past quarter without significant buying activity.

- Click to explore a detailed breakdown of our findings in Porch Group's earnings growth report.

- Our expertly prepared valuation report Porch Group implies its share price may be lower than expected.

Fiverr International (FVRR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fiverr International Ltd. operates a global online marketplace and has a market cap of approximately $750.48 million.

Operations: The company generates its revenue from the Internet Software & Services segment, amounting to $427.40 million.

Insider Ownership: 11.6%

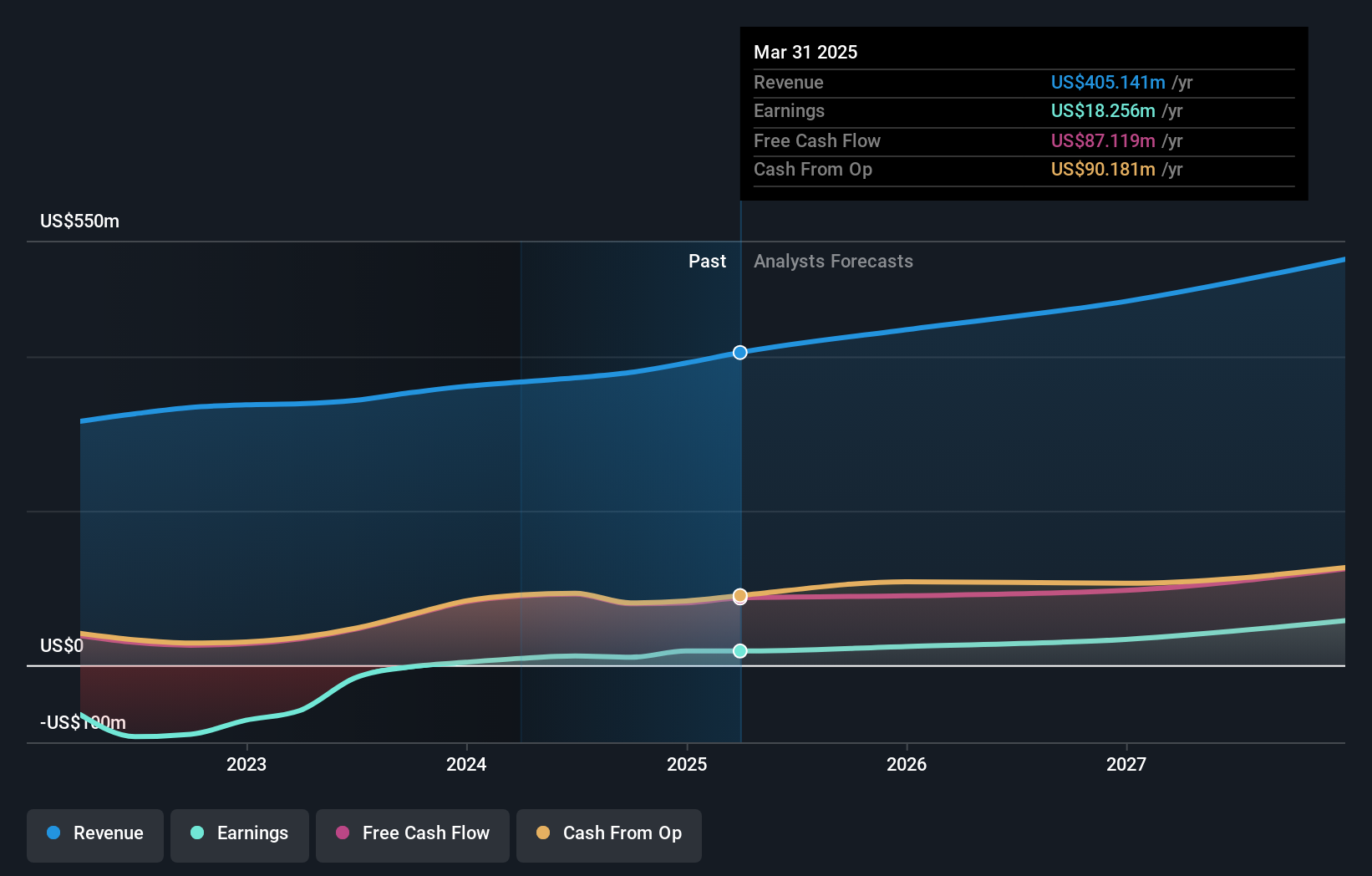

Earnings Growth Forecast: 46.6% p.a.

Fiverr International is experiencing robust earnings growth, with profits increasing by 121.2% over the past year and forecasts predicting a 46.65% annual rise, surpassing US market averages. Despite trading below fair value estimates, its revenue growth of 6.3% annually lags behind the market's pace. Recent Q3 results showed sales of US$107.9 million and net income rising to US$5.54 million from US$1.35 million last year, underscoring Fiverr's potential amidst evolving AI-driven marketing strategies.

- Click here to discover the nuances of Fiverr International with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Fiverr International is trading behind its estimated value.

Where To Now?

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 190 more companies for you to explore.Click here to unveil our expertly curated list of 193 Fast Growing US Companies With High Insider Ownership.

- Ready To Venture Into Other Investment Styles? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ASTH

Astrana Health

A healthcare management company, provides medical care services in the United States.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives