- United States

- /

- Software

- /

- NasdaqGS:PONY

Pony AI (PONY): Assessing Valuation After Recent 51.5% Share Price Surge

Reviewed by Simply Wall St

Pony AI (PONY) has recently drawn investor attention following its latest monthly stock moves. While swings in share price are not unusual in this sector, the company’s financial results offer some perspective on where things stand.

See our latest analysis for Pony AI.

Pony AI’s share price return has been anything but dull lately, with a steep 51.5% run-up over the past 90 days. This far outpaces its smaller moves earlier in the year. The stock’s momentum has been building despite some short-term volatility, which suggests investors are reassessing its growth prospects and risk profile as the company navigates a rapidly evolving industry.

If you’re interested in uncovering what else is making waves in the market, now’s the perfect moment to broaden your scope and explore fast growing stocks with high insider ownership

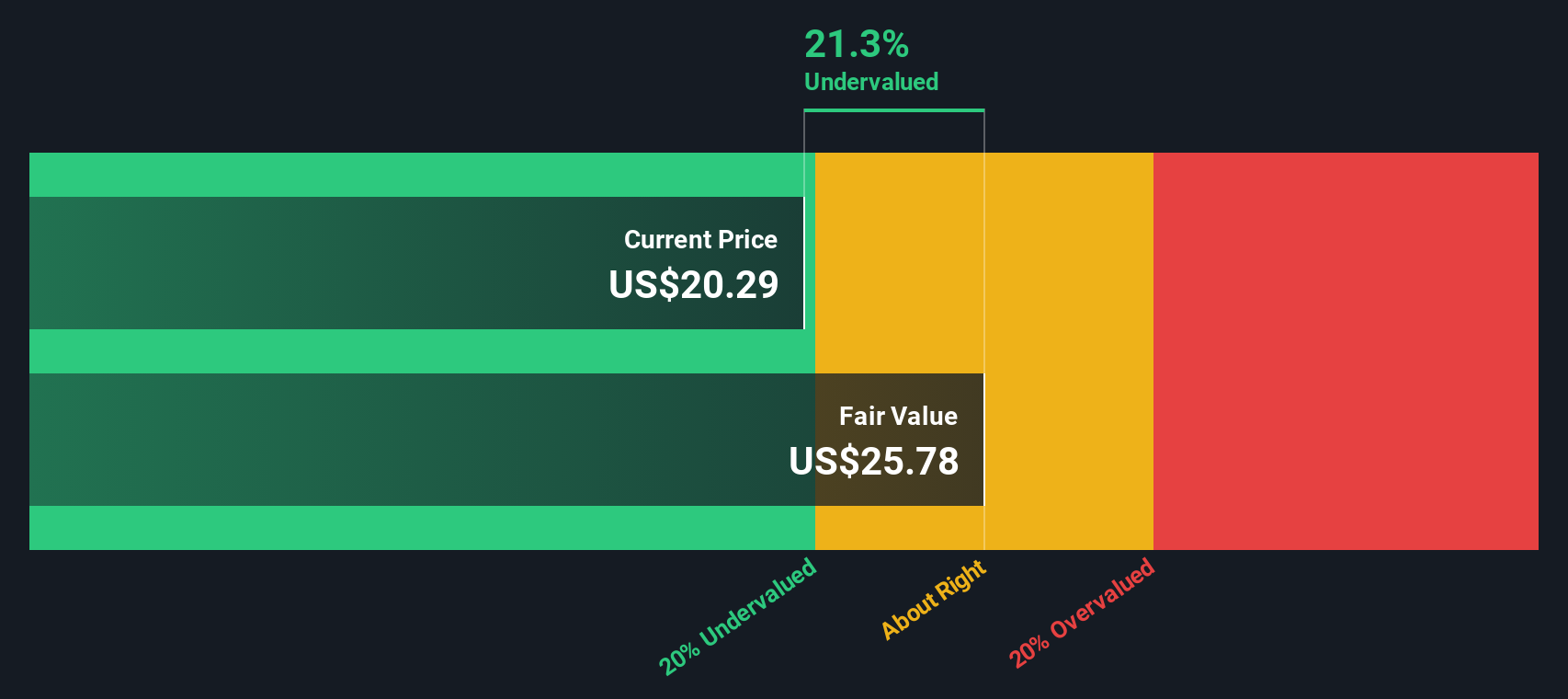

With shares surging well ahead of fundamentals and analyst targets still indicating upside, the key question now is whether Pony AI remains undervalued or if the market has already factored in all the growth ahead.

Price-to-Book of 8.9x: Is it justified?

Pony AI’s shares trade at 8.9 times their book value, well above both the US Software sector average and the average for peer companies. At a last close price of $19.76, the stock appears expensive relative to its assets on this metric.

The price-to-book (P/B) ratio compares a company’s market value to its book value, offering a useful lens for asset-heavy tech firms and companies with unproven earnings power. For an AI-driven software player still searching for profitability, the P/B ratio allows investors to assess whether future growth is already priced in.

Compared to the US Software industry’s average P/B of 3.8x and its peer group’s average of 7.8x, Pony AI’s 8.9 multiple suggests that the market expects substantial growth or a turnaround in profitability. With the figure well above these benchmarks, investors are paying a premium in anticipation of revenue expansion and long-term industry leadership.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 8.9x (OVERVALUED)

However, sustained losses and unpredictable revenue growth could quickly shift investor sentiment if performance disappoints or if industry dynamics change.

Find out about the key risks to this Pony AI narrative.

Another View: Discounted Cash Flow Model Highlights Undervaluation

While Pony AI’s price-to-book ratio suggests the stock is expensive, our DCF model offers a different perspective. According to the SWS DCF model, the shares trade about 16.7% below their fair value estimate. This raises the question: is the market too pessimistic or simply cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pony AI for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pony AI Narrative

If you see things differently or want to draw your own conclusions, you can dig into the numbers and craft your perspective in just a few minutes. Do it your way

A great starting point for your Pony AI research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye out for fresh opportunities. Here are three ways you can broaden your portfolio and catch the next wave of winners with confidence:

- Capture high growth potential and innovation by checking out these 26 AI penny stocks that are transforming everything from automation to data analysis.

- Unlock steady income streams by reviewing these 24 dividend stocks with yields > 3% that deliver attractive yields and consistent cash flow.

- Position yourself ahead of the next big tech leap by investigating these 28 quantum computing stocks and exploring breakthroughs that may redefine tomorrow’s markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PONY

Pony AI

Through its subsidiaries, engages in the autonomous mobility business in the People’s Republic of China, the United States, and internationally.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives