- United States

- /

- Software

- /

- NasdaqGS:PLTR

Palantir (PLTR) Profit Margin Surges, Reinforcing Bullish Narratives Despite Valuation Concerns

Reviewed by Simply Wall St

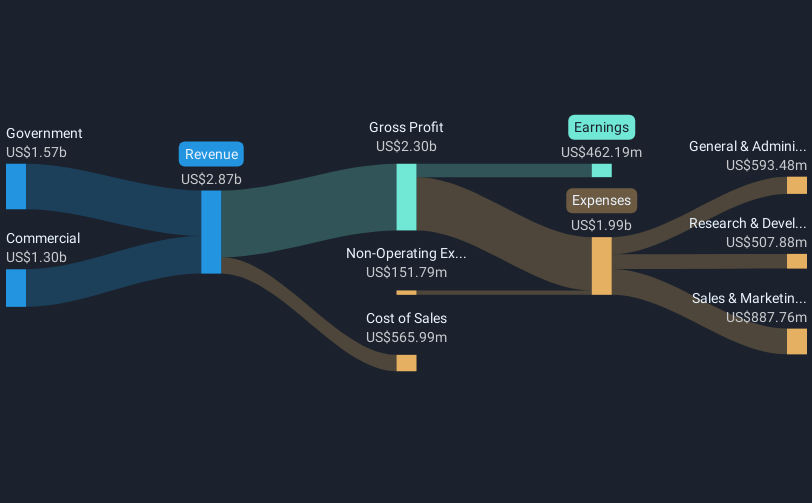

Palantir Technologies (PLTR) turned in a standout performance this quarter, posting net profit margins of 28.1% compared to 18% in the previous year and driving EPS higher in tandem with a massive 129.8% surge in earnings growth year over year. Analysts project revenue will increase at an annual rate of 26.7%, with profit growth forecasts even stronger at 29.2% per year for at least the next three years. With accelerating profits, expanding margins, and robust outlooks, investors are weighing the pace of growth against Palantir’s premium valuation multiples.

See our full analysis for Palantir Technologies.The next section dives into how these headline results stack up against the main narratives in the market. Readers can expect to see which stories get validated and which face a serious reality check.

See what the community is saying about Palantir Technologies

Profit Growth Dwarfs Sector Pace

- Forecast annual profit growth of 29.2% at Palantir nearly doubles the US market average of 15.8%, while revenue is projected to climb 26.7% per year versus just 10.4% for peers.

- Sustained growth rates, according to the prevailing market view, are seen as heavily supporting optimism about Palantir’s business model durability and addressable market expansion.

- Forecasts for at least three years of continued high growth highlight how the company’s outperformance sets it apart from the typical software peer.

- With both profit and revenue growth rates far ahead of the US average, optimism persists even as growth rates slow from historic highs.

Valuation Premium Draws Scrutiny

- Palantir trades at 68 times book value, higher than the peer average of 51 times and well above the US software industry average of 3.8 times, prompting a debate about whether its growth story can justify this premium.

- Prevailing market view highlights how valuation concerns act as a counterbalance to the company’s track record, especially given it sits far above typical industry multiples.

- Investors are likely to look for continued margin and profit momentum to support these multiples in future reporting periods.

- The persistent premium over both direct peers and the broader industry suggests the market is factoring in a rare and enduring competitive edge.

No Major Risks Flagged in Filings

- Recent filings and available statements indicate meaningful earnings and revenue growth for Palantir without any new or unusual risks being highlighted for this period.

- Ongoing positive trends, based on prevailing market view, reinforce confidence in the company’s operational performance and near-term outlook while encouraging investors to focus on execution rather than unknown hazards.

- Accelerating profits and improving margins direct attention to business fundamentals rather than risk disclosure in this cycle.

- With no flagged risks, the company’s main challenge remains living up to growth expectations embedded in its current valuation.

For a balanced breakdown of growth, valuation, and narrative trends, see what’s driving shifts in the broader market story for Palantir: 📊 Read the full Palantir Technologies Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Palantir Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? In just a few minutes, you can share your perspective and shape your own story: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Palantir Technologies.

See What Else Is Out There

Palantir’s lofty valuation multiples raise concerns that future growth may already be priced in. This puts pressure on the company to continually outperform.

If you’re searching for stocks where the price hasn’t run ahead of fundamentals, discover better value prospects using these 850 undervalued stocks based on cash flows today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives