- United States

- /

- Software

- /

- NasdaqGS:PLTR

How Palantir’s New Army Supply Chain Partnership Could Influence the PLTR Investment Case

Reviewed by Sasha Jovanovic

- In November 2025, Exiger announced it had partnered with Palantir Technologies to deliver an integrated AI-driven supply chain and risk management capability for the U.S. Army, combining Palantir’s AI platform with Exiger’s supply chain analytics under a multi-million-dollar contract.

- This collaboration showcases how Palantir’s technology is being leveraged to enhance military readiness and operational efficiency by integrating real-time data intelligence into key defense infrastructure.

- We'll explore how Palantir’s expanded defense partnerships, especially its integration into Army supply chain operations, shape its investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Palantir Technologies' Investment Narrative?

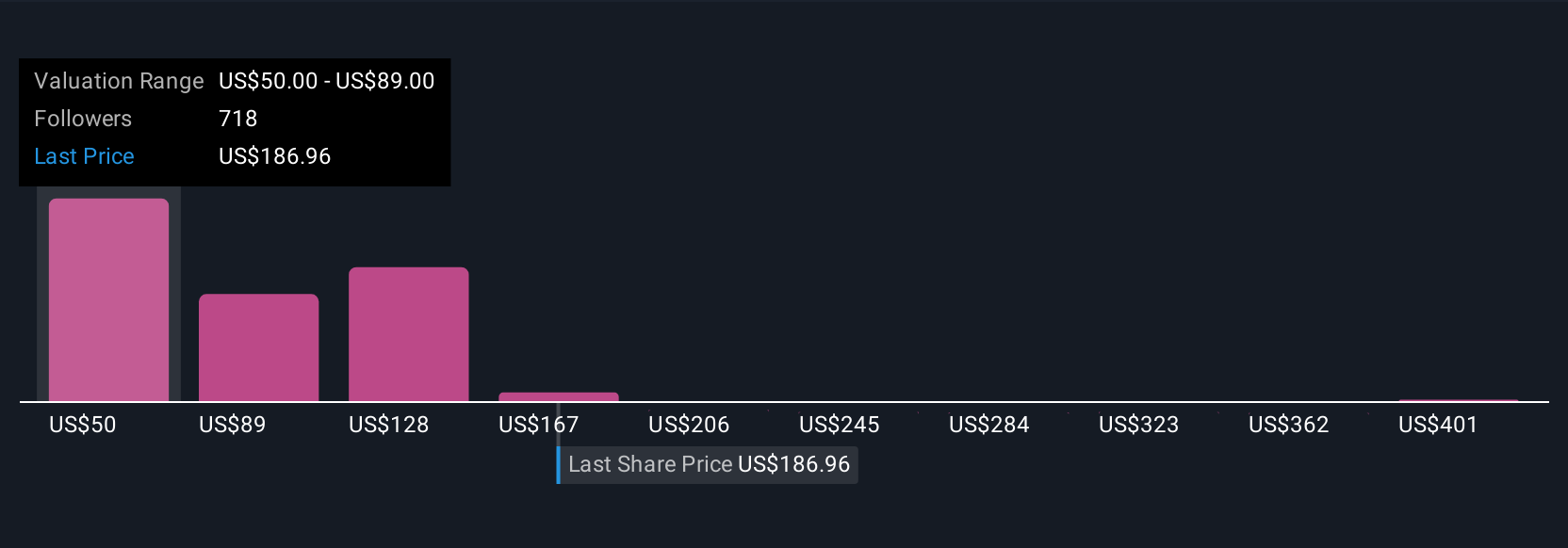

Being a Palantir Technologies shareholder often means buying into a long-term vision of AI transforming large-scale operations, particularly in critical sectors like defense and government. The latest partnership with Exiger and the resulting U.S. Army contract support Palantir’s reputation for delivering real-world solutions in defense infrastructure, potentially reinforcing short-term catalysts centered on government demand for resilient, AI-driven supply chains. While this client win sharpens Palantir’s relevance in military readiness and may help maintain momentum in public sector contract wins, its impact on immediate financial results may be less material, considering the company’s already robust government pipeline. On the risk side, nothing about the deal addresses major concerns like Palantir’s high valuation or the pressures of scaling commercial adoption and defending sensitive government contracts amid intense competition. Still, recent news highlights how crucial ongoing execution is to the story.

But keep in mind, high valuation remains a concern investors should be aware of. Palantir Technologies' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 156 other fair value estimates on Palantir Technologies - why the stock might be worth less than half the current price!

Build Your Own Palantir Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Palantir Technologies research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Palantir Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Palantir Technologies' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026