- United States

- /

- Software

- /

- NasdaqCM:PGY

Is Pagaya Technologies an Opportunity After Sharp Gains and New Fintech Partnerships?

Reviewed by Bailey Pemberton

- Wondering if Pagaya Technologies is a bargain or overpriced? You are not alone, especially with so much buzz around its rapid rise.

- The stock has been on a wild ride lately, climbing an impressive 142.9% year-to-date before pulling back 10.0% in the last week and 22.7% over the last month.

- In addition to this recent volatility, news about Pagaya's expansion into new financial partnerships and strategic moves in the fintech sector have captured investor attention. This has fueled both optimism and some caution. These announcements have played a role in driving recent price swings and market sentiment.

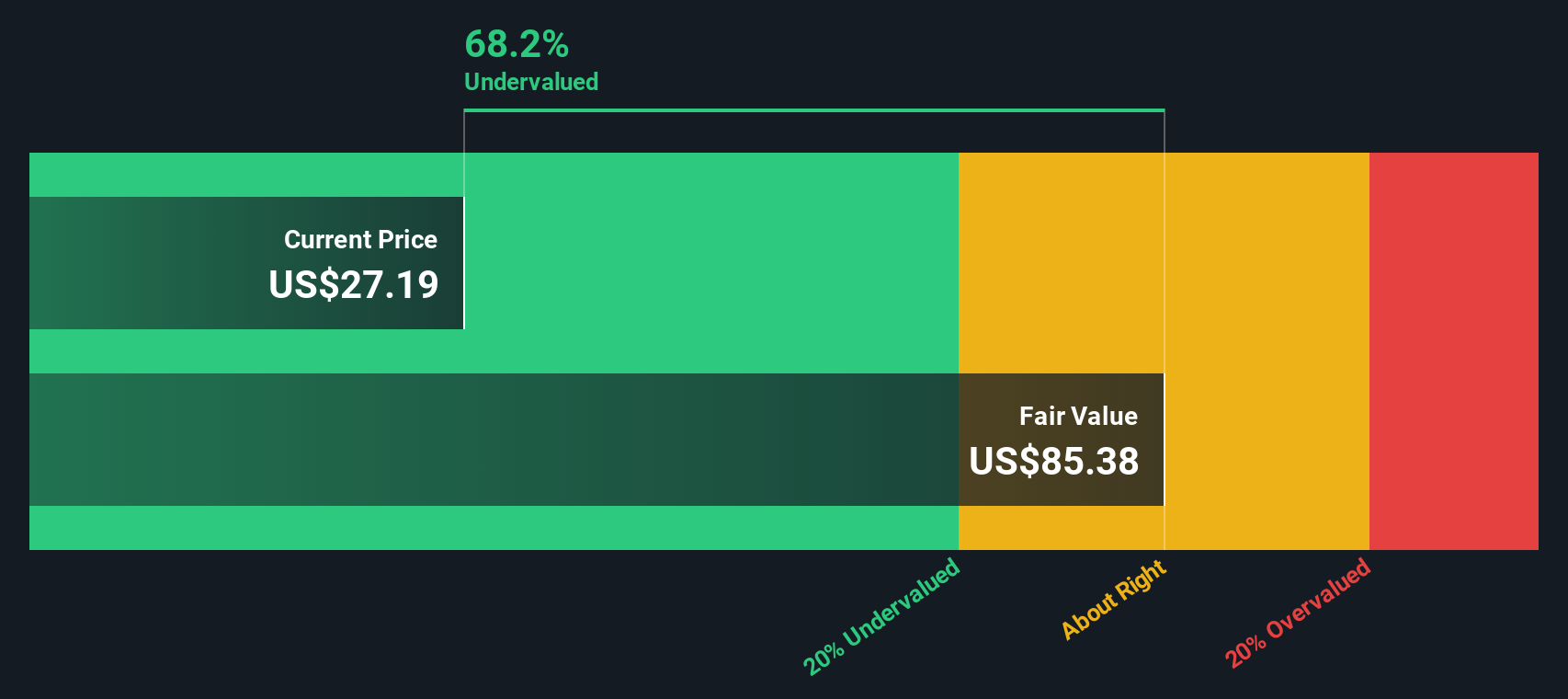

- If you are looking at valuation, Pagaya earns a 5 out of 6 on our valuation checks, signaling it is undervalued by most measures. Let's dig into why that score matters and, more interestingly, explore the ways investors are assessing value. Plus, there is a fresh perspective you will not want to miss at the end of this article.

Approach 1: Pagaya Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those expected cash flows back to today's dollars. This approach is widely used for growth companies because it centers on the company’s ability to generate cash over time, rather than relying solely on near-term earnings.

For Pagaya Technologies, the current Free Cash Flow stands at $104.6 Million. Analysts' forecasts anticipate negative Free Cash Flow of $-17.6 Million for the year ending 2023, but model projections show a strong rebound with Free Cash Flow expected to reach $640.5 Million by 2035. Each year, growth rates start high, for example a projected increase of 57.7% in 2026, and naturally taper off as the business matures, with a 5.46% growth rate by 2035. These projections are based on both analysts’ estimates for the next five years and automated extrapolations beyond that.

Based on this cash flow analysis, the intrinsic value of Pagaya Technologies is calculated at $86.85 per share. Given the current share price, this represents a 73.1% discount, indicating that the stock is notably undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pagaya Technologies is undervalued by 73.1%. Track this in your watchlist or portfolio, or discover 861 more undervalued stocks based on cash flows.

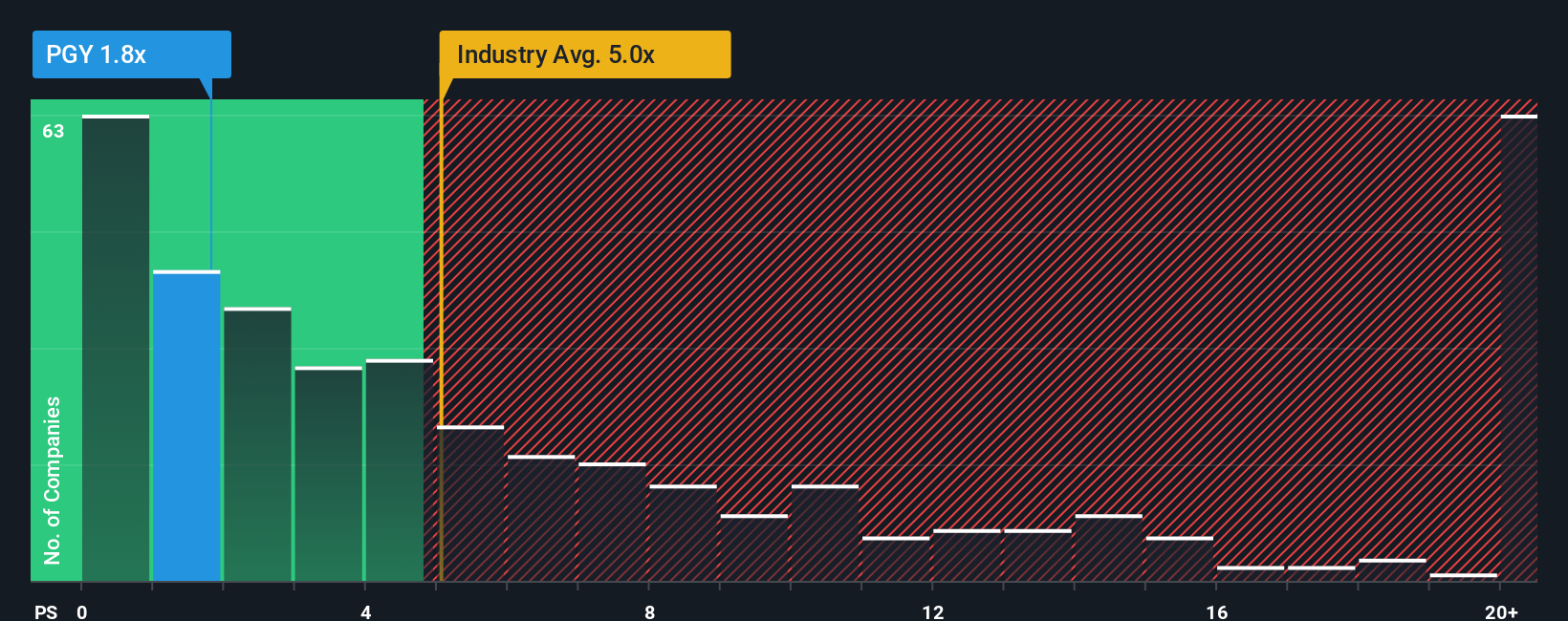

Approach 2: Pagaya Technologies Price vs Sales

Price-to-Sales (P/S) is often considered a suitable valuation metric for companies like Pagaya Technologies, particularly in the fintech and software sectors, where profits may be inconsistent or negative due to reinvestment in rapid growth. The P/S ratio helps investors understand how much they are paying for every dollar of revenue, which serves as a solid benchmark when earnings are not yet stable.

Growth expectations and risk levels directly influence what constitutes a “normal” or “fair” Price-to-Sales ratio. Higher growth or improved profitability for a company often translates into a higher fair multiple, while greater risk or uncertain prospects warrant a lower one.

Pagaya Technologies currently trades at a P/S ratio of 1.55x. By comparison, the software industry average stands at 4.86x, and its peer group averages 3.56x. This places Pagaya well below both benchmarks.

Simply Wall St’s “Fair Ratio” for Pagaya is calculated at 3.82x. Unlike a simple industry or peer average, the Fair Ratio incorporates company-specific factors such as projected revenue growth, profit margins, risk profile, market capitalization, and the broader industry landscape. This tailored benchmark gives investors a more nuanced view of appropriate valuation.

When comparing Pagaya's actual P/S multiple of 1.55x to its Fair Ratio of 3.82x, it is clear the stock is trading at a substantial discount relative to what would be justified given its fundamentals.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

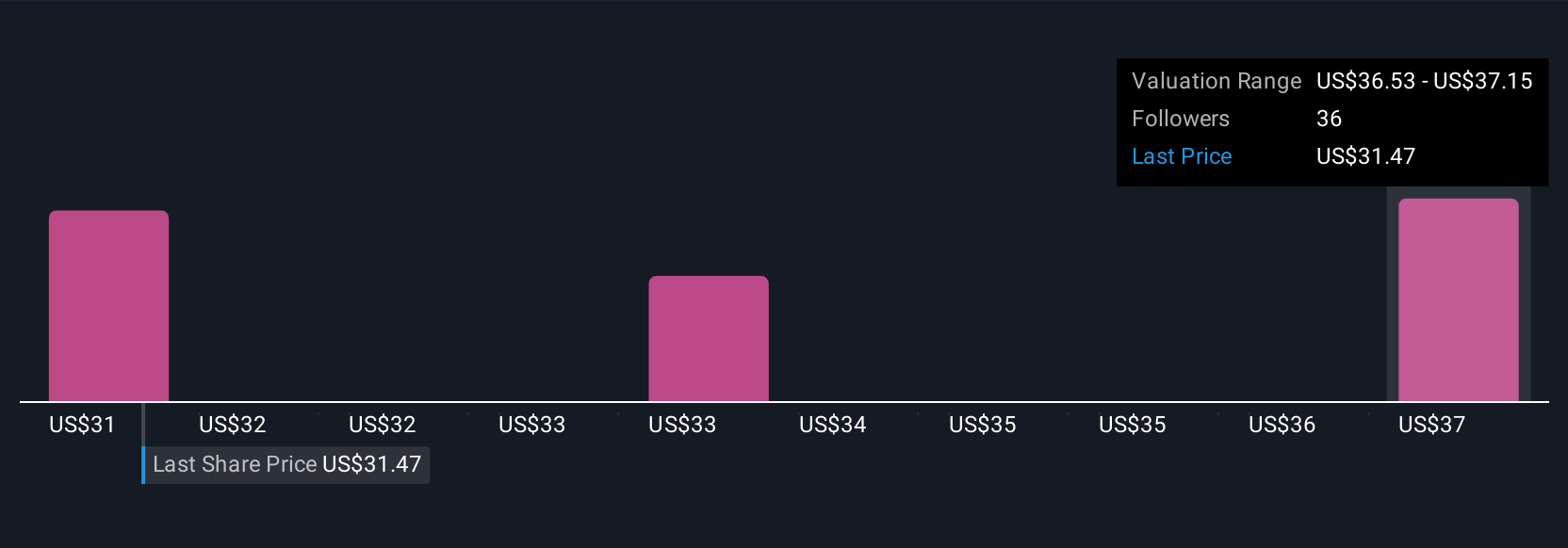

Upgrade Your Decision Making: Choose your Pagaya Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is more than just numbers; it is your story or perspective about a company like Pagaya Technologies, built around your own estimates for its fair value, future revenue, earnings, and margins. Narratives link a company's real-world story directly to a financial forecast and then to a fair value you believe in, helping you make sense of the market’s shifting signals. This tool, available on Simply Wall St's Community page (trusted by millions of investors), makes sophisticated investing accessible to everyone by letting you easily build or follow Narratives and instantly compare them. Narratives also help you act with confidence by showing how your Fair Value compares to today's price, clarifying whether the stock could be a buy or a sell right now. Because they update dynamically as new news or earnings land, you never fall behind. For example, two investors may have completely different views on Pagaya: one sees big upside with a fair value of $54.00 based on rapid expansion and new AI products, while another sees more risk and pegs fair value at $27.00, highlighting market volatility and competition.

Do you think there's more to the story for Pagaya Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PGY

Pagaya Technologies

A product-focused technology company, deploys data science and proprietary artificial intelligence-powered technology for financial services and other service providers, their customers, and asset investors in the United States, Israel, and the Cayman Islands.

Undervalued with high growth potential.

Market Insights

Community Narratives