- United States

- /

- Software

- /

- NasdaqGS:PANW

Is Palo Alto Networks Still a Bargain After Recent Price Dip and Strategic Partnerships?

Reviewed by Bailey Pemberton

- Ever wondered if Palo Alto Networks is priced right for long-term investors, or if the recent buzz is hiding a bargain? You are not alone in wanting the real story behind this cybersecurity leader's current value.

- After an impressive three-year gain of 137.8%, shares have been more volatile lately. There was a 6.3% drop over the past week and a 2.4% dip in the last month, though the stock is still up 12.3% year-to-date.

- Headlines are swirling around Palo Alto Networks' strategic partnerships and ongoing sector innovation. These developments have stoked interest and debate around its potential. The company's leadership in AI-powered security and notable global deals continue to shape investor expectations.

- On our valuation scale, Palo Alto Networks scores just 1 out of 6 for being undervalued. Let's take a closer look at how that number is calculated and explore why a deeper review of valuation methods may reveal something even more important by the article's end.

Palo Alto Networks scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Palo Alto Networks Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by extrapolating future cash flow projections and discounting those amounts back to today's value. It is a well-known technique for evaluating whether a stock is priced fairly based on its ability to generate free cash in the future.

For Palo Alto Networks, the most recent reported Free Cash Flow (FCF) stands at $3.5 billion. According to analyst projections, the company's annual FCF is expected to climb consistently, reaching roughly $7.9 billion by July 2030. While analysts provide up to five years of detailed estimates, cash flows beyond this period are extrapolated based on trends and sector expectations.

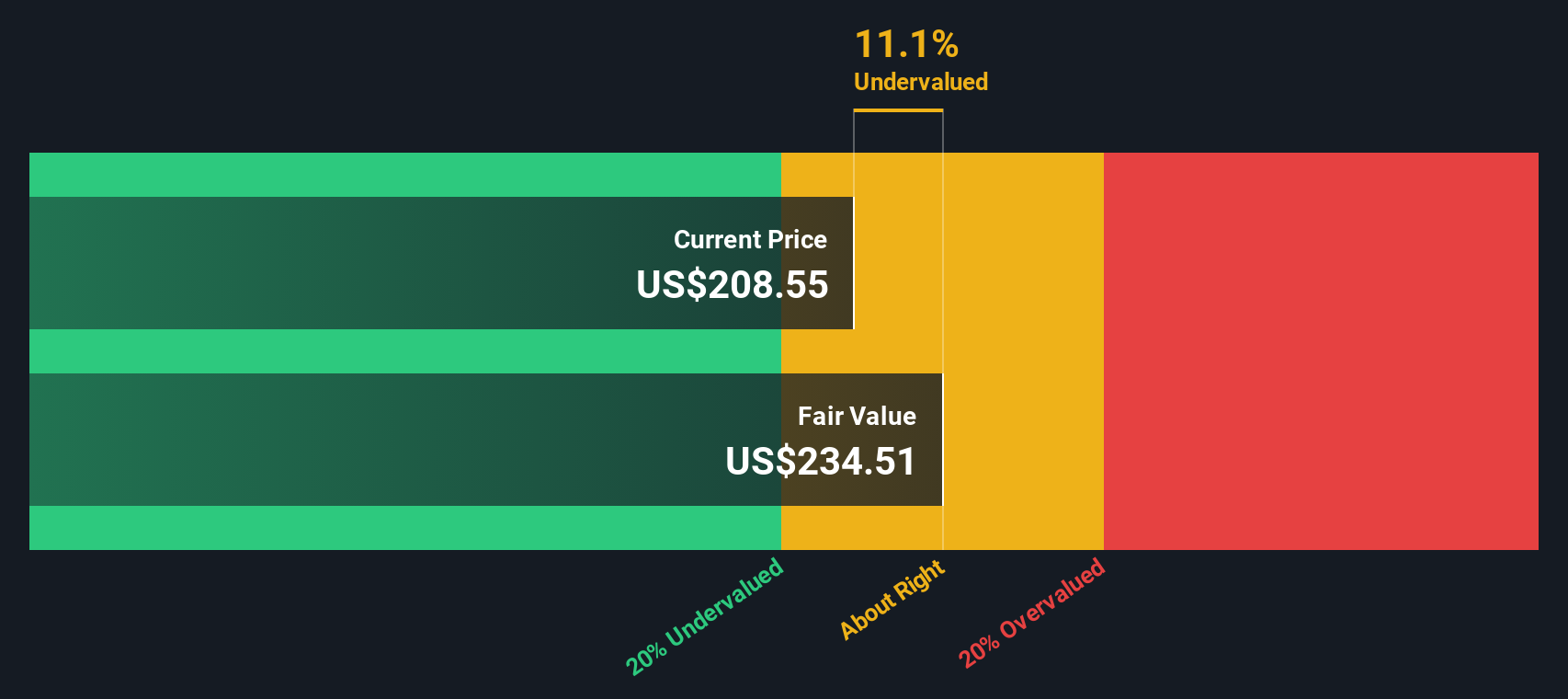

This two-stage Free Cash Flow to Equity model arrives at an intrinsic value of $227.63 per share. Compared with the current market price, this indicates the stock is 10.9% undervalued based on projected future cash flows.

For investors, the numbers suggest Palo Alto Networks could offer some value, though the margin is not dramatic. Cash flow momentum supports a positive outlook. Potential buyers should also weigh other valuation models and market risks.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Palo Alto Networks is undervalued by 10.9%. Track this in your watchlist or portfolio, or discover 895 more undervalued stocks based on cash flows.

Approach 2: Palo Alto Networks Price vs Earnings (PE)

For profitable companies like Palo Alto Networks, the Price-to-Earnings (PE) ratio is a popular valuation tool. It allows investors to assess how much the market is paying for each dollar of earnings, making it an intuitive way to compare value across similar businesses and industries.

However, growth expectations and risk both play important roles in shaping what is considered a “normal” or fair PE ratio. Fast-growing companies typically command higher PE multiples because investors expect future earnings to climb. Conversely, businesses facing greater uncertainty or risk often trade at a discount, reflecting caution from the market.

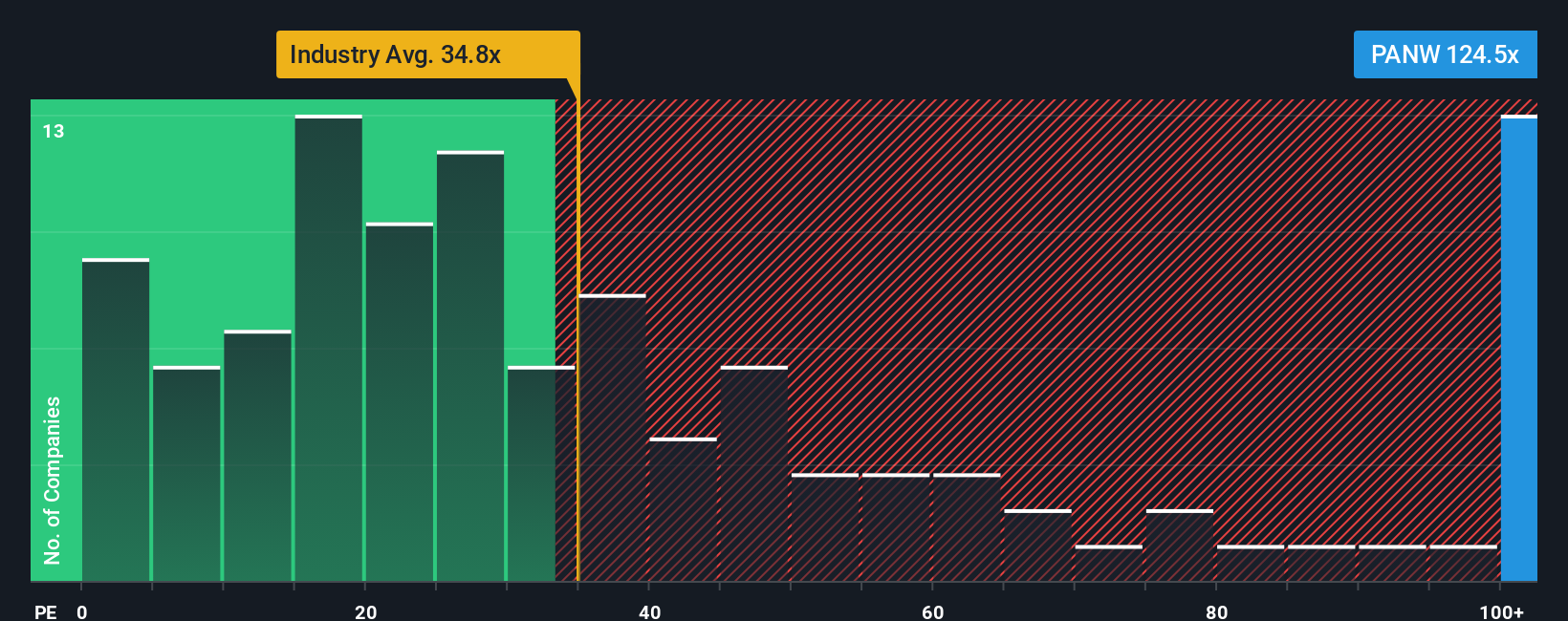

Palo Alto Networks currently trades at a PE multiple of 121.1x. This stands well above both the software industry average of 30.8x and the average of its listed peers at 50.9x. To provide a more tailored benchmark, Simply Wall St calculates a “Fair Ratio” specific to the company by considering its earnings growth, profitability, industry dynamics, size, and risk factors. For Palo Alto Networks, the Fair Ratio is 44.5x.

Unlike simple comparisons with industry averages or peers, the Fair Ratio offers a more complete picture by factoring in what really makes Palo Alto Networks unique. It weights tangible differences such as superior growth potential or competitive advantages rather than just grouping all software stocks together.

With the current PE multiple of 121.1x significantly higher than the Fair Ratio of 44.5x, Palo Alto Networks appears to be substantially overvalued based on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Palo Alto Networks Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is your personal story or perspective on a company, built from your own assumptions about future revenue, earnings, margins, and ultimately fair value. It goes beyond the numbers by connecting what you believe will drive Palo Alto Networks’ future with how much you think its shares are really worth.

With Narratives, you can translate your industry knowledge and outlook into a tailored financial forecast, linking the Palo Alto Networks story directly to a fair value calculation. This method is accessible to everyone and available on Simply Wall St’s Community page, where millions of investors build and update Narratives to reflect their unique views.

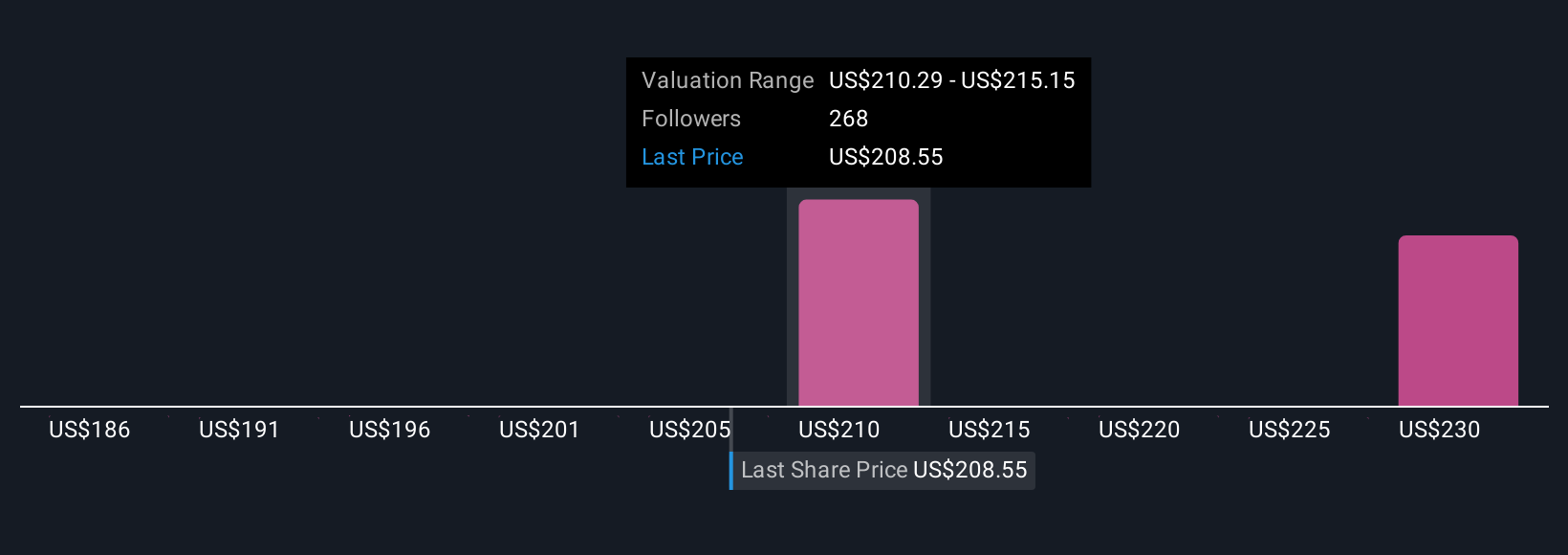

As new information emerges, such as breaking news or earnings results, Narratives update dynamically, helping you decide whether the current price presents an opportunity or a warning sign. For Palo Alto Networks, some investors may create an optimistic Narrative, forecasting robust AI-driven growth and targeting a fair value above $240, while others may factor in competitive risks and see a fair value near $131. Narratives help you compare these perspectives, make more informed decisions, and invest with clarity and confidence.

Do you think there's more to the story for Palo Alto Networks? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives