- United States

- /

- Software

- /

- NasdaqGS:PANW

How Palo Alto Networks' Autonomous AI Security Launches Could Shape the Investment Outlook for PANW

Reviewed by Sasha Jovanovic

- In late October 2025, Palo Alto Networks announced a series of next-generation AI security and automation products, including Prisma AIRS 2.0, Cortex AgentiX, and Cortex Cloud 2.0, designed to deliver comprehensive protection and autonomous workflow orchestration across the entire AI and cloud application lifecycle.

- A unique highlight of these launches is the integration of autonomous AI red teaming and model inspection, directly addressing the urgent need for robust enterprise guardrails as AI-driven threats evolve.

- We'll now explore how Palo Alto Networks' focus on autonomous AI agent security may reshape its investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

Palo Alto Networks Investment Narrative Recap

To own a piece of Palo Alto Networks, you have to believe the company's integrated, AI-powered security platforms will remain essential as organizations rapidly adopt AI and cloud technologies. The recent launches, Prisma AIRS 2.0, Cortex AgentiX, and Cortex Cloud 2.0, build on this vision, but they do not fundamentally change the near-term catalyst: broad enterprise security modernization. The most significant risk remains ongoing integration and acquisition challenges, especially with potential deals like CyberArk, which could threaten cohesion and innovation. Prisma AIRS 2.0, with its end-to-end protection for AI-driven applications, stands out from the new announcements and directly addresses rising enterprise concerns about safeguarding AI. Its deep integration of threat detection and continuous red teaming could enhance customer trust, but effective platform integration remains critical. However, despite these advancements, investors should be aware of one contrasting factor: even the most advanced platforms can fall short if integration complications emerge...

Read the full narrative on Palo Alto Networks (it's free!)

Palo Alto Networks is expected to generate $13.3 billion in revenue and $2.0 billion in earnings by 2028. This outlook requires annual revenue growth of 13.1% and an increase in earnings of $0.9 billion from the current $1.1 billion.

Uncover how Palo Alto Networks' forecasts yield a $217.67 fair value, in line with its current price.

Exploring Other Perspectives

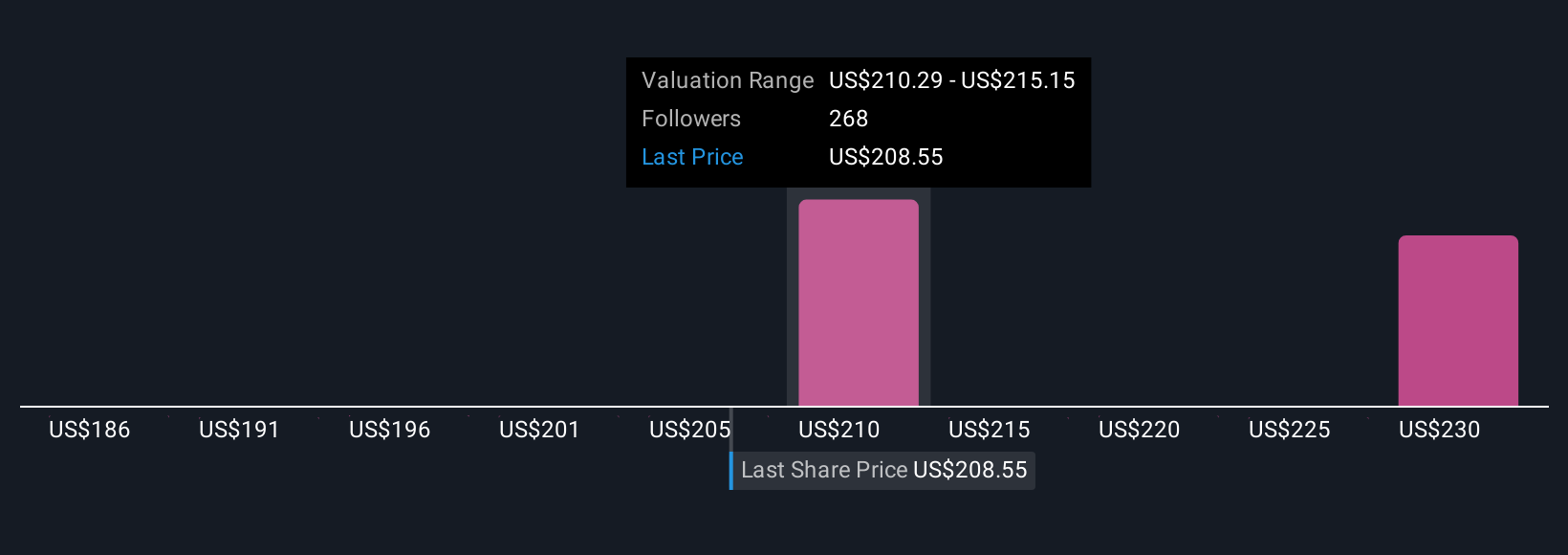

Private investors in the Simply Wall St Community post fair value estimates for Palo Alto Networks ranging from US$186.50 to US$240.32, based on 20 diverse analyses. These broad opinions arrive as integration and acquisition risks continue to shape the company’s future, offering plenty of contrasting viewpoints for you to consider.

Explore 20 other fair value estimates on Palo Alto Networks - why the stock might be worth 14% less than the current price!

Build Your Own Palo Alto Networks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Palo Alto Networks research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Palo Alto Networks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Palo Alto Networks' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives