- United States

- /

- Software

- /

- NasdaqGS:PANW

How IGEL's Prisma Browser Integration With Palo Alto Networks (PANW) Reflects Its Cloud Security Ambitions

Reviewed by Sasha Jovanovic

- Earlier this week, IGEL announced that the Palo Alto Networks Prisma Browser, a SASE-natively integrated secure browser, is now available on the IGEL App Portal, combining IGEL OS with Prisma Browser to enhance endpoint security for organizations operating in hybrid and cloud environments.

- This integration provides enterprise-grade security and regulatory compliance features, catering to critical industries such as healthcare and finance where data protection and consistent Zero Trust access are increasingly essential.

- We'll explore how the rollout of Prisma Browser on IGEL OS supports Palo Alto Networks’ broader transition to unified, cloud-based security solutions.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Palo Alto Networks Investment Narrative Recap

Palo Alto Networks appeals to investors who believe in the continuous demand for unified, cloud-based cybersecurity solutions, as digital transformation and regulatory pressures grow. The integration of Prisma Browser with IGEL further reinforces product strengths in regulated industries, but is unlikely to materially shift the primary short-term catalyst, which remains sustained double-digit revenue growth driven by platform adoption. The main risk continues to be the challenge of integrating acquisitions like CyberArk, along with potential customer churn if product cohesion lags.

Among recent company announcements, the $25 billion CyberArk acquisition stands out for its relevance. This move expands Palo Alto Networks’ reach in the identity security sector, aligning with the company’s emphasis on building a comprehensive security platform. Strong annual recurring revenue and successful product rollouts are supporting revenue momentum, helping offset any near-term integration concerns for now.

However, investors should also be aware that, despite positive product integration, a key risk remains if large-scale enterprise platform deals slow down or customer retention among major clients weakens...

Read the full narrative on Palo Alto Networks (it's free!)

Palo Alto Networks is projected to reach $13.3 billion in revenue and $2.0 billion in earnings by 2028. This outlook is based on annual revenue growth of 13.1% and an increase in earnings of $0.9 billion from the current $1.1 billion level.

Uncover how Palo Alto Networks' forecasts yield a $216.33 fair value, in line with its current price.

Exploring Other Perspectives

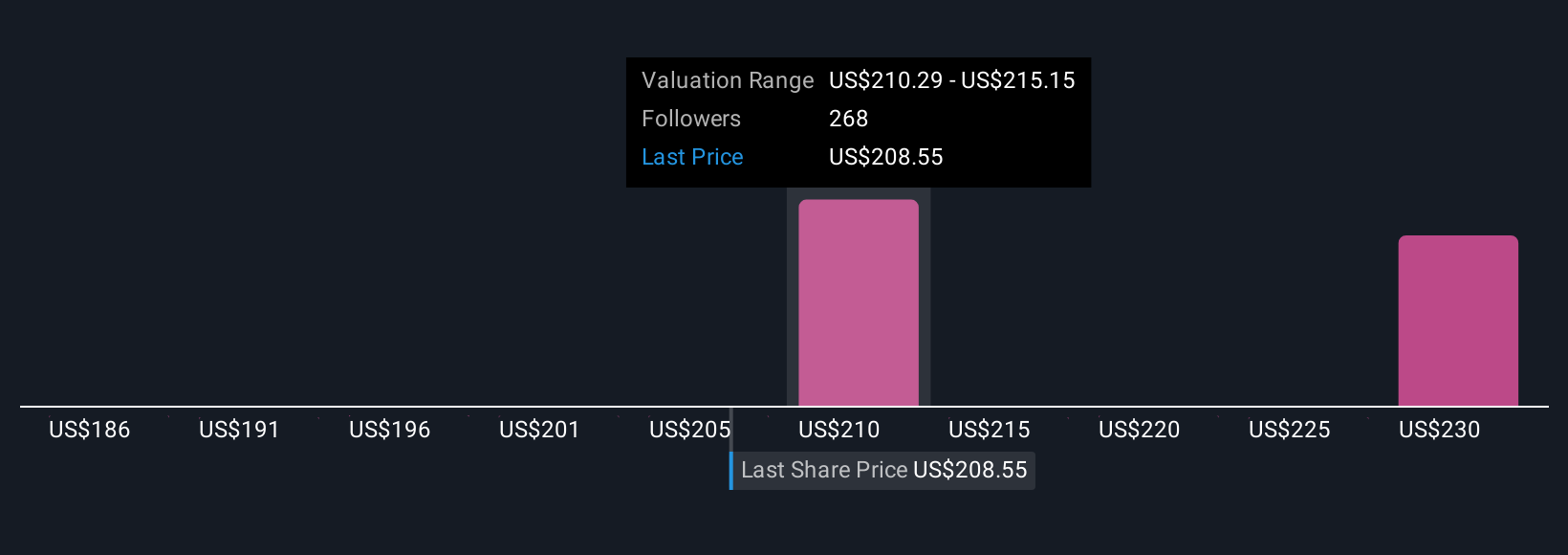

Nineteen fair value estimates from the Simply Wall St Community put Palo Alto Networks’ worth anywhere between US$186.50 and US$235.07 per share. While integration of new offerings supports revenue growth, the ongoing risk of rising competition and margin pressure could influence long-term outcomes, dig deeper into the range of investor opinions and what drives these outlooks.

Explore 19 other fair value estimates on Palo Alto Networks - why the stock might be worth 14% less than the current price!

Build Your Own Palo Alto Networks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Palo Alto Networks research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Palo Alto Networks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Palo Alto Networks' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives