- United States

- /

- Software

- /

- NasdaqGS:PANW

A Look at Palo Alto Networks (PANW) Valuation Following Major AI Security Product Launches

Reviewed by Simply Wall St

Palo Alto Networks (PANW) just took the wraps off a suite of new products, headlined by Cortex Cloud 2.0 and Prisma AIRS 2.0. These offerings set a fresh benchmark for AI-driven security. The updates focus on automating security workflows and managing cloud and AI risks.

See our latest analysis for Palo Alto Networks.

Palo Alto Networks’ steady stream of AI and cloud-focused launches has kept investors’ attention and fueled strong momentum in recent months. The company boasts a 29.7% share price return over the last 90 days and an impressive 21.4% one-year total shareholder return. This caps off an exceptional multiyear run that reflects increasing confidence in PANW’s leadership and long-term potential.

If PANW’s surge in next-gen security has you curious, now is a perfect time to discover other ambitious tech innovators with our See the full list for free.

With shares trading near recent highs after a wave of ambitious AI product launches, the question is whether Palo Alto Networks has more room to run or if the market has already priced in all its future growth potential.

Most Popular Narrative: Fairly Valued

Palo Alto Networks last closed at $219.23, just above the most widely followed narrative's fair value estimate of $217.67. With expectations finely balanced, how bullish are analysts about the future drivers of this stock?

Ongoing industry consolidation, as enterprises seek to simplify and maximize the effectiveness of their security stack, has strengthened the trend toward platformization. This has resulted in larger multi-platform deal sizes, improved cross-sell, higher net retention rates (120%), and near zero churn among platformized clients. All of these factors support future margin expansion and earnings growth.

Want to know the bold assumptions behind this balanced view? Future growth, profit margins and lofty earnings multiples power the valuation math. What’s the linchpin tying together this security leader’s price target? Only the full narrative lays out which financial leaps underpin that fair value.

Result: Fair Value of $217.67 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising costs associated with maintaining a leading position in AI and intense industry competition could challenge Palo Alto Networks’ profit margins and slow its ambitious growth plans.

Find out about the key risks to this Palo Alto Networks narrative.

Another View: What About the DCF?

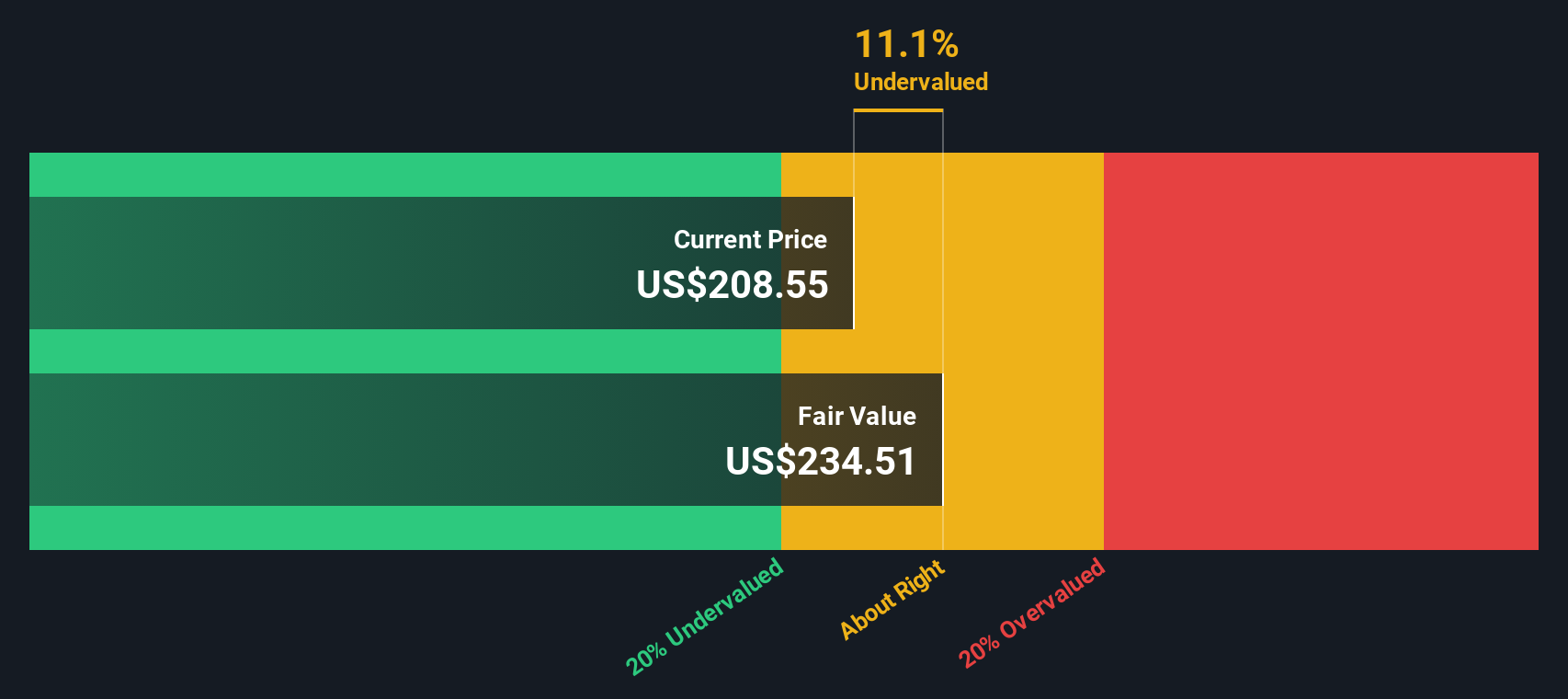

Looking through the lens of the SWS DCF model reveals something different. By this approach, Palo Alto Networks appears undervalued, with the current share price trading 6.9% below our fair value estimate of $235.37. This could raise the question of whether the market is overlooking further upside.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Palo Alto Networks for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 841 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Palo Alto Networks Narrative

Prefer to draw your own conclusions? Dig into the numbers and craft a personal take on Palo Alto Networks’ story. Your analysis could reshape the narrative in just a few minutes. Do it your way

A great starting point for your Palo Alto Networks research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't stop at just one standout stock. Give yourself an edge by checking out other timely opportunities waiting in the wings with the Simply Wall Street Screener.

- Boost your portfolio with reliable income by targeting these 18 dividend stocks with yields > 3% offering yields above 3%.

- Stay ahead of trends and pinpoint growth potential through these 26 AI penny stocks riding the surge in artificial intelligence innovation.

- Unearth hidden gems trading below fair value by reviewing these 841 undervalued stocks based on cash flows, where strong fundamentals meet attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives