- United States

- /

- Biotech

- /

- NasdaqGM:VCEL

High Growth Tech Stocks To Explore In November 2024

Reviewed by Simply Wall St

The United States market has experienced a notable upswing, climbing 3.9% over the last week and 33% over the past year, with earnings forecasted to grow by 16% annually. In this dynamic environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability to capitalize on these favorable conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| AsiaFIN Holdings | 51.75% | 58.17% | ★★★★★★ |

| Invivyd | 47.87% | 67.72% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Blueprint Medicines | 25.26% | 68.92% | ★★★★★★ |

| Travere Therapeutics | 31.19% | 72.58% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 240 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Vericel (NasdaqGM:VCEL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vericel Corporation is a commercial-stage biopharmaceutical company focused on the research, development, manufacture, and distribution of cellular therapies for sports medicine and severe burn care markets in North America, with a market cap of $2.80 billion.

Operations: Vericel focuses on cellular therapies, generating revenue primarily from its biotechnology segment, which accounts for $226.84 million. The company's operations are centered in North America, targeting sports medicine and severe burn care markets.

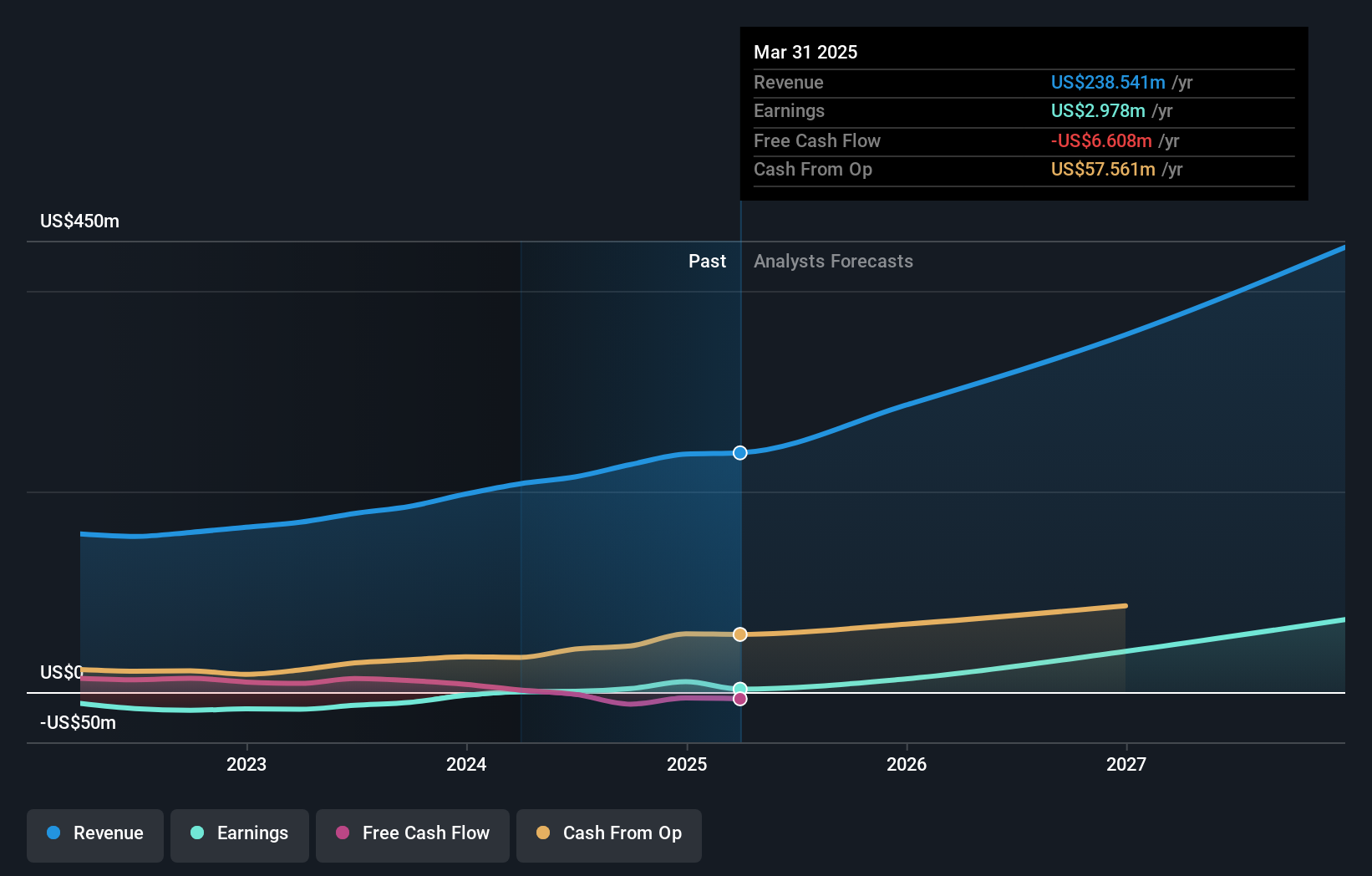

Vericel's recent FDA approvals for MACI Arthro and pediatric NexoBrid signify strategic expansions in less invasive medical procedures and broader demographic reach, respectively. These innovations not only cater to a substantial segment of the $3 billion addressable market but also align with industry shifts towards specialized, patient-centric solutions. Financially, Vericel has demonstrated robust growth with a 21.3% increase in revenue year-over-year and is projecting continued expansion with revenue guidance set between $238 million to $242 million for 2024. This growth trajectory is underscored by an anticipated earnings increase of 51.6% annually over the next three years, reflecting both operational efficiency and market penetration.

- Click here to discover the nuances of Vericel with our detailed analytical health report.

Gain insights into Vericel's past trends and performance with our Past report.

AvePoint (NasdaqGS:AVPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AvePoint, Inc. offers a cloud-native data management software platform across North America, Europe, the Middle East, Africa, and Asia Pacific with a market cap of $2.94 billion.

Operations: AvePoint generates revenue primarily from its Software & Programming segment, which amounts to $315.92 million. The company's focus is on providing cloud-native data management solutions across multiple regions globally.

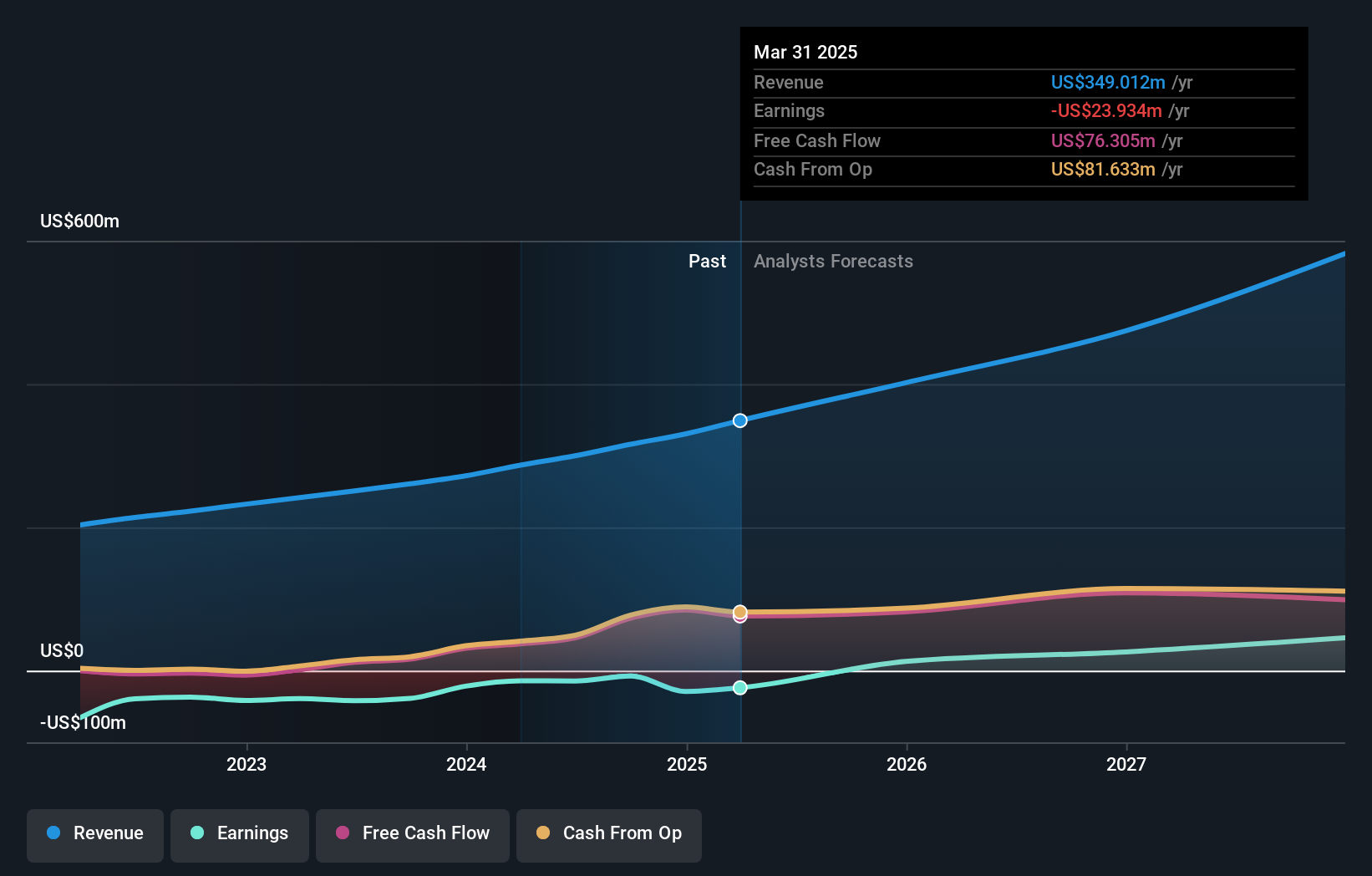

AvePoint's recent pivot towards AI-driven innovation, highlighted by the establishment of its AI Lab in collaboration with the Singapore Economic Development Board, underscores a strategic focus on leveraging artificial intelligence to enhance its SaaS offerings. This move is not only expected to spur significant research and development but also aligns with AvePoint's financial trajectory where earnings are forecasted to grow by an impressive 115.3% annually. Moreover, with a reported revenue increase of 17.5% year-over-year and a shift from a net loss to net income this quarter, AvePoint demonstrates robust potential in operational turnaround and market expansion.

- Click here and access our complete health analysis report to understand the dynamics of AvePoint.

Assess AvePoint's past performance with our detailed historical performance reports.

Okta (NasdaqGS:OKTA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Okta, Inc. operates as an identity partner both in the United States and internationally, with a market cap of approximately $13.33 billion.

Operations: As an identity partner, Okta generates revenue primarily from its Internet Software & Services segment, totaling $2.45 billion. The company's operations focus on providing identity solutions across various regions.

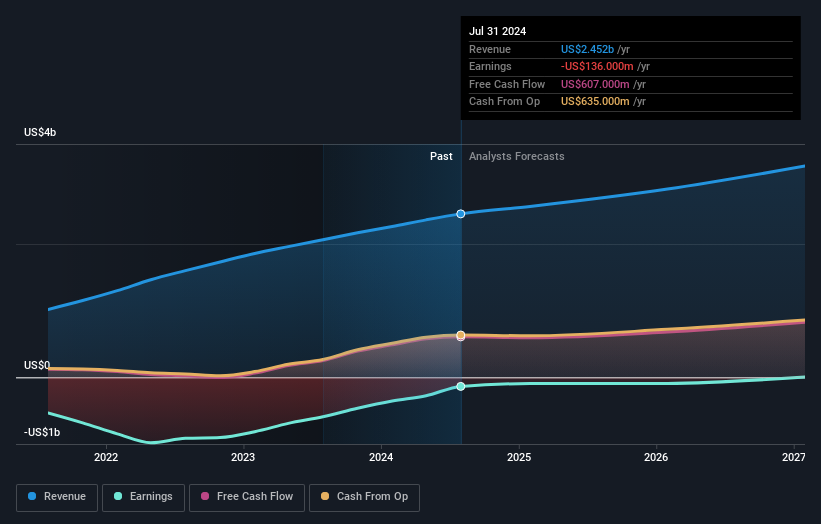

Okta's strategic partnerships, such as the recent collaboration with Persona for enhanced identity verification, underscore its commitment to securing digital identities amid increasing cyber threats. This initiative not only expands its service offerings but also strengthens its position in the cloud-based identity management sector. Additionally, Okta's financial performance has shown significant improvement with a jump in quarterly revenue from $556 million to $646 million and a swing to a net income of $29 million from a previous loss of $111 million. The company forecasts an encouraging revenue growth rate of 10.5% annually, outpacing the broader U.S. market projection of 8.9%. These developments reflect Okta's robust strategy in navigating the complexities of cybersecurity and identity management while enhancing shareholder value through focused R&D efforts which have been pivotal in transitioning from losses to profitability.

- Delve into the full analysis health report here for a deeper understanding of Okta.

Gain insights into Okta's historical performance by reviewing our past performance report.

Where To Now?

- Take a closer look at our US High Growth Tech and AI Stocks list of 240 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VCEL

Vericel

A commercial-stage biopharmaceutical company, engages in the research, development, manufacture, and distribution of cellular therapies for sports medicine and severe burn care markets in North America.

Flawless balance sheet with high growth potential.