- United States

- /

- IT

- /

- NasdaqGS:OKTA

Examining Okta’s Valuation After 4% Slide and Latest Cybersecurity Initiatives

Reviewed by Bailey Pemberton

- If you have ever wondered whether Okta stock is a value gem or just riding the hype, you are in the right place for some clarity.

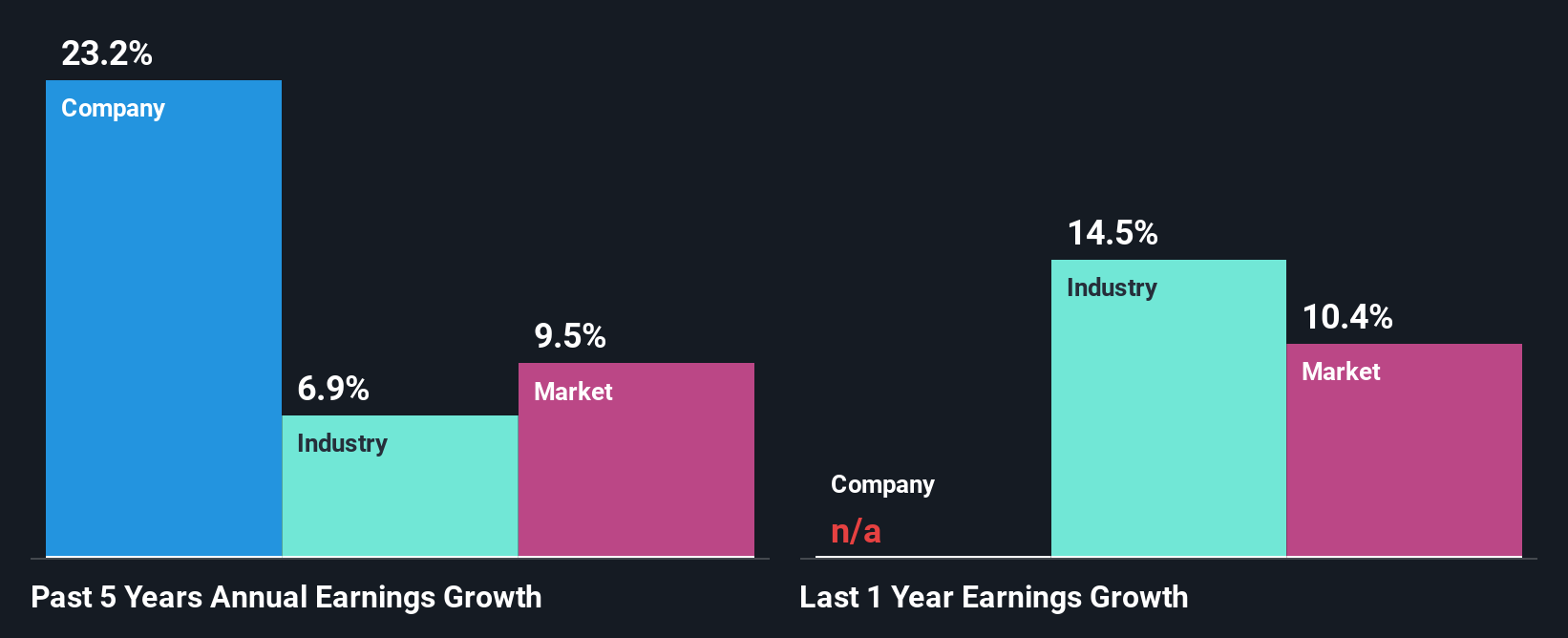

- Over the past year, Okta shares have climbed 10.0%, but there have been bumps along the way, including a 4.3% dip this past week and an 8.3% move down over the last month.

- Recent headlines have focused on Okta’s initiatives in identity and cybersecurity, which have drawn investor interest and sparked renewed debate over the company’s long-term prospects. Strategic partnerships and product updates continue to shape sentiment around Okta’s growth trajectory.

- Currently, Okta scores a 3 out of 6 on our valuation checks, so let’s explore what that means using the main approaches to valuation. Stay tuned for an even smarter way to interpret this at the end.

Find out why Okta's 10.0% return over the last year is lagging behind its peers.

Approach 1: Okta Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today's value. This approach is widely used because it considers both current financial performance and future growth potential.

For Okta, the DCF model begins with its latest twelve-month Free Cash Flow, which stands at $830 million. Analyst estimates suggest that Okta will steadily grow its FCF, reaching around $1.28 billion by 2030. Notably, analyst estimates are available for the next five years. Further projections come from Simply Wall St’s own modeling.

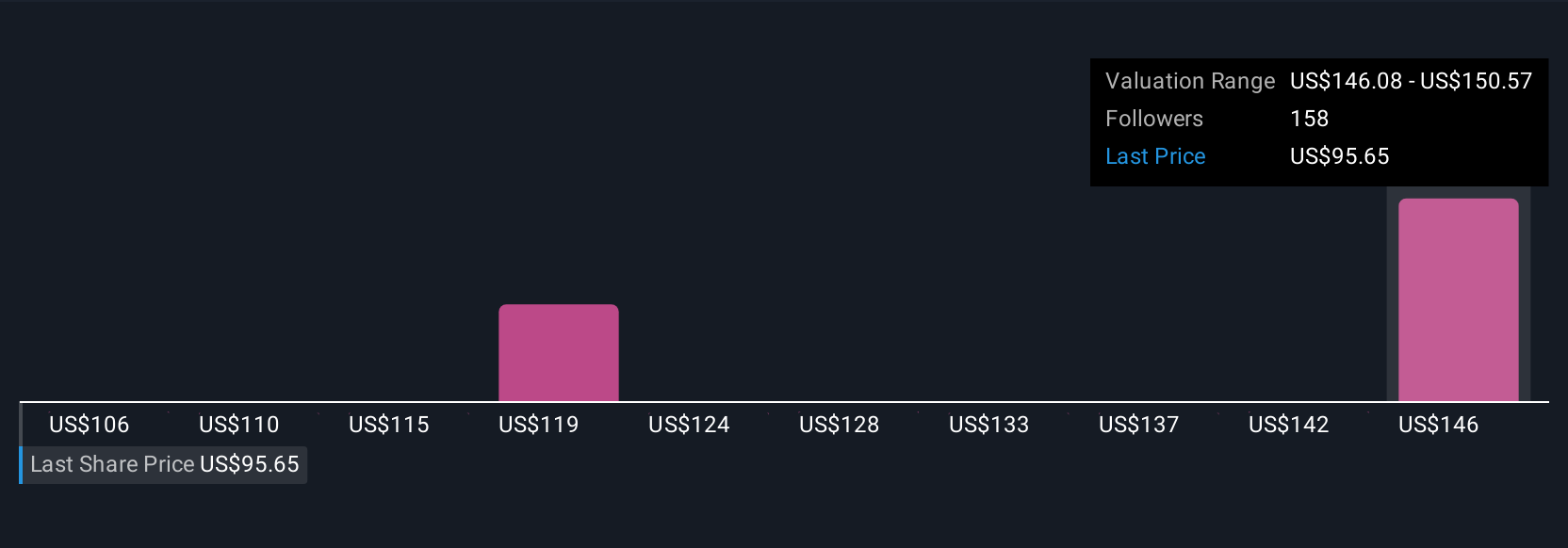

Using the 2 Stage Free Cash Flow to Equity model, Okta’s intrinsic fair value is calculated at $118.78 per share. According to the current analysis, this implies that Okta’s stock is trading at a 31.8% discount to its fair value. This indicates significant undervaluation.

This sizable discount suggests that, based on long-term cash flow generation, the market may be pricing Okta shares too conservatively relative to its growth prospects and cash flow profile.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Okta is undervalued by 31.8%. Track this in your watchlist or portfolio, or discover 905 more undervalued stocks based on cash flows.

Approach 2: Okta Price vs Earnings

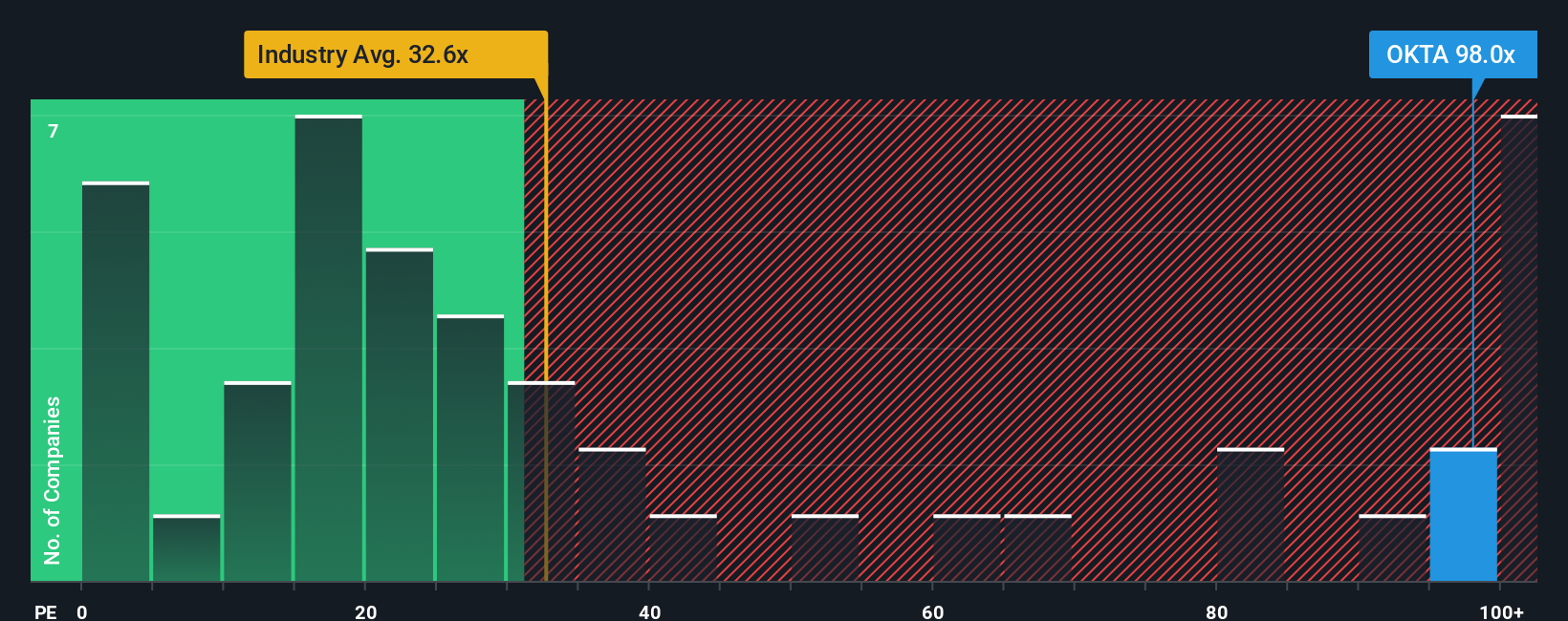

For profitable companies, the Price-to-Earnings (PE) ratio is often the most effective way to compare valuation because it directly reflects how much investors are willing to pay for each dollar of earnings. A lower PE can suggest a stock is cheap relative to its earnings potential, while a higher PE may reflect strong growth expectations or lower risks.

However, what counts as a "normal" or "fair" PE ratio depends on both industry norms and company-specific factors. Higher growth prospects and lower risks generally warrant a higher PE. Lower growth or greater uncertainty push the fair value lower.

Okta currently trades at an 85.0x PE ratio. This is well above the IT industry average of 27.4x and the average of its peer group, which stands at 29.1x. To get a more tailored view, Simply Wall St calculates a proprietary Fair Ratio. This approach goes deeper than simple peer or industry averages by incorporating factors such as Okta’s earnings growth, profit margins, market capitalization, and risk profile. For Okta, this Fair Ratio comes out to 40.8x.

The Fair Ratio offers a more nuanced benchmark because it accounts for unique company attributes rather than relying solely on broad comparisons. Since Okta’s current PE is substantially higher than its Fair Ratio, the stock appears overvalued based on this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1418 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Okta Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives, a smarter, more dynamic approach for making investment choices.

A Narrative is your investment story for a company like Okta, combining your unique perspective with the numbers, such as your assumptions about fair value, future revenue, earnings, and profit margins. Instead of relying on averages or single models, Narratives connect a company’s story to a financial forecast and then to an actionable fair value, empowering you to see the bigger picture behind the numbers.

Narratives are easy to use and available on Simply Wall St’s platform in the Community page, trusted by millions of investors. They help you make clear buy or sell decisions by showing you how your forecasted Fair Value compares to the current share price. Narratives also automatically update when new information like earnings or news is released so your investment view stays relevant.

For example, one Narrative values Okta at $147.87 per share, focusing on profitability finally being within reach, while another more cautious perspective sets a fair value at $75.00, emphasizing competitive risks and slower growth. Narratives let you reflect your own story and adapt as Okta changes, making smarter investing truly accessible.

Do you think there's more to the story for Okta? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives