- United States

- /

- Software

- /

- NasdaqGS:NTNX

Nutanix (NTNX): Assessing Valuation After Fresh Partnerships and Rising Institutional Optimism

Reviewed by Simply Wall St

Recent positive analyst sentiment around Nutanix (NTNX), together with new partnerships like those with DartPoints and Leostream, have drawn attention to the company’s positioning. These moves come just ahead of Nutanix's upcoming earnings report.

See our latest analysis for Nutanix.

After a steady string of enterprise partnerships and fresh institutional attention, Nutanix has gained momentum with a 16.3% year-to-date share price return, standing out even as tech sector sentiment has wavered. Its 13.9% one-year total shareholder return and an impressive 164% over three years underscore that recent enthusiasm is not just a short-term blip. This is the latest chapter in a longer trend of value creation.

If these kinds of strategic moves and sustained returns have you curious about what else is rising, now is a smart time to widen your search and discover fast growing stocks with high insider ownership

With shares outperforming the tech sector and institutional activity on the rise, investors now face a critical question: Is the stock undervalued with more upside to come, or has the market already priced in Nutanix’s future growth?

Most Popular Narrative: 18.1% Undervalued

With Nutanix last closing at $71.24 and the widely followed narrative setting fair value at $87.03, the story behind these numbers is a bold one that attracts attention from both bulls and skeptics.

Accelerating adoption of hybrid and multi-cloud architectures, highlighted by new integrations with Google Cloud and deepening partnerships with AWS, Azure, Dell, and Pure Storage, positions Nutanix to capture a broader share of enterprise infrastructure modernization budgets. This expands its addressable market and drives sustained revenue growth. Ongoing enterprise digital transformation and demand for scalable solutions, as evidenced by large multi-year deals, major wins like Finanz Informatik, and increasing contributions from Global 2000 customers, provide a robust pipeline for future "land and expand" motions, improving both revenue visibility and opportunities for net new ARR expansion.

Want to see what’s fueling this high valuation? The narrative is built around optimism for surging growth, longer contracts, and a margin leap few dare project. Which key financial leaps and market bets back it all up? Uncover the dramatic assumptions underpinning this price target. There’s far more to the story.

Result: Fair Value of $87.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, as industry-wide pricing pressures and customer concentration could limit Nutanix's expansion if competition intensifies or key clients shift strategies.

Find out about the key risks to this Nutanix narrative.

Another View: What Do Multiples Say?

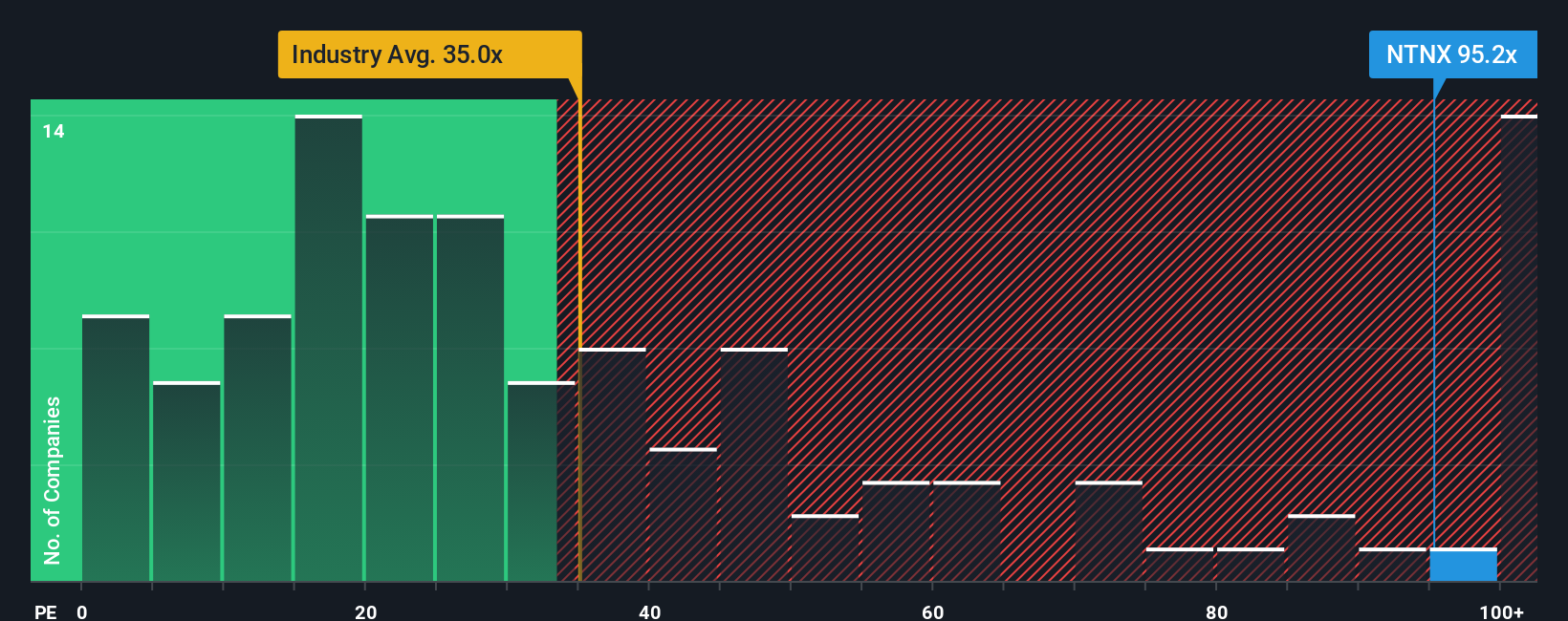

While analysts set Nutanix's fair value well above its current price, traditional valuation metrics tell a different story. The company’s price-to-earnings ratio stands at 101.7x, almost triple the US Software industry average of 34.7x and nearly double the peer average of 51.3x. The fair ratio, based on regression analysis, suggests a more grounded figure of 52.1x.

That gap could mean Nutanix’s premium valuation leaves little room for error if expectations shift. Is this a justified price for future growth, or does it signal heightened risk for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nutanix Narrative

If you want to question these perspectives or have your own take, dive into the data and craft your personal Nutanix story in minutes. Do it your way.

A great starting point for your Nutanix research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at one company. Supercharge your research now with hand-picked stock ideas, each offering a different edge and fresh opportunities you can act on today.

- Tap into income opportunities by checking out these 22 dividend stocks with yields > 3% to see which companies consistently deliver attractive yields above 3%.

- Seize the potential in tomorrow's artificial intelligence leaders by following these 26 AI penny stocks, which are already riding the wave of rapid innovation in this explosive sector.

- Find compelling bargains by targeting these 832 undervalued stocks based on cash flows, identifying stocks that the market has overlooked based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nutanix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTNX

Nutanix

Provides an enterprise cloud platform in North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives