- United States

- /

- Software

- /

- NasdaqGS:NTNX

How Investors May Respond To Nutanix (NTNX) Expanding Cloud Partnerships to Target Regulated Industries

Reviewed by Sasha Jovanovic

- In recent days, DartPoints announced its acceptance into the Nutanix Elevate Service Provider Program, enabling DartPoints to offer fully managed, secure, and compliant private cloud solutions powered by Nutanix's enterprise-grade hyperconverged infrastructure, while Leostream renewed its alliance with Nutanix to deliver validated, high-performance virtual desktop infrastructure for demanding enterprise environments.

- These collaborations strengthen Nutanix's presence in regulated industries and expand its ecosystem, highlighting a focus on advanced security, unified management, and scalable infrastructure for enterprise clients seeking hybrid and multi-cloud options.

- We'll examine how DartPoints' adoption of Nutanix's technology for compliant cloud environments could impact Nutanix's long-term growth narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Nutanix Investment Narrative Recap

For Nutanix shareholders, the key belief centers around the company capturing a larger share of the hybrid and multi-cloud infrastructure market, fueled by continued enterprise digital transformation and the need for scalable, secure private cloud solutions. The recent DartPoints partnership adds incremental validation to Nutanix’s strength in regulated industries, but it is not likely to meaningfully shift the near-term earnings catalyst, sustained revenue growth from new enterprise wins, nor does it address the biggest risk, which remains competition from hyperscale public cloud providers.

Among recent announcements, the large multi-year deal with Finanz Informatik stands out as most relevant, as it demonstrates Nutanix’s ability to secure business with major clients in highly regulated sectors. Deals like this add credibility to Nutanix's position as a critical partner for complex, compliance-heavy workloads, potentially supporting continued ARR expansion and margin improvement, despite ongoing industry pricing pressure.

Yet investors should also be aware that, in contrast, the risk of public cloud giants encroaching on Nutanix’s client base could still limit...

Read the full narrative on Nutanix (it's free!)

Nutanix's forecast calls for $3.9 billion in revenue and $513.0 million in earnings by 2028. This is based on annual revenue growth of 15.3% and an increase in earnings of $324.6 million from the current $188.4 million level.

Uncover how Nutanix's forecasts yield a $87.03 fair value, a 24% upside to its current price.

Exploring Other Perspectives

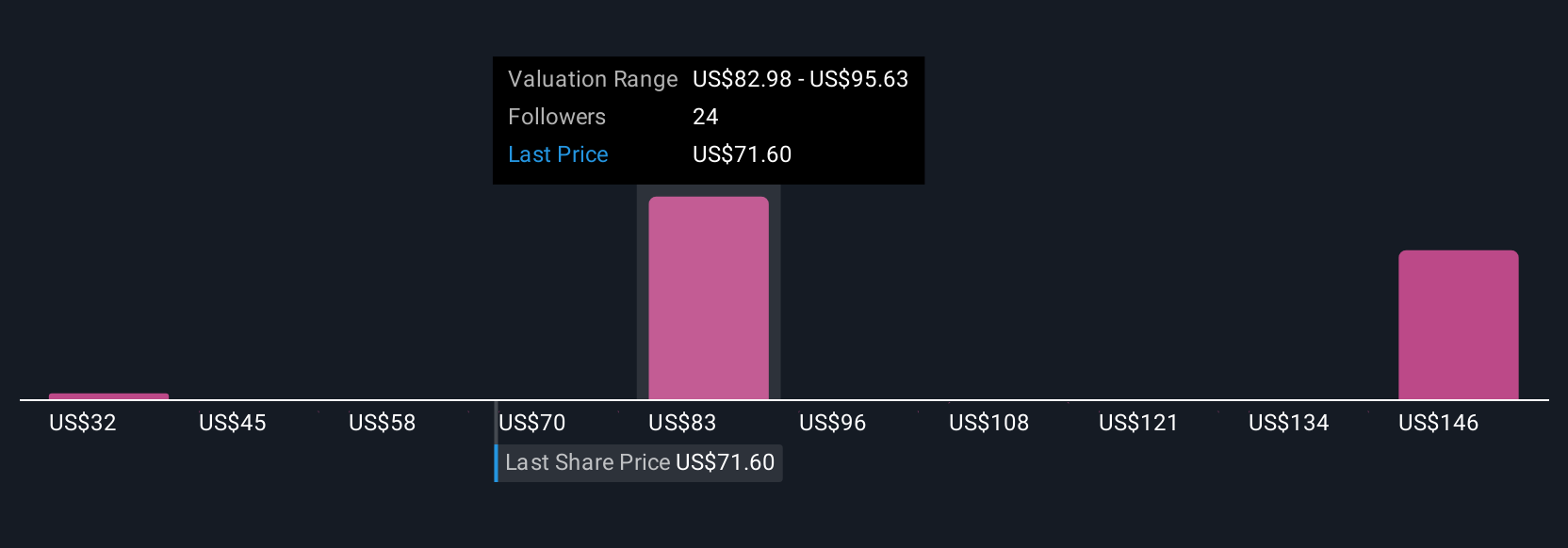

Simply Wall St Community members offered seven distinct fair value estimates for Nutanix, spanning US$32.34 to US$118.13 per share. While many see opportunity, the ongoing competitive push from hyperscale cloud providers highlights why opinions, and potential performance, can differ so widely.

Explore 7 other fair value estimates on Nutanix - why the stock might be worth less than half the current price!

Build Your Own Nutanix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nutanix research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nutanix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nutanix's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nutanix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTNX

Nutanix

Provides an enterprise cloud platform in North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives