- United States

- /

- Software

- /

- NasdaqCM:NCTY

The9 Limited's (NASDAQ:NCTY) 28% Share Price Plunge Could Signal Some Risk

Unfortunately for some shareholders, the The9 Limited (NASDAQ:NCTY) share price has dived 28% in the last thirty days, prolonging recent pain. The good news is that in the last year, the stock has shone bright like a diamond, gaining 114%.

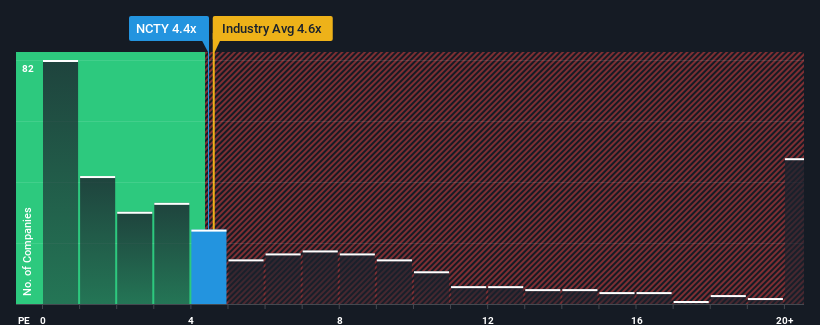

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about The9's P/S ratio of 4.4x, since the median price-to-sales (or "P/S") ratio for the Software industry in the United States is also close to 4.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for The9

How The9 Has Been Performing

The recent revenue growth at The9 would have to be considered satisfactory if not spectacular. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on The9's earnings, revenue and cash flow.How Is The9's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like The9's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 2.8% last year. Pleasingly, revenue has also lifted 40% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 18% shows it's noticeably less attractive.

With this information, we find it interesting that The9 is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

With its share price dropping off a cliff, the P/S for The9 looks to be in line with the rest of the Software industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that The9's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

There are also other vital risk factors to consider and we've discovered 3 warning signs for The9 (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if The9 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NCTY

The9

Operates as a cryptocurrency mining company in China, Eastern Europe, Asia, and North America.

Moderate risk with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success