- United States

- /

- Software

- /

- NasdaqGS:NBIS

Nebius Group (NasdaqGS:NBIS): Valuation Insights Following Monumental $17.4 Billion Azure AI Contract with Microsoft

Reviewed by Simply Wall St

Nebius Group (NasdaqGS:NBIS) just landed a five-year, $17.4 billion contract with Microsoft to deliver GPU resources for Azure. This new agreement closely follows Microsoft’s expanded partnership with OpenAI and places Nebius at the center of the evolving AI infrastructure landscape.

See our latest analysis for Nebius Group.

Nebius Group’s momentum has surged following its blockbuster Azure deal, with a year-to-date share price return of 328.78% and a staggering 549.55% total shareholder return over the past 12 months. Recent volatility in the stock reflects shifting investor perceptions around both the company’s growth potential and the unique risks that come with scaling to meet massive AI demand.

If you’re watching how AI’s infrastructure boom is shaping the market, this is the perfect time to broaden your search and discover See the full list for free.

With the share price soaring, fresh analyst targets still implying upside, and explosive revenue gains, is the future growth of Nebius already reflected in today’s price? Or does the recent surge present a new buying opportunity?

Most Popular Narrative: 16% Undervalued

Nebius Group’s most widely followed narrative puts fair value at $156.40, around 16% above the latest close of $130.82. This narrative frames Nebius as a company poised to benefit from AI’s massive secular tailwinds, but also facing real pressures as competitors and costs ramp up.

The current valuation assumes Nebius Group can sustain hyper growth in AI compute infrastructure. However, market-wide demand for AI and machine learning clouds is attracting intense competition and accelerating adoption of open-source technologies, which could drive pricing pressure and erode margins over the next several years. This could directly impact long-term profitability and gross margins.

Want to know the hypergrowth story that powers this bullish call? The engine behind the narrative is exceptionally bold on revenue and earnings expansion. Which ambitious assumptions set the price so high? Discover the quantitative leap that’s baked into the fair value outlook when you dive deeper into the full narrative.

Result: Fair Value of $156.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid expansion may strain Nebius’s ability to execute efficiently. Rising regulatory and competitive pressures could also weigh on its long-term margins.

Find out about the key risks to this Nebius Group narrative.

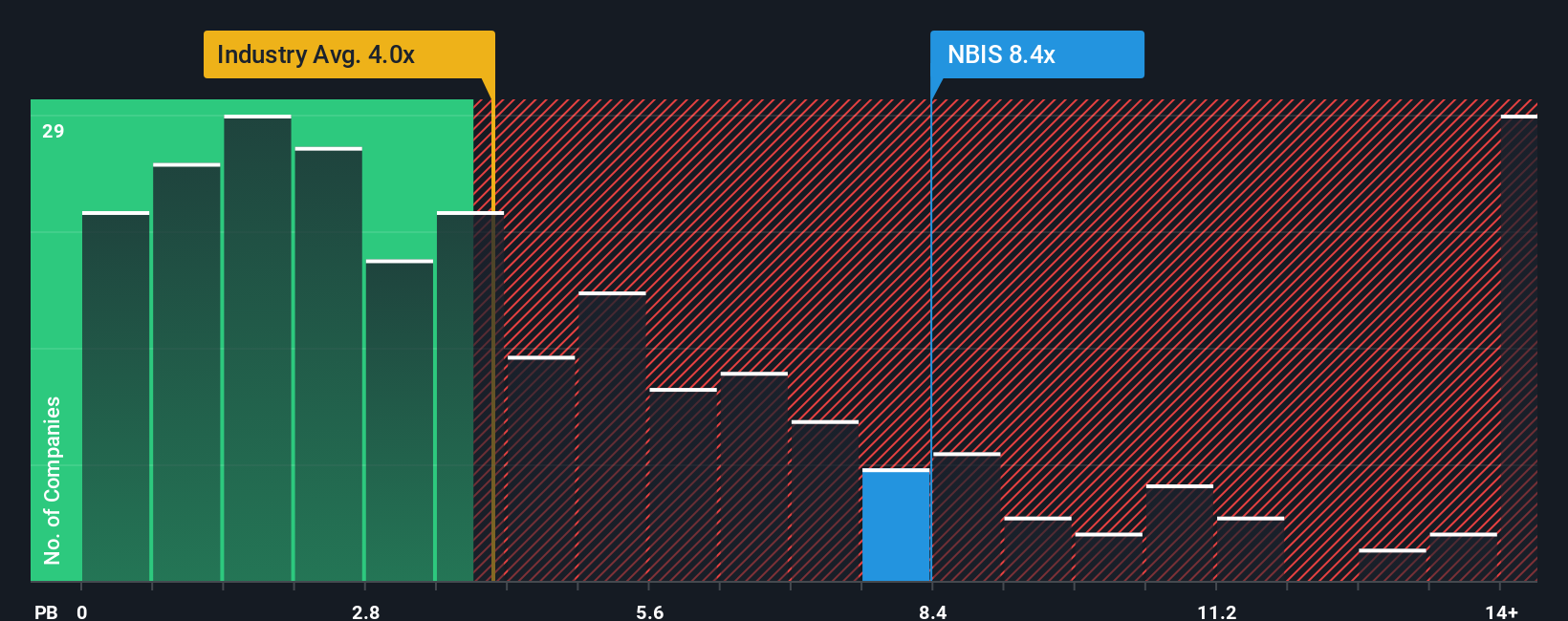

Another View: Market Multiple Shows a Premium

Looking at Nebius Group's valuation through a different lens, the Price-to-Book Ratio stands at 8.7x, which is more than double the US Software industry average of 4x. While this does suggest investor enthusiasm for future growth, it also highlights a risk. If market sentiment cools or industry peers catch up, the premium could shrink quickly. Is there still a margin of safety at this level?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nebius Group Narrative

Don’t see your perspective reflected, or want to dig into the numbers first-hand? It’s quick and easy to craft your own take in just a few minutes. Do it your way

A great starting point for your Nebius Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your strategy to one stock when fresh opportunities are everywhere? Don’t let the next winning trend pass you by. Expand your watchlist and get ahead of the crowd with these hand-picked stock ideas:

- Boost your portfolio with steady income by reviewing these 22 dividend stocks with yields > 3% delivering attractive yields above 3%.

- Jump on the front lines of innovation by scouting these 28 quantum computing stocks powering breakthroughs in computing and tomorrow’s technology landscape.

- Take advantage of market discounts by targeting these 840 undervalued stocks based on cash flows that are trading below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nebius Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIS

Nebius Group

A technology company, engages in building full-stack infrastructure to service the global AI industry in the Netherlands, Europe, North America, and Israel.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives