- United States

- /

- Software

- /

- NasdaqGS:MTLS

As Materialise (NASDAQ:MTLS) hikes 11% this past week, investors may now be noticing the company's one-year earnings growth

Over the last month the Materialise NV (NASDAQ:MTLS) has been much stronger than before, rebounding by 30%. But that is minimal compensation for the share price under-performance over the last year. In fact the stock is down 45% in the last year, well below the market return.

While the stock has risen 11% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Materialise

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Even though the Materialise share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

It's surprising to see the share price fall so much, despite the improved EPS. So it's well worth checking out some other metrics, too.

Materialise's revenue is actually up 17% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

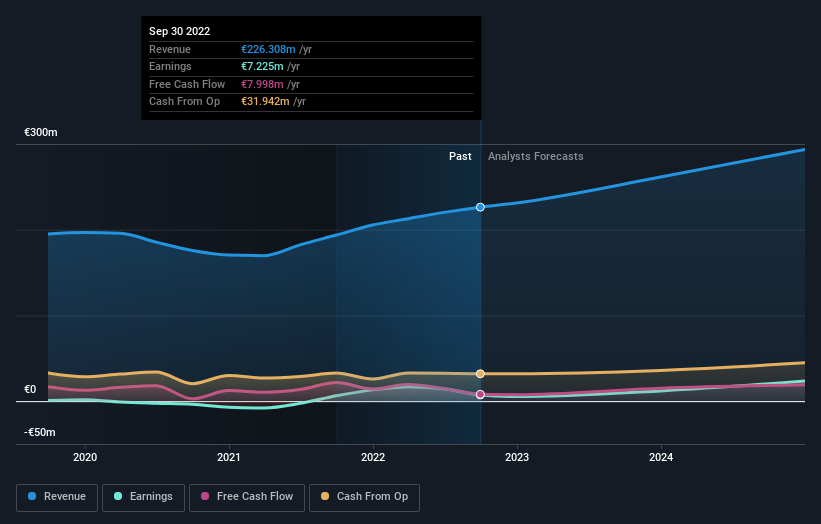

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Materialise has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Materialise's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 8.1% in the twelve months, Materialise shareholders did even worse, losing 45%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.9% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before deciding if you like the current share price, check how Materialise scores on these 3 valuation metrics.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MTLS

Materialise

Provides additive manufacturing and medical software tools, and 3D printing services in the Americas, Europe, Africa, and the Asia-Pacific.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives