- United States

- /

- Software

- /

- NasdaqGS:MSTR

MicroStrategy (MSTR) Profitability Return Reinforces Bullish Narratives Despite Dilution and Earnings Quality Concerns

Reviewed by Simply Wall St

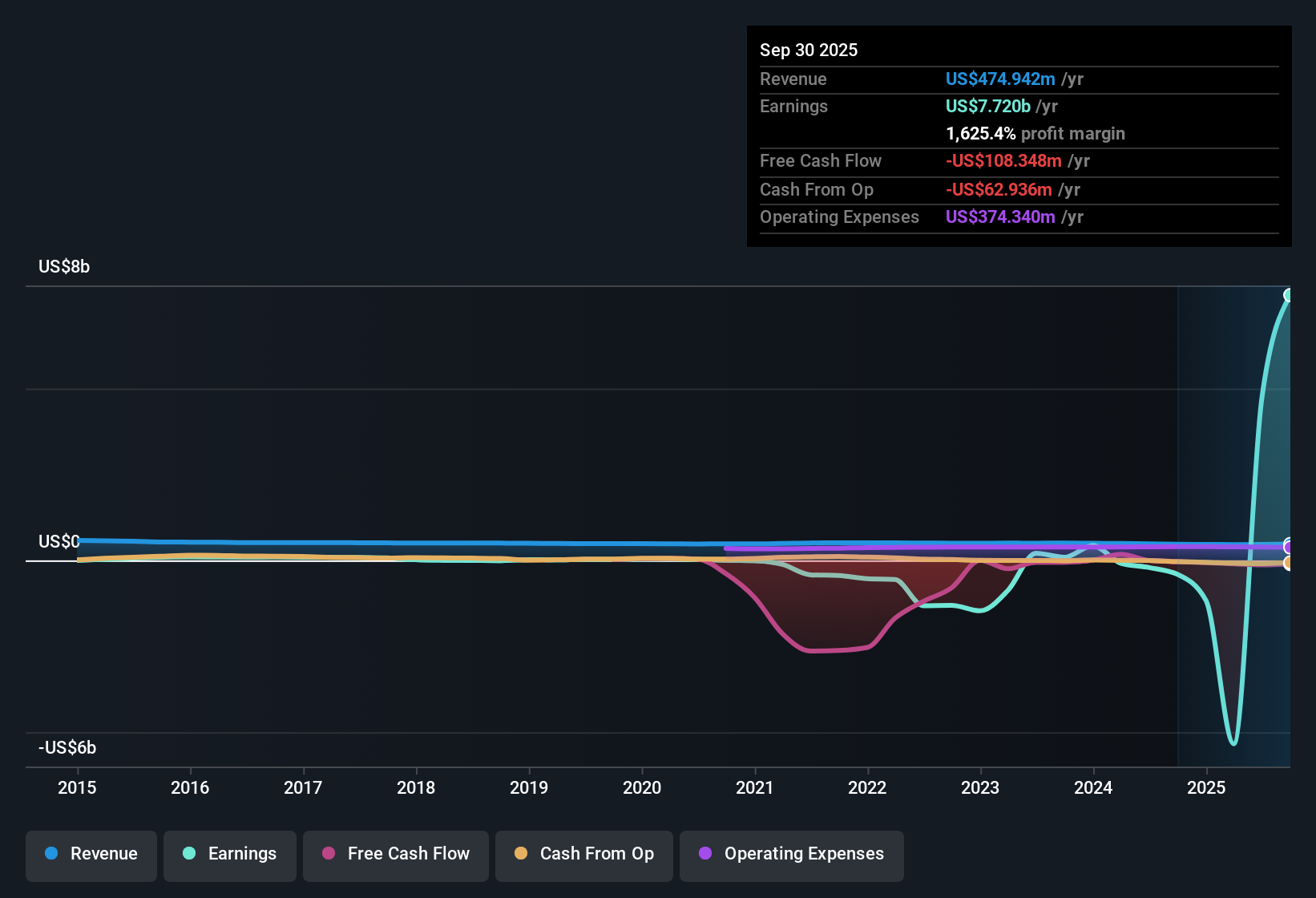

MicroStrategy (MSTR) made a notable return to profitability this year, seeing a sharp turnaround compared to prior periods. Earnings have increased at an impressive 34.3% annual rate over the last five years, and forecasts project earnings growth of 19.2% per year going forward, outpacing the broader US market’s expected 15.9% annual rate. While revenue is expected to grow by just 0.8% per year, considerably slower than the US average, the company finds itself trading at a Price-To-Earnings ratio of 10x, well below industry and peer averages. Despite a strong profit trajectory, investors remain watchful due to high levels of non-cash earnings and recent share dilution.

See our full analysis for Strategy.Next, we’ll see how these headline results measure up to the major narratives shaping investor sentiment and the long-term outlook. Some expectations could be confirmed, while a few established views may have to be revisited.

See what the community is saying about Strategy

Profit Growth Dominates at 34.3% Pace

- Earnings have compounded at a rapid 34.3% annual growth rate over the past five years, signaling sustained business momentum that stands out among US software firms.

- Where many competitors have struggled for consistent bottom-line gains, what’s surprising is how this sustained earnings climb heavily supports optimism among investors by defying conventional expectations for such modest top-line expansion.

- Despite revenue’s muted 0.8% forecasted growth, this profit acceleration points to high operating leverage or disciplined expense management.

- With industry peers showing much higher Price-To-Earnings ratios but less compelling growth records, the multiyear profit trend gives bulls firm ground for their case.

- Investors are watching to see if this rare blend of slow revenue yet rapid earnings gains can persist as market conditions evolve.

Non-Cash Earnings and Dilution in Focus

- High levels of non-cash earnings suggest that a sizable portion of reported profits may not convert directly into cash, prompting extra scrutiny among investors tracking earnings quality.

- Critics highlight that, on top of non-cash profit components, recent share dilution has weighed on per-share metrics, challenging the case for unqualified optimism.

- This means each share owns a slightly smaller percentage of the company than a year ago, which can mute the upside for ongoing shareholders.

- While persistent profit growth is clear, these risks caution against relying solely on headline profit acceleration as a long-term forecast indicator.

P/E Ratio Discounts Relative to Industry Giants

- MicroStrategy trades at a Price-To-Earnings ratio of 10x, dramatically below both the US software industry average of 34.7x and the peer average of 82.6x. This highlights substantial relative undervaluation according to standard metrics.

- Prevailing investor analysis pins much of this discount on lingering concerns over revenue growth and earnings composition, creating a tension between discounted valuation and the durability of future earnings streams.

- This valuation is a double-edged sword: it can attract value-focused buyers, but it also signals the market sees risks not reflected in the bottom line.

- Investors must weigh whether the discount represents overlooked upside or a justified caution signal, especially considering quality of profits and dilution risk.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Strategy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you have a unique take on the figures presented? Share your perspective and build your own narrative in just minutes. Do it your way

A great starting point for your Strategy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite impressive profit growth, MicroStrategy faces hesitation from investors because of slow revenue expansion, high non-cash earnings, and recent share dilution.

If consistency is your priority, check out stable growth stocks screener (2103 results) to focus on companies delivering dependable revenue and earnings growth, rather than just volatile bottom-line gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSTR

Strategy

Operates as a bitcoin treasury company in the United States, Europe, the Middle East, Africa, and internationally.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives