- United States

- /

- Software

- /

- NasdaqGS:MSFT

Microsoft (NasdaqGS:MSFT) Expands AI and Cloud Innovations with Strategic Alliances in Healthcare

Reviewed by Simply Wall St

Microsoft (NasdaqGS:MSFT) is experiencing a period of growth driven by its strategic focus on cloud services and AI innovation, as evidenced by a 23% increase in Microsoft Cloud revenue. However, challenges such as the mixed impact of the Activision acquisition and competitive pressures in the AI sector highlight the complexities the company faces. In the discussion that follows, we will examine Microsoft's financial performance, strategic initiatives, market opportunities, and the competitive risks that could influence its future trajectory.

Navigate through the intricacies of Microsoft with our comprehensive report here.

Innovative Factors Supporting Microsoft

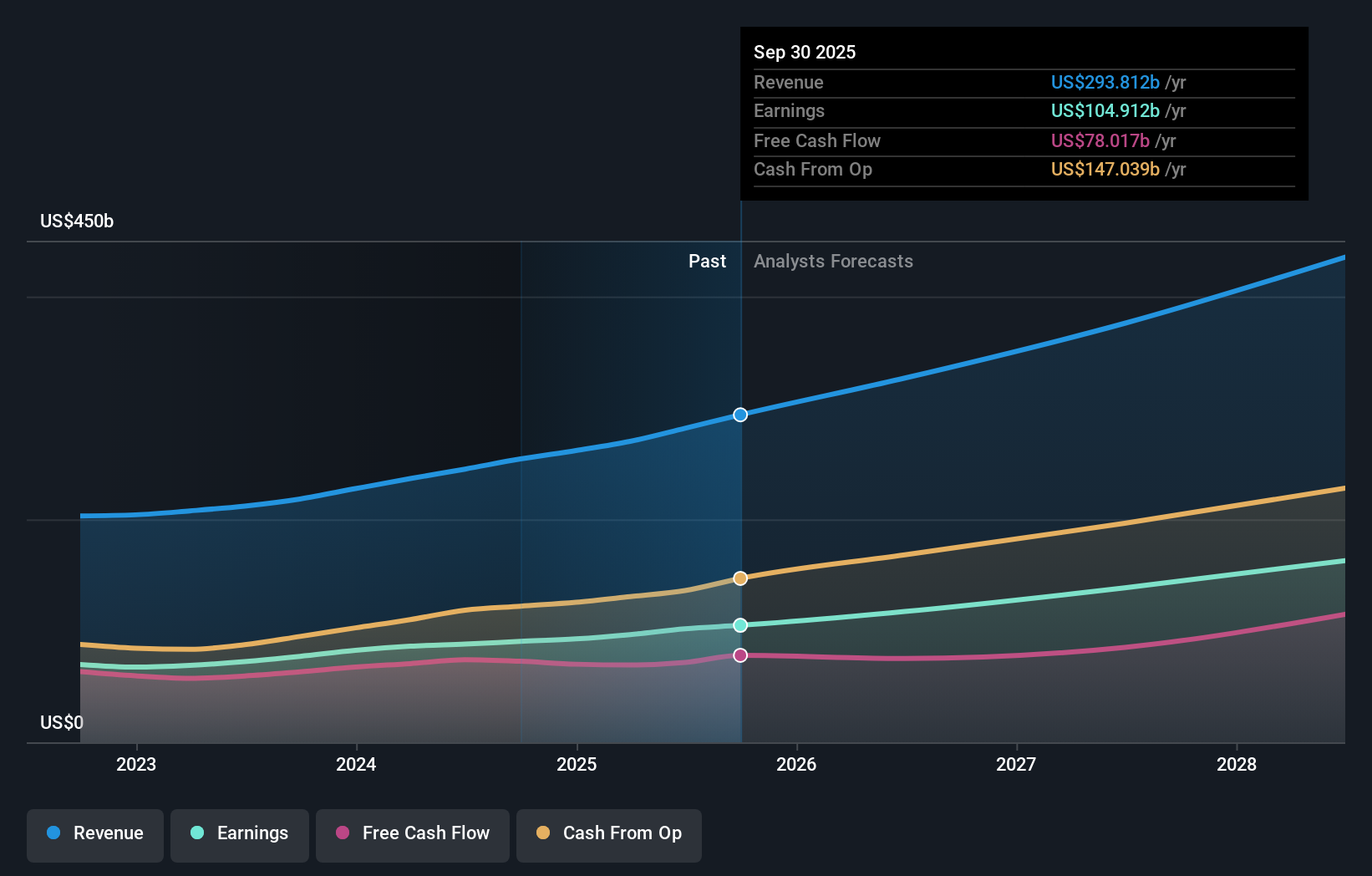

Microsoft's financial health is exemplified by its impressive revenue growth of 15% year-over-year, reaching over $245 billion, as highlighted by Satya Nadella. The company's strategic focus on cloud services has resulted in Microsoft Cloud revenue surpassing $135 billion, marking a 23% increase. These figures underscore the company's strong market position and its ability to leverage innovation, particularly in AI, to drive growth. Microsoft's seasoned management team, with an average tenure of 6.7 years, plays a crucial role in steering the company towards its strategic goals. Additionally, Microsoft's dividend payments have been stable and reliable over the past decade, with a recent 10% increase, reflecting its commitment to returning value to shareholders. Despite its high Price-To-Earnings Ratio of 35.3x compared to the peer average of 32.8x, Microsoft is trading below its estimated fair value, suggesting potential undervaluation.

Strategic Gaps That Could Affect Microsoft

The acquisition of Activision has had a mixed impact, contributing to revenue growth but also dragging down operating income by 2 points, as noted by Amy Hood. This highlights the challenges Microsoft faces in integrating large acquisitions. Furthermore, a 9% decline in Office Commercial licensing indicates a shift towards cloud offerings, which, while strategic, affects traditional revenue streams. The moderation in growth of Office 365 Commercial seats, growing only 7% year-over-year, suggests a need for revitalizing certain segments. Microsoft's Price-To-Earnings Ratio, while favorable compared to the US Software industry average of 40.4x, remains a point of concern when compared to peers, indicating potential overvaluation in certain contexts.

Emerging Markets Or Trends for Microsoft

Microsoft is well-positioned to capitalize on emerging opportunities in AI and cloud expansion, with plans to increase infrastructure investments in FY '25. The launch of Copilot+ PCs and the focus on gaming reflect Microsoft's strategy to diversify and strengthen its product offerings. The company's strategic alliances, such as the collaboration with Infosys to accelerate AI adoption, further enhance its market position. Microsoft's initiatives in healthcare AI models and data solutions through Microsoft Fabric demonstrate its commitment to leveraging AI to address industry-specific challenges, creating new growth avenues.

Competitive Pressures and Market Risks Facing Microsoft

While Microsoft continues to innovate, it faces significant competitive pressures, particularly in the AI space. The constraints on AI capacity, as mentioned by Amy Hood, pose a risk to scaling AI-driven solutions. Additionally, economic softness in Europe could impact revenue growth, especially in non-AI consumption segments. The competitive environment is further intensified by rivals like Apple, which is reportedly in talks to invest in OpenAI, a key player in the AI race. These external factors, combined with internal challenges, require Microsoft to navigate carefully to maintain its market leadership.

To gain deeper insights into Microsoft's historical performance, explore our detailed analysis of past performance. To dive deeper into how Microsoft's valuation metrics are shaping its market position, check out our detailed analysis of Microsoft's Valuation.Conclusion

Microsoft's impressive revenue growth and strategic focus on cloud services highlight its strong market position and potential for continued expansion, particularly in AI. However, challenges such as the integration of large acquisitions and shifts in traditional revenue streams require careful management to sustain growth. The company's strategic initiatives in AI and cloud expansion, coupled with its alliances, position it well to capitalize on emerging opportunities despite competitive pressures. While Microsoft's Price-To-Earnings Ratio suggests it is expensive relative to its peers, its trading below estimated fair value indicates potential for future appreciation, suggesting a positive outlook for investors who are confident in its strategic direction and market adaptability.

Taking Advantage

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices and solutions worldwide.

Flawless balance sheet with solid track record and pays a dividend.