- United States

- /

- Software

- /

- NasdaqGS:MSFT

Microsoft (MSFT): Annual Earnings Up 12.9%, Profit Growth Outpaces Market Narratives

Reviewed by Simply Wall St

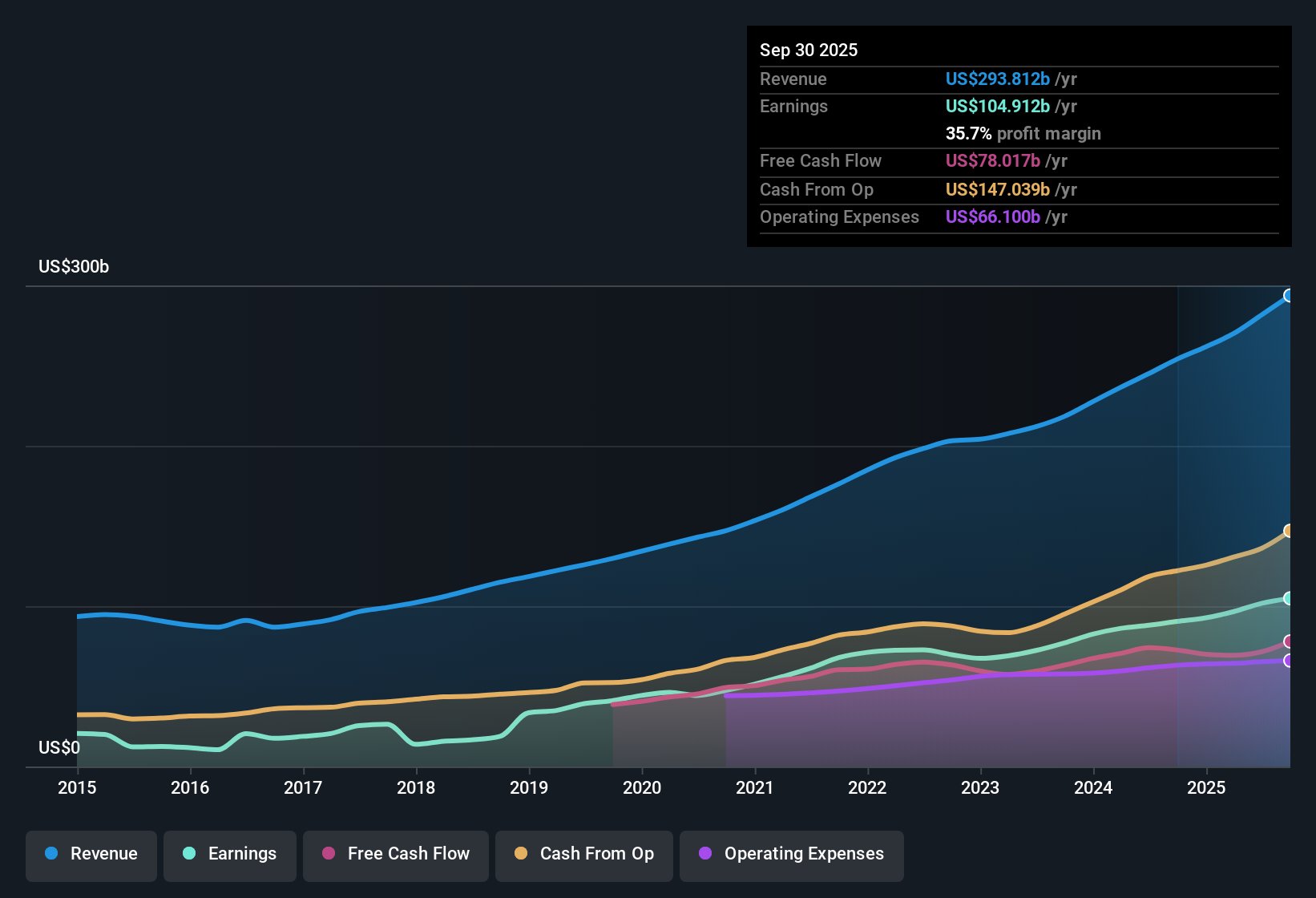

Microsoft (MSFT) booked annual earnings growth of 12.9% over the last five years, with profits jumping 15.9% year over year and net profit margin reaching 35.7%, just above last year’s 35.6%. Revenue is on track to climb 12.3% per year, ahead of the US market’s 10.3% forecast, while EPS is set to rise at 14.22% annually, slightly behind the broader market’s expected pace of 15.9%. Investors will note the company’s strong and consistent profit margins, but must also weigh its above-industry price-to-earnings ratio and current share price premium when considering what is next for Microsoft.

See our full analysis for Microsoft.Next, we will see how these headline results compare to the broader Microsoft narrative and whether the story is supported by the numbers or turns out to be more hype than substance.

See what the community is saying about Microsoft

Cloud and AI Drive Massive Backlog

- Microsoft’s backlog for future contracted revenue stands at $368 billion, highlighting the heavy commitments coming from the rapid buildout of its cloud and AI offerings.

- Analysts' consensus view emphasizes that ongoing expansion of Azure, with significant enterprise migrations and integration of AI capabilities across Microsoft’s product stack, is expected to lock in high-margin, recurring revenue streams and underpin durable earnings growth.

- This growth is supported by the integration of AI across Azure, Copilot, and Dynamics 365, fueling usage intensity and average revenue per user.

- Strong cloud commitments on the books position Microsoft to sustain double-digit top-line advances as digital transformation efforts accelerate globally.

Margin Strength Under Heavy Investment

- Net profit margin has risen to 35.7%, even as Microsoft continues to invest heavily in infrastructure for AI and cloud, suggesting margin resilience despite high capital expenditures.

- Analysts' consensus view notes that management’s focus on software-driven efficiency and innovations, such as platform optimizations delivering 90% more tokens per GPU year over year, is enabling sustained margin stability and offsetting the impact of growing costs.

- Flat or expanding operating margins are expected, with analysts projecting profit margins will move up to 37.3% over the next three years despite elevated CapEx commitments.

- Strong demand for integrated cybersecurity solutions is also bolstering high-margin revenue streams, supporting both gross and net margin performance.

Premium Valuation Versus Industry and Fair Value

- Microsoft’s price-to-earnings ratio stands at 37.3x, lower than the peer average of 38.9x but notably higher than the US software industry average of 34.1x. Compared to its DCF fair value of $391.88, the current share price of $525.76 marks a 34% premium.

- Analysts' consensus view suggests this premium reflects confidence in Microsoft’s future growth and margin durability, but creates a high bar for future returns if execution or market momentum wobbles.

- The current share price of $525.76 is still below the single allowed analyst price target of $623.01, leaving some implied upside versus consensus forecasts.

- However, to justify today’s market pricing, investors must believe in recurring revenue growth, persistent margin strength, and successful scaling of major AI and cloud initiatives against industry competition.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Microsoft on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the numbers? Share your perspective and craft your own story in just a few minutes. Do it your way

A great starting point for your Microsoft research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite Microsoft’s impressive momentum, its current share price trades at a significant premium to fair value and industry peers. This demands ongoing flawless execution to justify future returns.

Concerned about paying too much? Use these 848 undervalued stocks based on cash flows to pinpoint stocks that market has overlooked, delivering stronger value without the same valuation risks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives