- United States

- /

- Software

- /

- NasdaqGS:MSFT

Is Microsoft (MSFT) Overvalued After Its Recent Steady Share Price Climb?

Microsoft (MSFT) has quietly drifted higher recently, with the stock up about 3% over the past month and roughly 17% year to date, even as gains cooled in the past 3 months.

See our latest analysis for Microsoft.

That steady climb comes after a brief cooling period, with the current share price at $488.02 and a solid year to date share price return suggesting momentum is consolidating rather than collapsing, backed by very strong multi year total shareholder returns.

If Microsoft has you thinking about where the next wave of tech leaders might come from, it could be worth exploring other high growth tech and AI stocks today.

With Microsoft still growing revenue and profits at double digit rates and trading at a discount to Wall Street targets, investors face a familiar dilemma: is this a fresh buying opportunity, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 16.2% Overvalued

Compared to Microsoft’s last close near $488, the most followed narrative pegs fair value lower at around $420, implying the current AI optimism might be running ahead of fundamentals.

The central thesis is alarming: Microsoft is building a future where its costs are skyrocketing, its products are losing their competitive edge, and its own technology is actively shrinking its addressable market.

The ship is massive, and momentum will carry it forward for years. However, if Microsoft continues to sell an inferior, job-destroying AI while forcing users to endure a degrading Windows experience, it will eventually find that its enterprise fortress is built on sand.

According to PicaCoder, this valuation leans heavily on a specific blend of slowing growth, rich profit margins, and a future earnings multiple that looks stretched against those assumptions. Want to see exactly how those moving parts combine to justify a lower fair value than today’s price?

Result: Fair Value of $420 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this thesis could unwind if Copilot adoption meaningfully boosts high margin software revenue, or if AI infrastructure spending converts quickly into durable cloud profits.

Find out about the key risks to this Microsoft narrative.

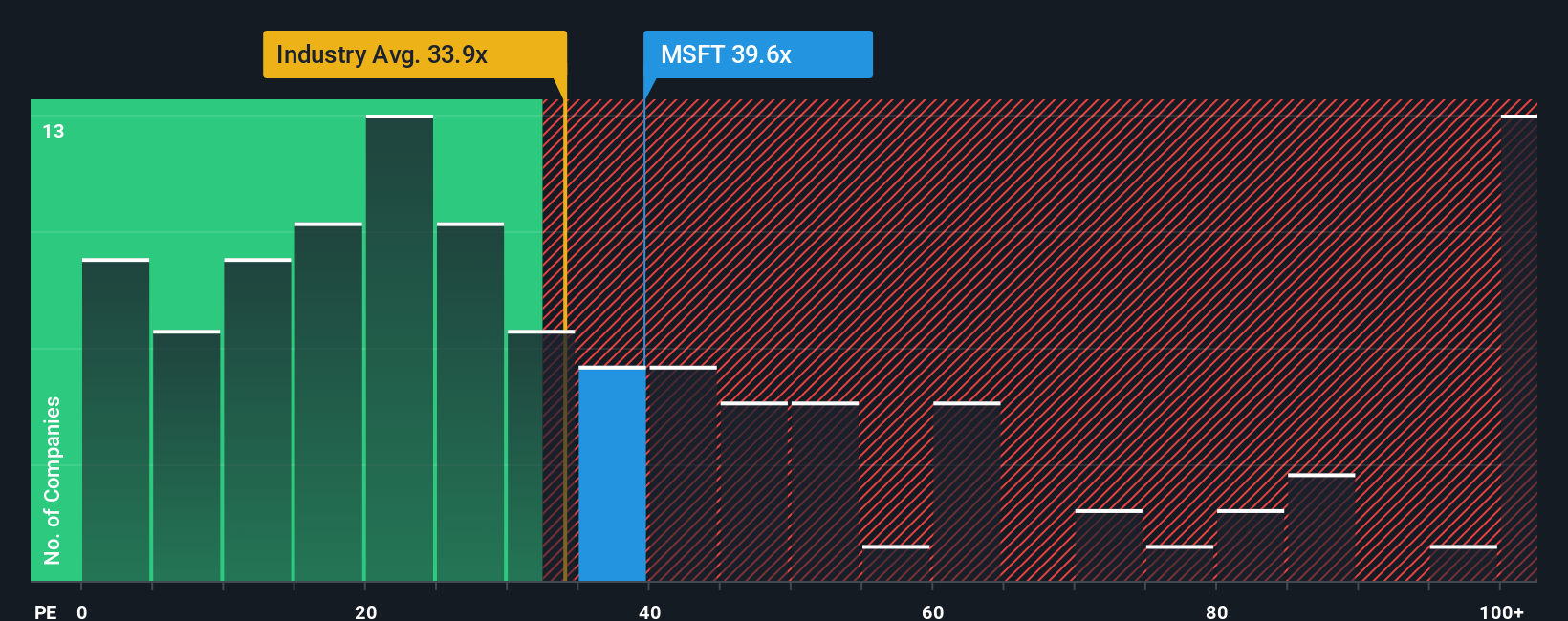

Another View: Market Ratios Tell a Different Story

While PicaCoder sees Microsoft as 16.2% overvalued, our valuation checks paint a more mixed picture. The stock trades on a 34.6x price to earnings ratio, richer than the US Software industry at 31.9x and peer average of 33x, yet still below a fair ratio of 52.7x that the market could drift toward.

This leaves investors weighing a premium tag today against the risk that sentiment cools before earnings catch up, or the chance that profits grow into the higher multiple. Which side of that trade do you want to be on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Microsoft Narrative

If you are skeptical of any of these views or prefer your own data driven approach, you can quickly build a personalized take in minutes using Do it your way.

A great starting point for your Microsoft research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, put your research to work by scanning fresh opportunities on Simply Wall Street’s Screener, so potential winners do not slip past you.

- Capture potential mispricings by targeting companies that look overlooked on cash flow metrics through these 905 undervalued stocks based on cash flows before the market catches up.

- Capitalize on the AI revolution by focusing on next generation innovators powered by these 24 AI penny stocks that could shape tomorrow’s winners.

- Boost your income potential by zeroing in on reliable payers using these 10 dividend stocks with yields > 3% and strengthen the foundation of your long term portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Okamoto Machine Tool Works focus on profitability

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Inotiv NAMs Test Center

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.