- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:LILA

August 2025's Top Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market hovers near record highs, investors are closely watching Federal Reserve signals and retail earnings to gauge economic momentum amid moderated expectations for interest rate cuts. In such an environment, growth companies with strong insider ownership can offer a compelling opportunity, as they often align management interests with shareholder value and demonstrate confidence in long-term prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.5% | 93.2% |

| Prairie Operating (PROP) | 30.4% | 91.3% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| Hippo Holdings (HIPO) | 12.7% | 41.2% |

| Hesai Group (HSAI) | 21.3% | 42.2% |

| FTC Solar (FTCI) | 23.2% | 63.1% |

| Credo Technology Group Holding (CRDO) | 11.5% | 36.4% |

| Cloudflare (NET) | 10.6% | 45.8% |

| Atour Lifestyle Holdings (ATAT) | 21.9% | 23.5% |

| Astera Labs (ALAB) | 12.3% | 37.2% |

We'll examine a selection from our screener results.

Liberty Latin America (LILA)

Simply Wall St Growth Rating: ★★★★☆☆

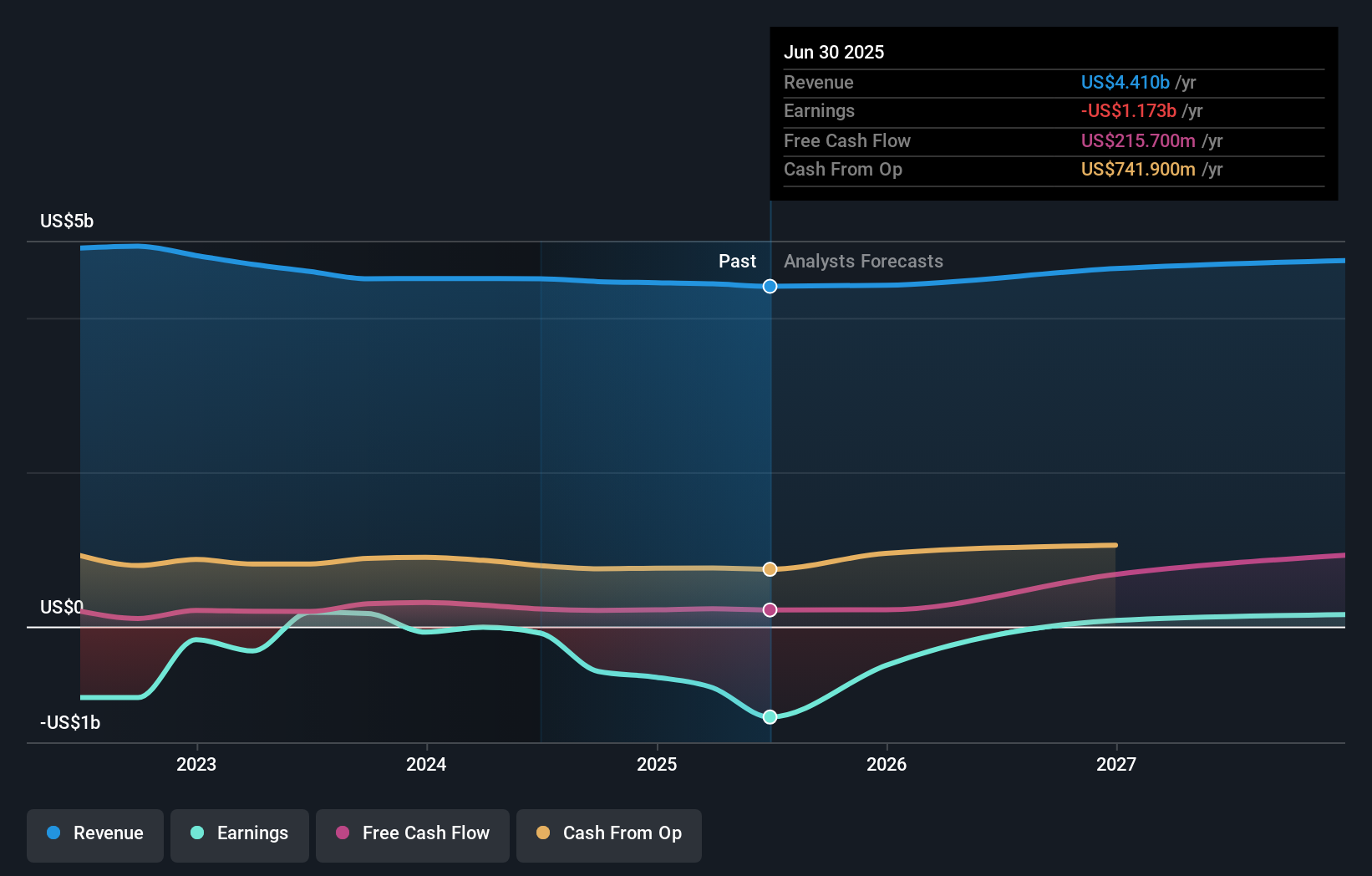

Overview: Liberty Latin America Ltd. offers fixed, mobile, and subsea telecommunications services across various regions including Puerto Rico, Panama, and the Caribbean, with a market cap of approximately $1.59 billion.

Operations: The company's revenue segments include C&W Panama with $751.10 million, Liberty Networks at $444.90 million, Liberty Caribbean generating $1.46 billion, Liberty Costa Rica contributing $623.10 million, and Liberty Puerto Rico with revenues of $1.22 billion.

Insider Ownership: 11.1%

Liberty Latin America is trading significantly below its estimated fair value, suggesting potential undervaluation. Although revenue growth is projected at 3.2% annually, slower than the US market average of 9.3%, earnings are expected to grow substantially by over 100% per year, indicating a positive profit trajectory within three years. Recent expansions in Mexico and Peru align with their $250 million investment strategy to bolster regional connectivity, despite recent financial losses and index exclusions.

- Take a closer look at Liberty Latin America's potential here in our earnings growth report.

- Our valuation report here indicates Liberty Latin America may be undervalued.

monday.com (MNDY)

Simply Wall St Growth Rating: ★★★★☆☆

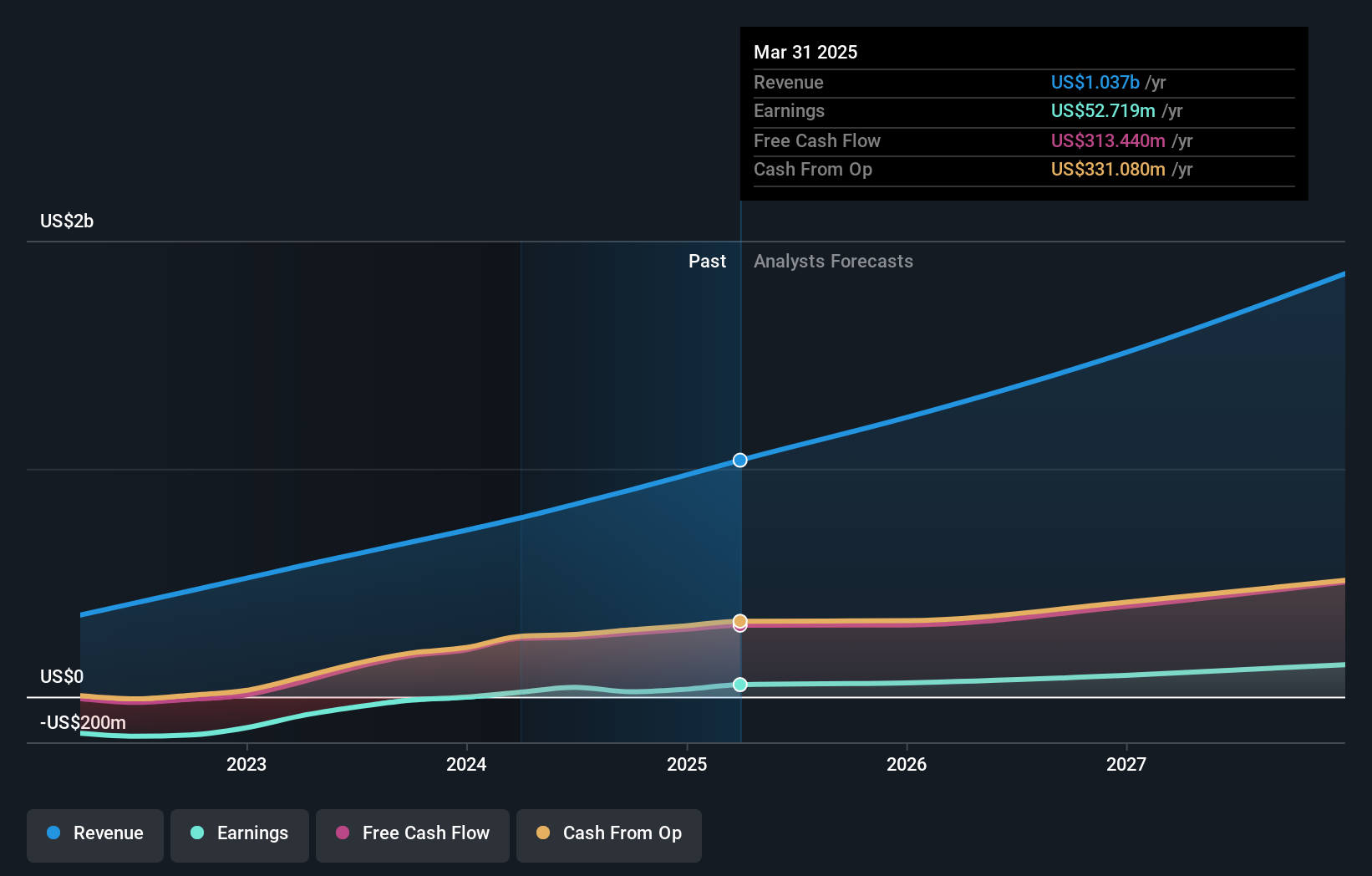

Overview: monday.com Ltd., along with its subsidiaries, develops software applications across various regions including the United States, Europe, the Middle East, Africa, and the United Kingdom, with a market cap of $9.06 billion.

Operations: The company's revenue segment is primarily from Internet Software & Services, totaling $1.10 billion.

Insider Ownership: 13.7%

monday.com, with substantial insider ownership, is positioned for growth despite a recent dip in net income to US$1.57 million from US$14.32 million year-over-year. Revenue rose to US$299.01 million in Q2 2025, and forecasts suggest continued robust growth with annual revenue expected to reach over $1 billion. Recent AI advancements and strategic integrations like Proggio enhance its platform's appeal, while new leadership aims to drive marketing innovation amidst forecasted earnings growth of 35% annually.

- Click here and access our complete growth analysis report to understand the dynamics of monday.com.

- Insights from our recent valuation report point to the potential undervaluation of monday.com shares in the market.

Hinge Health (HNGE)

Simply Wall St Growth Rating: ★★★★☆☆

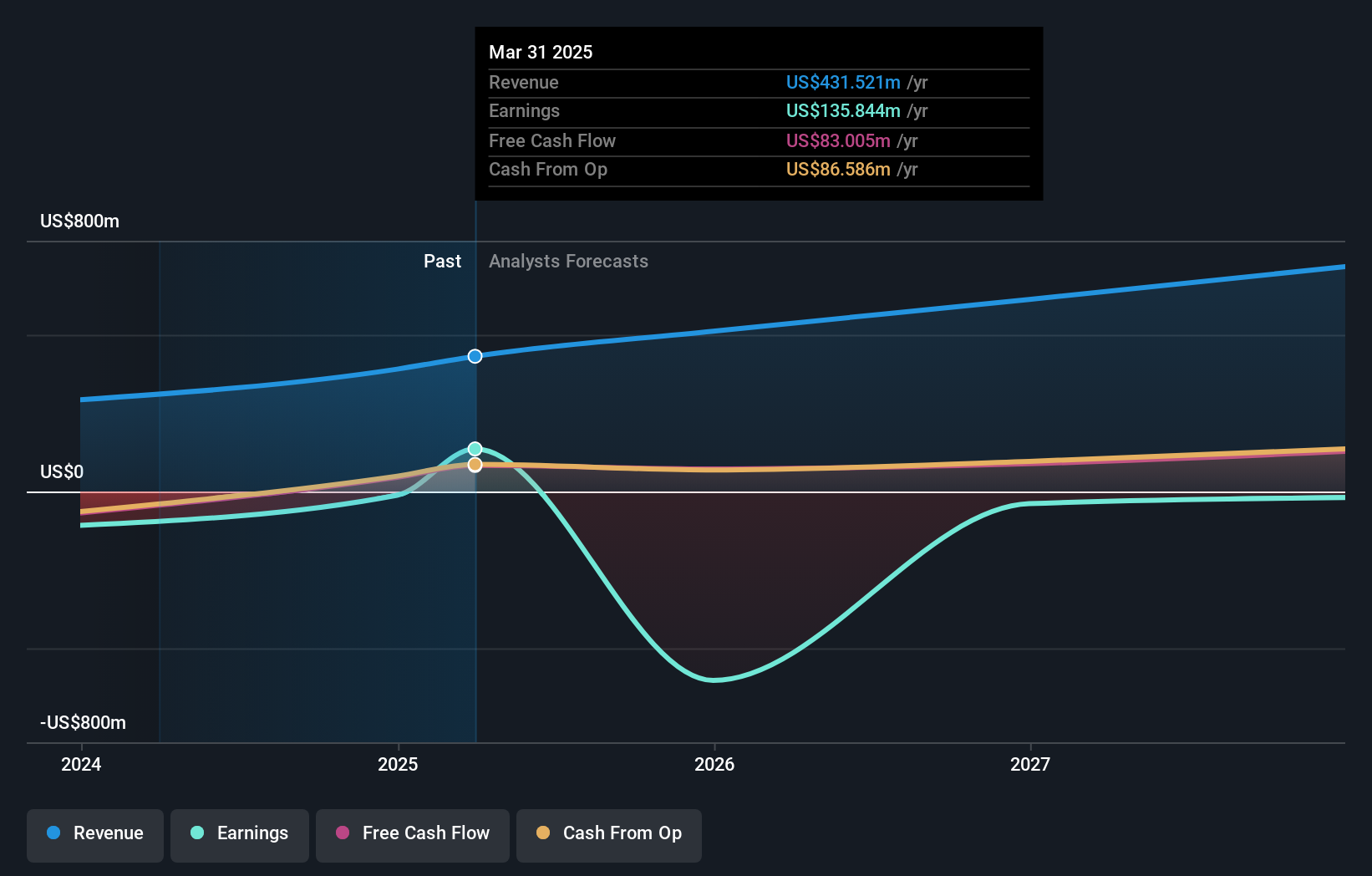

Overview: Hinge Health, Inc. develops healthcare software focused on joint and muscle health, with a market cap of $4.63 billion.

Operations: The company's revenue is derived entirely from its healthcare software segment, amounting to $480.79 million.

Insider Ownership: 17.3%

Hinge Health, with significant insider ownership, is on a growth trajectory despite recent share price volatility. The company reported a 40.9% revenue increase in the past year and forecasts indicate profitability within three years. Recent initiatives like HingeSelect aim to reduce healthcare costs and improve access to musculoskeletal care, potentially enhancing market position. Following its IPO raising $437 million, the company projects substantial revenue growth for 2025, aligning with its innovative digital health solutions strategy.

- Delve into the full analysis future growth report here for a deeper understanding of Hinge Health.

- In light of our recent valuation report, it seems possible that Hinge Health is trading beyond its estimated value.

Seize The Opportunity

- Click here to access our complete index of 192 Fast Growing US Companies With High Insider Ownership.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LILA

Liberty Latin America

Provides fixed, mobile, and subsea telecommunications services in Puerto Rico, Panama, Costa Rica, Jamaica, Latin America and the Caribbean, the Bahamas, Trinidad and Tobago, Barbados, Curacao, Chile, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives