- United States

- /

- Software

- /

- NasdaqGS:MGIC

The Bull Case For Magic Software Enterprises (MGIC) Could Change Following Dividend Hike and Raised Revenue Guidance

Reviewed by Sasha Jovanovic

- On November 18, 2025, Magic Software Enterprises' board declared a quarterly cash dividend of US$0.151 per share and raised full-year 2025 revenue guidance to US$610 million–US$620 million, reflecting improved operational momentum and a positive near-term outlook.

- The company also reported strong third quarter earnings, including US$161.66 million in sales and year-over-year growth in both net income and earnings per share, signaling ongoing business strength.

- We'll explore how the raised revenue guidance may reshape expectations for Magic Software Enterprises' long-term growth prospects.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Magic Software Enterprises Investment Narrative Recap

To be a shareholder in Magic Software Enterprises, you need confidence in the company’s ability to capture long-term growth from surging demand for digital transformation and AI-driven solutions. The recent upward revision to 2025 revenue guidance and solid Q3 results give additional weight to short-term optimism, while the greatest risk remains execution on ambitious technology projects amid rising competition. For now, the news strengthens the near-term catalyst without significantly altering the core risk profile.

Among the latest announcements, the board’s decision to declare a quarterly dividend of US$0.151 per share, distributing approximately 75% of profits, stands out. This payout underscores management’s steady approach to capital returns even as the company invests to sustain growth, reaffirming attention to shareholder value while navigating both opportunities and challenges.

However, despite these positive signals, investors should also be mindful that competition in AI and digital transformation is intensifying, and without sustained execution on growth projects...

Read the full narrative on Magic Software Enterprises (it's free!)

Magic Software Enterprises' outlook anticipates $708.7 million in revenue and $64.8 million in earnings by 2028. This scenario assumes annual revenue growth of 6.6% and a $26.4 million increase in earnings from the current $38.4 million level.

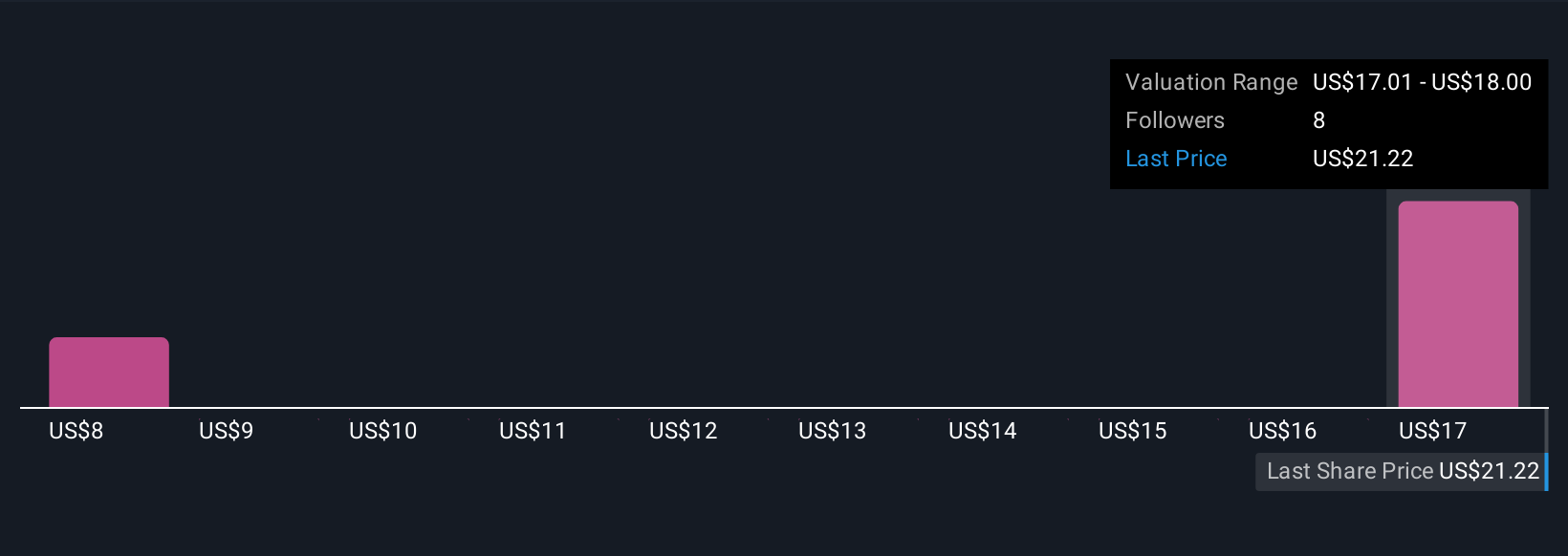

Uncover how Magic Software Enterprises' forecasts yield a $18.00 fair value, a 21% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see fair value for Magic Software Enterprises ranging from US$12.34 to US$18.00, based on two individual estimates. With management raising revenue forecasts after strong quarterly growth, differing expectations remind you to review multiple opinions before forming your view.

Explore 2 other fair value estimates on Magic Software Enterprises - why the stock might be worth as much as $18.00!

Build Your Own Magic Software Enterprises Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Magic Software Enterprises research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Magic Software Enterprises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Magic Software Enterprises' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGIC

Magic Software Enterprises

Provides proprietary application development, vertical software solutions, business process integration, information technologies (IT) outsourcing software services, and cloud-based services worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success