- United States

- /

- Software

- /

- NasdaqGS:MGIC

Magic Software Enterprises (NASDAQ:MGIC) Is Increasing Its Dividend To US$0.22

Magic Software Enterprises Ltd. (NASDAQ:MGIC) will increase its dividend on the 7th of April to US$0.22. This makes the dividend yield 2.5%, which is above the industry average.

View our latest analysis for Magic Software Enterprises

Magic Software Enterprises' Payment Has Solid Earnings Coverage

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Before this announcement, Magic Software Enterprises was paying out 74% of earnings, but a comparatively small 64% of free cash flows. In general, cash flows are more important than earnings, so we are comfortable that the dividend will be sustainable going forward, especially with so much cash left over for reinvestment.

Over the next year, EPS is forecast to expand by 42.2%. If the dividend continues along recent trends, we estimate the payout ratio will be 60%, which is in the range that makes us comfortable with the sustainability of the dividend.

Magic Software Enterprises' Dividend Has Lacked Consistency

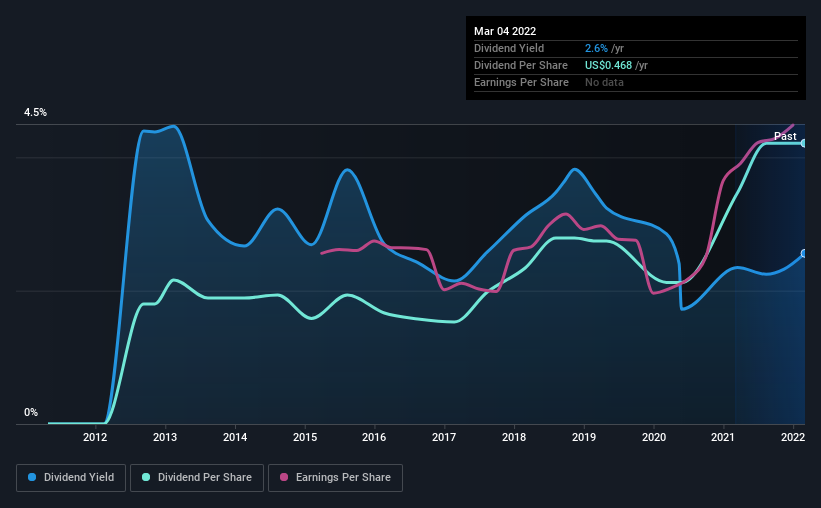

Looking back, Magic Software Enterprises' dividend hasn't been particularly consistent. This suggests that the dividend might not be the most reliable. Since 2013, the first annual payment was US$0.20, compared to the most recent full-year payment of US$0.47. This works out to be a compound annual growth rate (CAGR) of approximately 9.9% a year over that time. A reasonable rate of dividend growth is good to see, but we're wary that the dividend history is not as solid as we'd like, having been cut at least once.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. We are encouraged to see that Magic Software Enterprises has grown earnings per share at 17% per year over the past five years. EPS has been growing at a reasonable rate, although with most of the profits being paid out to shareholders, growth prospects could be more limited in the future.

Magic Software Enterprises Looks Like A Great Dividend Stock

Overall, a dividend increase is always good, and we think that Magic Software Enterprises is a strong income stock thanks to its track record and growing earnings. Distributions are quite easily covered by earnings, which are also being converted to cash flows. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 1 warning sign for Magic Software Enterprises that you should be aware of before investing. Is Magic Software Enterprises not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MGIC

Magic Software Enterprises

Provides proprietary application development, vertical software solutions, business process integration, information technologies (IT) outsourcing software services, and cloud-based services worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Take Two Interactive Software TTWO Valuation Analysis

Recursion Pharmaceuticals! WTH is going on?

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion