- United States

- /

- IT

- /

- NasdaqGM:MDB

Did MongoDB’s (MDB) New AI-Powered Modernization Platform Just Shift Its Investment Narrative?

- In September 2025, MongoDB introduced its AI-powered Application Modernization Platform (AMP), aiming to help enterprises quickly convert legacy systems into scalable, modern cloud services.

- This launch underscores MongoDB's increasing push into artificial intelligence-driven enterprise solutions, reflecting growing demand for digital transformation platforms that accelerate modernization in complex organizations.

- We’ll explore how MongoDB’s new AI-powered modernization platform could reshape its investment narrative by strengthening its position in the enterprise cloud transformation space.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

MongoDB Investment Narrative Recap

To be a MongoDB shareholder today, you need to believe in the company’s ability to lead ongoing enterprise cloud transformation, where rapid innovation and AI adoption are key. The launch of the AI-powered Application Modernization Platform (AMP) fits well with the overall narrative, but Atlas cloud migration and platform adoption remain the most important near-term growth drivers; the AMP does not materially shift the main risk, which is margin pressure from intensifying cloud-native database competition.

Among recent announcements, MongoDB’s August AI partner ecosystem expansion stands out. Improved embedding models and new partnerships broaden MongoDB’s AI toolkit, offering synergies with AMP’s modernization capabilities. Together, these innovations reinforce the platform’s stickiness and could support Atlas growth momentum if adoption expands among large enterprises.

On the flip side, investors should be aware of the risk that as Atlas revenues grow, increased competition from lower-cost, integrated cloud-native alternatives could...

Read the full narrative on MongoDB (it's free!)

MongoDB's outlook projects $3.5 billion in revenue and $5.0 million in earnings by 2028. This requires 16.8% annual revenue growth and a $83.6 million earnings increase from current earnings of $-78.6 million.

Uncover how MongoDB's forecasts yield a $350.80 fair value, a 9% upside to its current price.

Exploring Other Perspectives

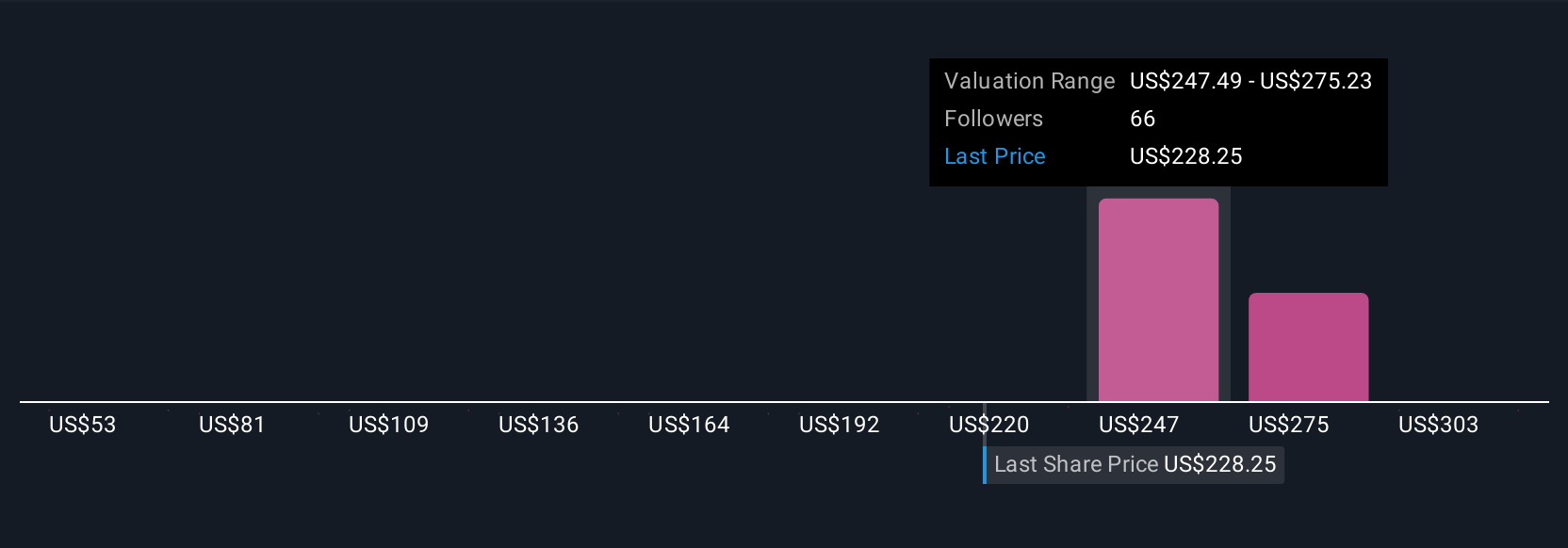

Simply Wall St Community contributors have published 11 fair value estimates for MongoDB, ranging from US$130.20 to US$394.78 per share. While community viewpoints are varied, keep in mind that intensifying competition from cloud-native alternatives remains a central consideration for future performance.

Explore 11 other fair value estimates on MongoDB - why the stock might be worth as much as 23% more than the current price!

Build Your Own MongoDB Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MongoDB research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MongoDB research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MongoDB's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MDB

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Czechoslovak Group - is it really so hot?

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion