- United States

- /

- Software

- /

- NasdaqCM:MARA

MARA Holdings (MARA) Margin Gains Challenge Bearish Narratives Despite Forecasted Earnings Decline

Reviewed by Simply Wall St

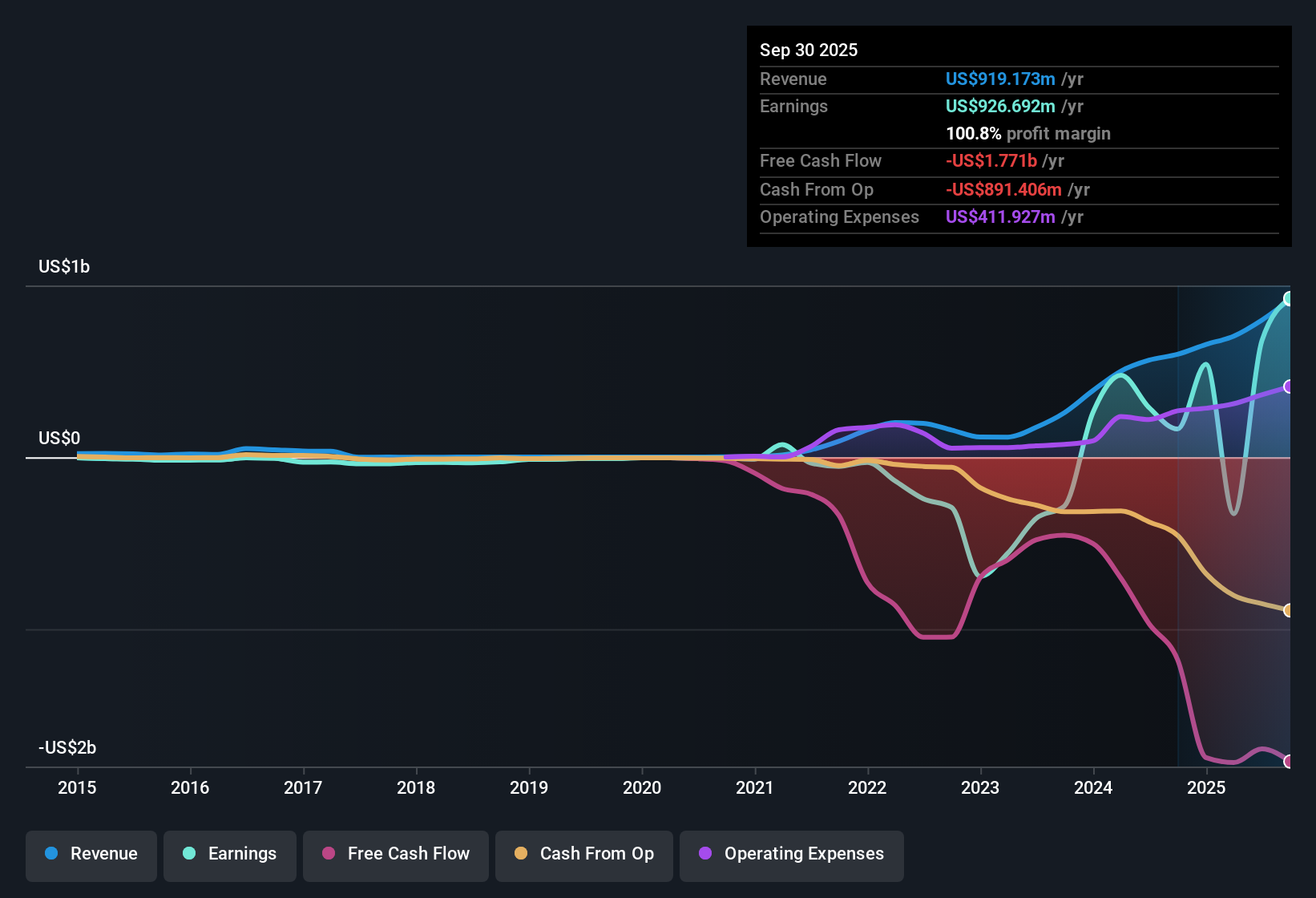

MARA Holdings (MARA) reported net profit margins of 27.5%, higher than last year, as earnings grew by 463.2% in the most recent year and have increased at a 39.9% annual rate over the past five years. The stock is currently trading at $17.13, sitting well below its estimated fair value of $23.32, with a price-to-earnings ratio of 6.6x that stands out against the software industry average. While revenue is forecast to grow 13.1% per year, outpacing the US market, investors are weighing this positive momentum against an expected annual earnings decrease of 132.7% over the next three years.

See our full analysis for MARA Holdings.Up next, we will see how the headline numbers compare to the market’s dominant narratives. Some assumptions may be validated, while others could get a fresh challenge.

See what the community is saying about MARA Holdings

Margins Poised for Sharp Compression

- Profit margins are forecast to fall steeply from the current 85.0% to just 2.8% by 2028, signaling a dramatic shift in the company’s cost environment.

- Analysts' consensus view highlights that, despite the sharp margin compression, MARA Holdings' move toward vertically integrated, energy-efficient operations is expected to lay groundwork for long-term margin recovery.

- This strategy is seen as a counterbalance to the pressure from expensive legacy contracts rolling off, cushioning some of the hit to future margins.

- However, consensus notes the company’s history of sector-leading cost management may be hard-pressed to fully offset margin erosion amid rising capital expenditures and a shift away from higher-margin bitcoin mining.

- Consensus narrative notes MARA Holdings’ impressive operational transformation stands to be tested in the next three years as margin declines weigh on net income resilience. This makes its execution on efficiency plans more critical than ever. 📊 Read the full MARA Holdings Consensus Narrative.

Capital Needs Set to Accelerate

- The number of shares outstanding is projected to grow by 7.0% per year over the next three years, directly reflecting the ongoing need for external funding as the company invests heavily in infrastructure.

- Bears argue that MARA’s shift to an asset-heavy, expansion-driven business model requires continuous high capital expenditures and could put consistent pressure on cash flow and limit flexibility.

- This risk is heightened if bitcoin prices stagnate or fall, as the core business remains highly reliant on mining economics to generate cash for growth.

- Bears also highlight that any misstep in project execution or regulatory setbacks could leave the company vulnerable to dilutive capital raises and margin squeezes, challenging its ability to balance growth and shareholder returns over time.

Valuation: Discount vs. Industry Remains Stark

- At a price-to-earnings ratio of 6.6x, MARA trades at a large discount compared to the US software industry average of 35.2x and peer group’s 57.9x, despite the worrying profit contraction on the horizon.

- Analysts’ consensus view notes that, even with an anticipated decline in earnings to $31.5 million by 2028, MARA’s current valuation reflects skepticism about its growth levers and margin trajectory rather than the company’s underlying revenue potential.

- Revenue is projected to grow 13.1% annually, outpacing the broader US market. Yet, the deep valuation gap suggests investors are waiting for clear, sustained evidence that new business lines and cost controls can offset the coming margin headwinds.

- This tension between rapid topline growth and falling earnings captures the core debate about whether MARA’s low valuation represents great value or embeds a realistic assessment of future risks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for MARA Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? Share your view and build your own narrative in just a few minutes: Do it your way

A great starting point for your MARA Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

MARA Holdings faces mounting margin pressure, rising capital needs, and uncertain earnings. Its growth outlook and profitability remain far from stable.

If you want companies with reliable performance and fewer surprises, use stable growth stocks screener (2074 results) to find those delivering consistent revenue and earnings expansion across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MARA

MARA Holdings

Operates as a digital asset technology company in the United States and Europe.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives