- United States

- /

- Software

- /

- NasdaqCM:MARA

A Fresh Look at Marathon Digital Holdings (MARA) Valuation After Recent Share Price Slide

Reviewed by Simply Wall St

MARA Holdings (MARA) shares have been on a downward trend over the past month, with the stock price sliding nearly 48%. Investors are paying close attention to what might be behind this persistent drop and the potential upside ahead.

See our latest analysis for MARA Holdings.

Despite a sharp 48% slide in the past month, MARA Holdings' momentum has been cooling for most of 2024, with a year-to-date share price return of -41.5%. Over the past year, the total shareholder return fell over 61%, but long-term holders have still enjoyed gains of more than 135% over five years. That mix of volatility and growth shows how quickly sentiment, and the stock’s fortunes, can shift as the company navigates both challenges and opportunities.

If MARA’s swings have you rethinking your portfolio, this could be a perfect opportunity to seek out new directions and discover fast growing stocks with high insider ownership

With its share price battered and trading well below analyst targets, could MARA Holdings be a diamond in the rough, or are investors right to wonder if all future growth is already priced in?

Most Popular Narrative: 58% Undervalued

Compared to its latest close at $10.07, the most widely followed narrative sets MARA Holdings' fair value much higher. This striking valuation puts the company in the spotlight and brings its future strategy under close examination.

MARA's strategic expansion into AI infrastructure and partnerships with leading AI and grid management companies positions the firm to benefit from the accelerating adoption of artificial intelligence and the growing demand for high-performance, energy-efficient compute, which is likely to unlock new, recurring revenue streams outside traditional bitcoin mining.

Curious about the bold assumptions shaping this call? The narrative builds its case on major shifts in business mix, anticipated sector leadership, and financial projections that challenge expectations. Want to see which numbers could justify such a premium? Click through for the full breakdown behind these headline projections.

Result: Fair Value of $23.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as MARA's dependence on bitcoin mining and challenges in executing changes to its business model could sharply alter these bullish projections.

Find out about the key risks to this MARA Holdings narrative.

Another View: What Do Multiples Say?

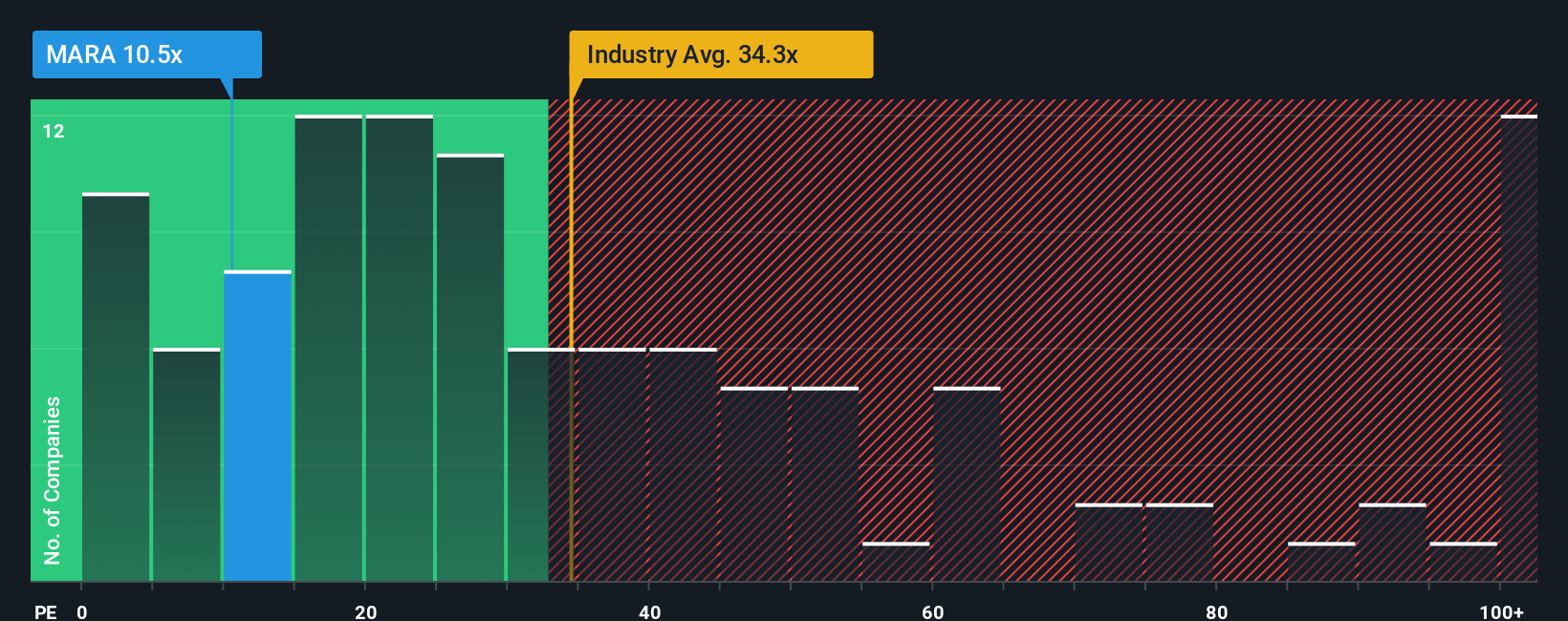

Taking a step back from fair value models, MARA’s price-to-earnings ratio sits at just 4.1 times. This is well below the US Software industry average of 28.8 times and the peer average of 14.2 times. Even when compared to its own fair ratio of 3.5, the stock looks relatively inexpensive. However, is this a true opportunity or a signal of hidden risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MARA Holdings Narrative

If you think the story looks different through your own lens or want to challenge these projections, dive in and see for yourself. Building your own narrative takes less than three minutes. Do it your way

A great starting point for your MARA Holdings research is our analysis highlighting 3 key rewards and 6 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize your chance to tap into the market’s greatest opportunities before everyone else does. Simply Wall Street’s tools can help you spot what others might miss.

- Boost your portfolio’s growth potential with these 26 AI penny stocks, which are at the forefront of artificial intelligence and digital transformation.

- Secure steady income by checking out these 16 dividend stocks with yields > 3%, offering robust yields above 3% and strong fundamentals.

- Ride the wave of blockchain innovation by acting early on these 81 cryptocurrency and blockchain stocks, which are building tomorrow’s decentralized technologies today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MARA

MARA Holdings

Operates as a digital asset technology company in the United States and Europe.

Medium-low risk and good value.

Similar Companies

Market Insights

Community Narratives