- United States

- /

- Software

- /

- NasdaqCM:BTDR

Three Elite Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As major U.S. stock indices like the Dow Jones, S&P 500, and Nasdaq are poised for solid weekly and monthly gains following strong earnings reports from tech giants Amazon and Apple, investors are keenly observing market dynamics. In such a climate, growth companies with high insider ownership can offer unique insights into potential long-term value creation as they often align management's interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Prairie Operating (PROP) | 31.3% | 115.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11% | 30.4% |

| Celsius Holdings (CELH) | 10.8% | 31.6% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 31.1% |

| AppLovin (APP) | 27.5% | 25.7% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

Bitdeer Technologies Group (BTDR)

Simply Wall St Growth Rating: ★★★★★★

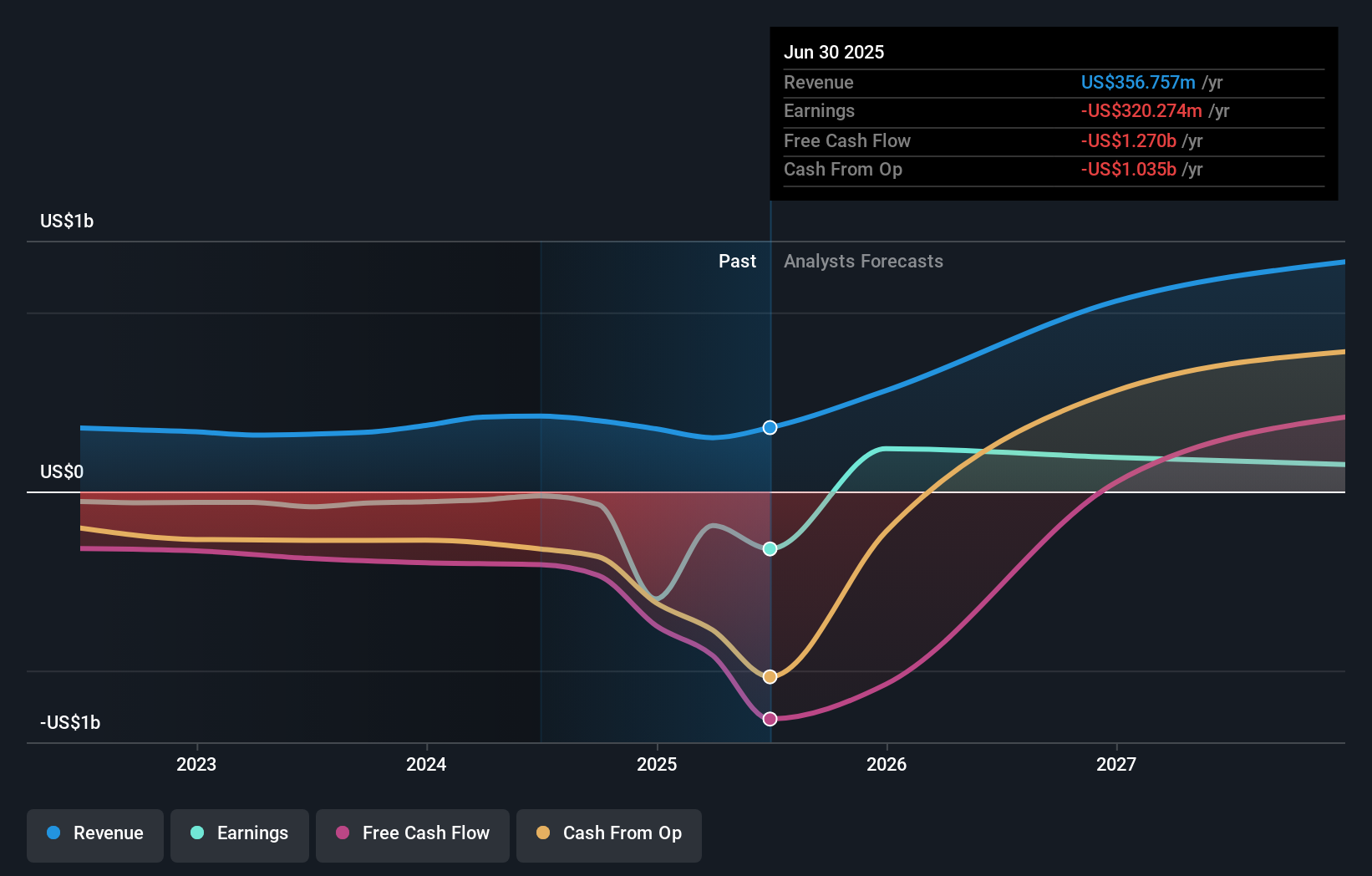

Overview: Bitdeer Technologies Group is a technology company specializing in blockchain and high-performance computing (HPC) operations across Singapore, the United States, Bhutan, and Norway, with a market cap of approximately $4.89 billion.

Operations: The company generates revenue from its data processing segment, which amounts to $356.76 million.

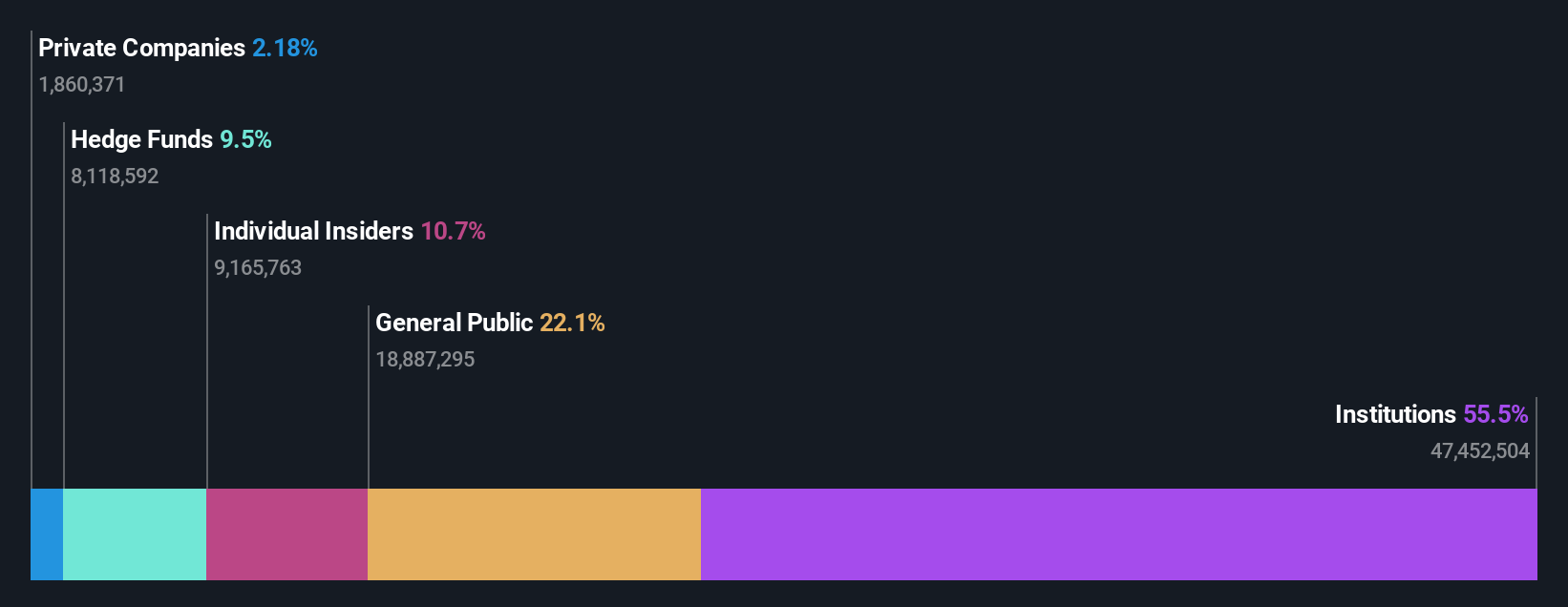

Insider Ownership: 37.3%

Earnings Growth Forecast: 96.9% p.a.

Bitdeer Technologies Group is poised for significant growth, with revenue expected to increase by 60.5% annually, outpacing the US market. The company anticipates becoming profitable within three years and forecasts a high return on equity of 21.7%. Recent innovations include the SEALMINER A3 series, enhancing energy efficiency and reducing operational costs for miners. Despite substantial past shareholder dilution and high share price volatility, Bitdeer trades at 93% below its estimated fair value.

- Click here and access our complete growth analysis report to understand the dynamics of Bitdeer Technologies Group.

- The valuation report we've compiled suggests that Bitdeer Technologies Group's current price could be quite moderate.

Liquidia (LQDA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Liquidia Corporation is a biopharmaceutical company that develops, manufactures, and commercializes products for unmet patient needs in the United States, with a market cap of approximately $1.93 billion.

Operations: The company generates revenue from its Pharmaceuticals segment, amounting to $19.32 million.

Insider Ownership: 10.1%

Earnings Growth Forecast: 62.7% p.a.

Liquidia is positioned for robust growth, with revenue projected to expand at 43.7% annually, surpassing the US market average. The company aims to achieve profitability within three years, although recent financials show a net loss of US$41.58 million in Q2 2025 despite increased revenue of US$8.84 million compared to the previous year. While insider selling has been significant recently, Liquidia trades at 82.9% below its estimated fair value, indicating potential undervaluation.

- Navigate through the intricacies of Liquidia with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Liquidia is priced higher than what may be justified by its financials.

IREN (IREN)

Simply Wall St Growth Rating: ★★★★★☆

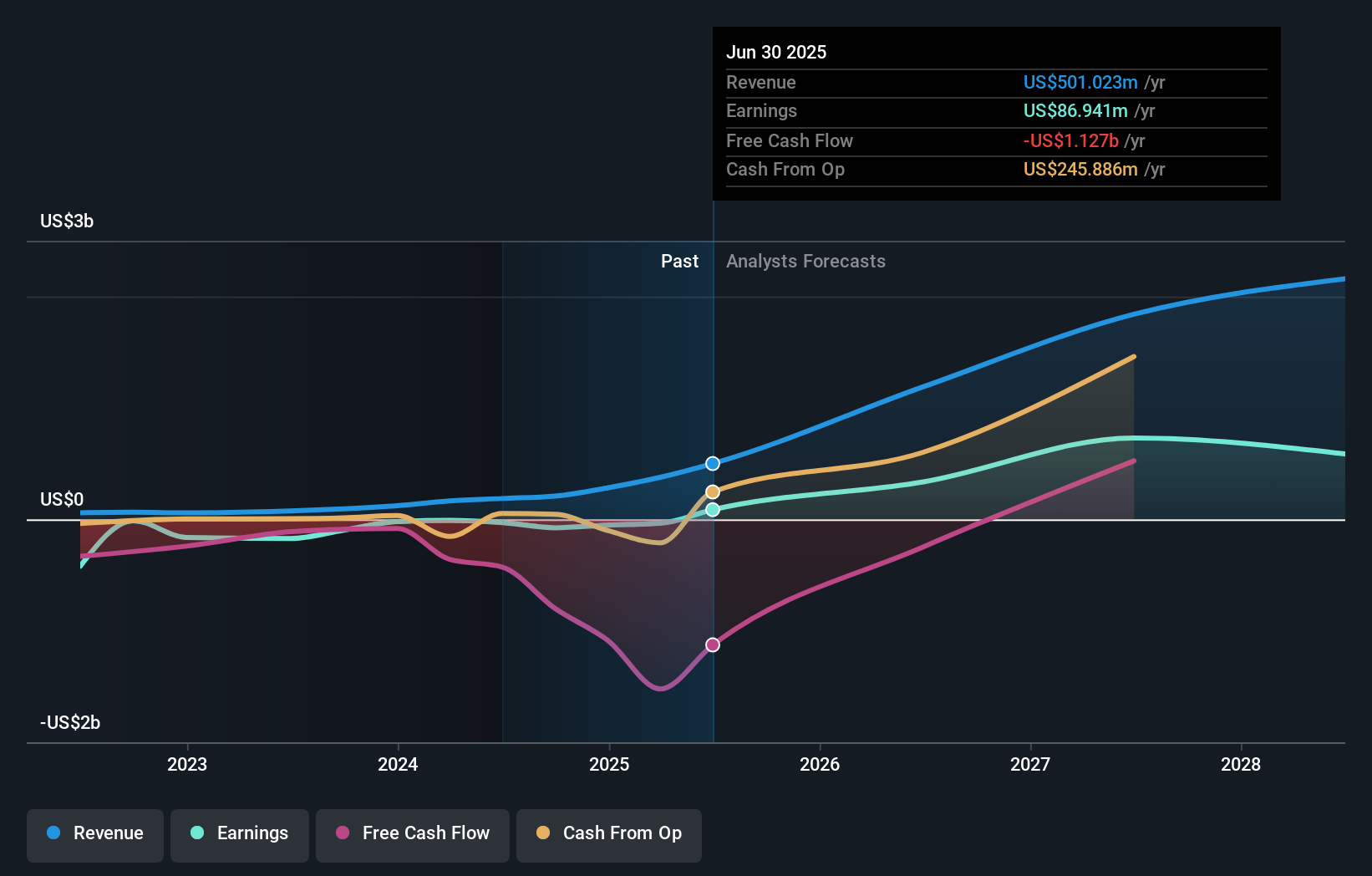

Overview: IREN Limited is a vertically integrated data center operator with operations in Australia and Canada, and it has a market cap of $16.55 billion.

Operations: The company generates revenue of $501.02 million from building and operating data center sites for Bitcoin mining purposes.

Insider Ownership: 10.8%

Earnings Growth Forecast: 52.4% p.a.

IREN is experiencing rapid growth, with revenue projected to increase by 29.6% annually, outpacing the US market. The company recently became profitable and forecasts a significant earnings growth rate of 52.4% per year. Despite a volatile share price and past shareholder dilution, insider activity shows more buying than selling in recent months. Recent strategic moves include expanding AI Cloud capacity to target over US$500 million in ARR by early 2026, supported by contracts for NVIDIA GPUs and a substantial power portfolio for future expansion.

- Take a closer look at IREN's potential here in our earnings growth report.

- According our valuation report, there's an indication that IREN's share price might be on the expensive side.

Key Takeaways

- Gain an insight into the universe of 202 Fast Growing US Companies With High Insider Ownership by clicking here.

- Curious About Other Options? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bitdeer Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTDR

Bitdeer Technologies Group

Operates as a technology company for blockchain and high-performance computing (HPC) in Singapore, the United States, Bhutan, and Norway.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives